Internet banking bps sberbank personal. Personal account in Internet banking bps-sberbank

With development banking sector Internet banking service has become widespread. Sberbank offers its customers a convenient system that allows them to make payments, transfers, and many other transactions without leaving their homes. Those who want to always have a bank at hand should get online banking.

What is the Internet banking service from Sberbank? This feature allows the customer to carry out most of the banking transactions that previously could only be performed through a bank branch or ATM. Internet banking is available today to get an entry through a personal computer or an application in the phone.

Internet banking BPS Sberbank was transformed in 2015 into Sberbank online, which operates today.

How to connect Internet banking BPS Sberbank?

To connect the Sberbank Internet banking service, you need to contact any branch of the bank. You should have a passport with you, since when filling out an application for connecting the service, you will need to fill out a questionnaire in which the client's data is indicated.

To gain access to Internet banking, you must:

- Come to the branch of Sberbank with a passport.

- Contact the cashier or the employee responsible for connection.

- The bank employee will draw up an application for connecting the Internet banking service to the client. This application must be signed.

- After the application is completed, an SMS notification will be sent stating that the Internet banking service is connected.

To get access to the Internet banking service, you must have an activated service Mobile bank to receive SMS notifications.

Internet banking is connected to one Sberbank card, even if the client has several of them. However, he will be able to receive information about all cards online.

How to register in BPS Sberbank Internet banking?

To register in the BPS Internet banking system of Sberbank, you just need to submit an application and connection at a bank branch. After all procedures are completed, the user will be automatically registered in the system and will be able to use the Internet banking service. However, the initial login and password are set automatically and are not considered secure. In order for the use of Internet banking to become completely safe, it is better when you first enter Personal Area change the username and set a new user password.

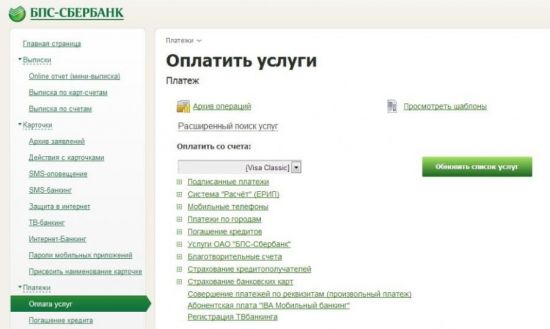

Internet banking BPS Sberbank: payment for services

Through the BPS Internet banking system, any user can pay for services. To do this, you need to enter your personal account by entering your login and password, as well as an SMS code. Since 2015, BPS Internet banking has been transformed into the Sberbank online system with improved protection using SMS alerts. That is why when paying for each service, confirmation SMS will be sent to the user's phone.

To pay for services using BPS Internet banking, you must:

- Log in to your personal internet banking account.

- Select the Transfers and payments tab.

- Go to the item of the type of payment for services that is required.

- Enter the details of the recipient and the amount of payment.

- Press the Done button.

- Confirm the correctness of the operation by SMS with a password.

- Get your payment receipt online.

It is necessary to enter the payment details correctly and accurately and be sure to check them before sending Money.

Thus, every client of the bank can connect Internet banking to BPS Sberbank. To do this, it is enough to have a phone, a Sberbank card and a passport. Connection is free of charge. The presence of a personal account in such a system allows you to pay for services, transfer funds and perform a lot of banking operations from your own computer or phone.

Internet banking from BPS-Sberbank is a special online service with which you can remotely track the status of your account, conduct certain Bank operations and so on. The functioning model of BPS Internet banking is as follows - the bank stores all the data about the client on its server, and the client connects to this database using the Internet, enters his personal account and performs all the operations that the bank allows.

What are the benefits of Internet banking

Internet banking has the following advantages:

- To carry out most transactions, you do not need to visit the bank - it is enough to have access to the Internet. Indeed, in bank branches there may be a long queue, and the bank branch itself may be far from home. With the help of Internet banking, you can carry out a large number of transactions (money transfer, payment utilities and so on) in a few clicks.

- A large number of services with which you can pay for various services. With the help of Internet banking, you can pay for electricity, water, gas, telephone, Internet, and so on.

- Instant blocking of the card. If a client's card was stolen, he can quickly log into his personal account and block it so that an attacker cannot use the card.

- Reliable protection against hacking using the SSL protocol. Using this protocol, Internet scammers will not be able to hack into your computer and transfer your money to their account.

Where and how to connect BPS Internet banking

Connecting BPS Internet banking looks like this:

- You apply to the nearest branch of BPS-Sberbank with a passport and write an application for connecting Internet banking.

- You are offered a service connection agreement; if you agree with it, then you sign it.

- You will be given a username and password with which you can access the site.

- In some cases, you will also have to contact the Bank's Digital Certificate Certification Center to obtain and install cryptoprotection tools.

How much does internet banking cost

You can connect Internet banking for the following fee:

- Connecting a client to the Internet banking system with the provision of a carrier of electronic keys - 25 Belarusian rubles, without providing a carrier of electronic keys - 12 Belarusian rubles.

- The monthly fee for using the service is 12 Belarusian rubles.

- Activation of the SMS-notification service when carrying out transactions with the card - 3 Belarusian rubles.

- The monthly fee for using the SMS notification service is 3 Belarusian rubles and 50 kopecks.

Conclusion

With the help of Internet banking, you can carry out banking transactions using the Internet. Among the main advantages of Internet banking are simplicity, a large number of additional services, high degree protection against unauthorized access. To connect the service, you need to contact the BPS-Sberbank branch and sign an agreement, as well as install a special program on your computer that will protect your computer from unauthorized access. Connecting Internet banking costs 12 or 25 Belarusian rubles, and the monthly fee is 12 Belarusian rubles.

Most large financial institutions provide their customers with the opportunity to perform transactions remotely through online banking. On the territory of Belarus, BPS Sberbank Online seems to be an extremely popular service that allows you to perform the operations most in demand among the clients of this bank.

What is BPS Sberbank Online

Online banking seems to be the main means for making transactions with accounts and cards remotely, which saves time and effort on visiting branches. At the same time, Internet banking BPS Sberbank Belarus is a local service, which in 2015 was transformed into a standard version of Sberbank Online.

Such a service has whole line advantages that made it incredibly popular with the clients of this bank. Among them:

- the possibility of remote payment for housing and communal services, communications, taxes;

- intuitive interface that even novice users can master;

- set up templates and auto payments;

- viewing the current exchange rate, balance of accounts and cards;

- search for the nearest terminals;

- the ability to remotely block the card, make transactions by the number of "plastic" or account.

Such broad functionality makes such a service extremely useful for consumers who have an open account with this bank.

BPS Sberbank offers remote service through internet banking

How to connect

One of the features of this service is the impossibility of its operation without prior registration of the user. To do this, the client will need to visit the nearest branch of Sberbank. The algorithm of actions that must be performed to gain access to the service will be as follows:

- Using the official website, find the nearest branch of this financial organization.

- Visit it, taking your passport with you, mobile phone.

- Contact the employee and express a desire to register in the Sberbank Online service.

- Fill out and sign an application for connection, indicating a valid phone number.

- Give the agreement to the employee and wait for an SMS message from the bank about the successful activation of the option.

In order for the registration to be successful, the consumer must fulfill a number of requirements necessary for the correct operation of the service. First of all, the client must have the Mobile Bank option activated, otherwise Sberbank-Online will not be able to function properly.

In addition, the user must have one of the products of this financial institution - a debit or credit card, savings account, deposit or otherwise. It should be remembered that the service is tied to one product even in cases where the user has several of them. At the same time, he will still retain the possibility of obtaining information about them via the Internet.

After the client submits an application, activates the option and registers in the system, he will be given a login and password from his personal account. Such a combination is generated automatically and is not considered safe. Because of this, it is highly recommended to change the password to your own immediately after the first successful login.

To register in Internet banking, you need to fill out a short form

Interface overview

After the user logs into his personal account, many functions become available to him. The system interface assumes the presence of several tabs at once, which deserve the attention of the client in the first place. Among them:

- "Payments and transfers";

- "Deposits and accounts";

- "Cards";

- "Credits".

"Deposits and accounts" contain information about all deposit products and accounts of the client, which he keeps in this organization. If desired, using this tab, you can open a new account, get a statement on existing deposits, and also deposit funds on them. When opening, the user will need to select the deposit program online, its term of placement, currency and amount of funds.

The "Maps" section contains comprehensive information on all open products of the client. The left part of the window contains information about the number, name and expiration date of the card, and the second - current balance, as well as available actions. The last point deserves special attention, since it can be used to rename the product, make it a settlement, configure the settings for SMS notifications about transactions, or block it altogether.

The category "Loans" contains information about all loans that the client has issued in Sberbank. With its help, you can quickly find out the amount that will need to be paid in the next payment, as well as the total amount of funds to be repaid. If there are funds for bank card, the user can enter monthly payment using the interface of this service.

Internet banking BPS of Sberbank allows you to remotely manage your cards, deposits, and also make payments

How to pay bills

As practice shows, most often users use Internet banking to pay for various bills and services. Sberbank-Online allows you to make such a procedure as simple as possible, since for payment you need to perform only a few manipulations:

- Log in to your personal account.

- Go to the "Payments and transfers" section.

- Select the services you would like to pay for.

- Specify payment details.

- Confirm the intention to make a payment using the verification code from the SMS message.

- Receive an electronic receipt.

Such a check should be kept until the funds are successfully credited. In this way, you can pay not only for services, but also to carry out transactions of funds in favor of other users. To do this, instead of the service provider, you must specify the details of the recipient.

BPS Bank is a remote customer service system from BPS-Sberbank operating in Belarus. Internet banking gives Belarusian customers the opportunity to use all the services of the bank and control accounts and cards online. All operations are carried out in your personal account, below you will learn how to register, log in to your account and use it.

Login and register an account

Until 2015, bpsb had a different banking system, after which it switched to the same service that operates in Russia - Sberbank Online.

Access to the personal account will be received only by a client who has an account or card in the BPS. There are two ways to become a user:

- By signing an agreement with the bank. You only need to take your passport with you.

- Registration without visiting a branch on the lender's website.

In the case of visiting a branch, the bank manager will issue a temporary password and login after submitting an application.

When registering on the site, you need to click on "Register" and enter:

- Identification number of the card or account.

- Mobile number to which session codes and passwords will be sent in the future to confirm transactions.

By clicking on "Continue" specified number password will be sent. By entering it into the line on the site, the identity of the client will be confirmed and access will be opened. Now you need to enter the LC.

The generated password is not secure. The user needs to change it in the future, creating a new, complex combination.

The entrance to the BPS personal account is carried out on the main page of the official website www.bps. sberbank. by. No special software or devices are required for authorization.

Recall that by entering the wrong password several times, access to the account will be blocked for several hours.

Using the BPS office

There are two options for connecting to the LC:

- For free.

- For 7.5 rubles per year (BYN version).

In the free subscription option, the client receives much fewer opportunities. He can only:

- Get information about bank accounts and cards.

- Use auto payment and SMS notification.

- Confirm transactions with input one-time passwords.

It is impossible to make payments on your own - only through automatic debiting of funds. This is only suitable for those who need to make periodic payments.

Therefore, paying such a small amount is worth it - the user will have access to all the functionality of the cabinet for a year.

The system is not much different from the Sberbank Online service operating in the Russian Federation. The account allows individuals to:

- Manage your accounts and cards.

- Transfer funds to private and legal entities to cards and accounts of BPS-Sberbank and other financial institutions.

- Open and replenish deposits, withdraw money to depersonalized metal accounts.

- Pay for services and purchases in online stores - housing and communal services, communications, the Internet, fines and taxes, etc.

- Arrange loans and make payments on them.

- View information about accounts, credit and debit cards, deposits, as well as information on the balance of funds and transactions.

- Receive payment documents and generate documentation from them.

- View background information about the exchange rate, the location of ATMs and branches of a financial institution, current promotions and programs, etc.

- Activate and deactivate bank services, order and block cards.

- Change account settings: personal account login data, make strictly defined services visible, view user authorization logs, etc.

- Take out insurance and make payments on it.

- SMS notifications about transactions.

- Auto-payment for specific transactions without the client's order (for this, the user must submit a list with payments and recipients).

- A service similar to the previous one - "Payment with one button". In one click, periodic payments are made, pre-set in the personal account, i.e. without visiting the bank.

- Approval of payments by entering one-time passwords sent via SMS to the user's number (for Visa and MasterCard cards, different service names are provided).

All operations are carried out in 4 sections:

- "Payments and transfers".

- "Deposits and Accounts".

- "Cards".

- "Credits".

Here you can not only carry out transactions, but also view information on currently issued banking products and already closed accounts. The main page of the cabinet already contains information about cards, deposits and accounts.

You can familiarize yourself with the terms of service for individuals on the bank's website by opening the "Individuals" section and going to the "Payment for services using remote channels" subsection. Here are instructions for working with the service, the procedure for maintenance, answers to basic questions and recommendations for ensuring the security of your account.

The work of the office is protected by the SSL protocol. Check the address bar when you get to the site - a lock icon should appear. This means that the data transfer is secure.

By setting up the One Button Payment feature, you can make payments for similar transactions every month.

The function of adjusting the visibility of products is purely aesthetic, allowing you to remove unnecessary information from the cabinet interface.

Note that in the account you can get a mini-statement, for the formation of which you need to draw up a report on personal account. To do this, you need to click on the “Statement” tab in the personal account and enter the following data in the fields that open:

- The beginning and end of the period for which the report is required.

- The card or account for which the statement is issued.

Checks and statements can be sent by email, saved as PDF and printed. The subsection “Payment sheets” will be useful for those who plan to conclude any deal in the near future. For example, if the employer signs an agreement with the BPS.

You can create template payments by entering the parameters in the "Quick Payments" subsection.

Important! Can be linked to an account or card online wallet Yandex.Money (this service is part of Sberbank). To do this, you will need to go through the identification procedure. Transfers from the wallet are possible to the cards:

- Visa.

- MasterCard.

- Belkart.

There are also mobile app BPS Bank. You can download it for Android and iOS from the PlayMarket and AppStore stores, respectively.

Important! A useful section called the financial manager can be found by opening the "My Finances" section. It will analyze the available profit on all active accounts, cards and loans.

If it is decided to terminate cooperation with the bank, the client only needs to submit an appropriate application for the closure of all products and services. After that, access to the LC will be closed.

So, access to the account is provided to persons who already have any banking product. The service is convenient and concise, offering all the possibilities for managing your funds and services.

BPS Sberbank Online - Internet banking in the Republic of Belarus. It is an intuitive web interface for communication between a client and a bank from anywhere in the world where there is access to the World Wide Web. This article explains how to register and log in.With the development of the banking sector, the Internet banking service has become widespread. Sberbank offers its customers a convenient system that allows them to make payments, transfers, and many other transactions without leaving their homes. Those who want to always have a bank at hand should get online banking.

bps sberbank internet banking login

Logging into the BPS-Sberbank Internet banking system is done by entering your login and password in a special form, which is located on the Sberbank Online page:

https://www.bps-sberbank.by/loginsbol or click on the login form

If you need to change your password or login, you need to follow the link "Change login and password" and then go through the process of replacing data.

BPS-Sberbank clients who have a valid bank card and the phone number of the Belarusian mobile operator (or an identity document).

BPS-Sberbank clients who have a valid bank card and the phone number of the Belarusian mobile operator (or an identity document).

Registration and entry into the system is carried out at www.bps-sberbank.by/registration-sbol. To start the registration procedure, under the login and password entry form, click on the "Registration" link.

At the first stage of registration, you need to enter a mobile phone and number payment card or an identification number document proving the identity of the client. After entering the required information, click "Continue".

At the second stage, come up with a login and password, a payment password and confirm the data with a code from the SMS message that should be sent to your phone specified in the previous step.

Near each data entry field there are hints, read them carefully and you will not be mistaken.

![]()

Check the box next to I agree with the contract for the provision of services "Sberbank Online", "Mobile Bank" in OJSC "BPS-Sberbank" and click the "Register" button.

After registering, you will be taken to the main page of your personal account.

Support

You can call the BPS Sberbank Contact Center by phone: ![]()

- 148 - from fixed and mobile networks of the Republic of Belarus

- (+37529) 5-148-148 – from abroad