Revaluation of currency balances in accounting: details. Revaluation of currency balances How to revaluate a currency in 1s 8.2

Why do you need " Currency revaluation"? I am often asked this question by novice accountants, because they have not yet encountered foreign exchange transactions in practice and do not understand where this revaluation comes from, how it is calculated and whether it is needed. Let's deal with this once and for all using the example of 1C: Accounting 8.3 , edition 3.0. Firstly, revaluation occurs "by itself" when close of the month.

Secondly, it arises only for organizations that have had currency transactions.

And that's why.

According to PBU 3/2006 on accounting for assets and liabilities, the value of which is expressed in foreign currency, we have:

The value of assets and liabilities, expressed in foreign currency, for reflection in accounting and financial statements to be converted into rubles.

The recalculation of the cost is made on the date of the transaction in foreign currency, as well as on the reporting date.

01.01.2014 the buyer transferred to our current account 1 dollar.

The wiring will be as follows:

D52 K62 1 USD

Please note that we recorded the transaction amount simultaneously in the transaction currency (1 dollar) and in rubles at the exchange rate on the date of the transaction (January 1, 2014, the dollar exchange rate was exactly 32.6587 rubles).

It turns out that all currency accounts keep their monetary indicators in two dimensions at once: in the account currency and in rubles (the main currency of regulated accounting for Russia).

Thus, at the end of the day on January 1, 2014, the balance of account 52 will be 1 USD and at the same time 32.6587 rubles.

Everything is great, but time is running out. The dollar exchange rate is changing. And now, at the end of the month (January 31, 2014), one dollar gives 35.2448 rubles.

And, if we look at our balance on account 52 at the end of the month, we will see that despite the fact that the exchange rate has changed, there is still 1 USD and 32.6587 rubles. But we know that one dollar already corresponds not to 32.6587 rubles, but to 35.2448 rubles! arose discrepancy between the amount of the balance in dollars and the amount of the balance in rubles.

So, this very recalculation of the value of assets and liabilities in foreign currency on the reporting date (that is, monthly) was invented in order to restore this correspondence between the currency and rubles every time at the end of the month.

In this case, the revaluation for account 52 as of January 31, 2014 will look like this:

D52 K91.01 2.5861 rubles

Thus, we revalued the ruble balance of account 52 by 2.5861 rubles at the expense of other income. It turns out that the rate for this month has grown - hence the income for the organization. If the exchange rate fell on the contrary, there would be other expenses.

So after reevaluating debit balance on account 52 at the end of the day on January 31, 2014 will be 1 USD and at the same time 35.2448 rubles.

But time goes by. And at the end of February for 1 dollar they give already 36.0501 rubles. This means that we again have a discrepancy between dollars and rubles on account 52, and at the same time, other income has arisen due to the appreciation in February.

The new revaluation will result in the following postings:

D52 K91.01 0.8053 rubles

And the debit balance on account 52 at the end of the day on February 28, 2014 will be the same 1 USD and at the same time 36.0501 rubles.

And so we will reevaluate indefinitely, until we have a non-zero balance of 52 accounts. Other currency accounts are revalued in the same way.

Here is the overestimation theory in brief currency funds V accounting. And now let's see how all this is implemented in the program using the example of 1C: Accounting 8.3 (version 3.0):

Loading exchange rates for 2014

Opening a currency account (USD)

To do this, go to the "Main"->"Organizations" section and open our organization there ():

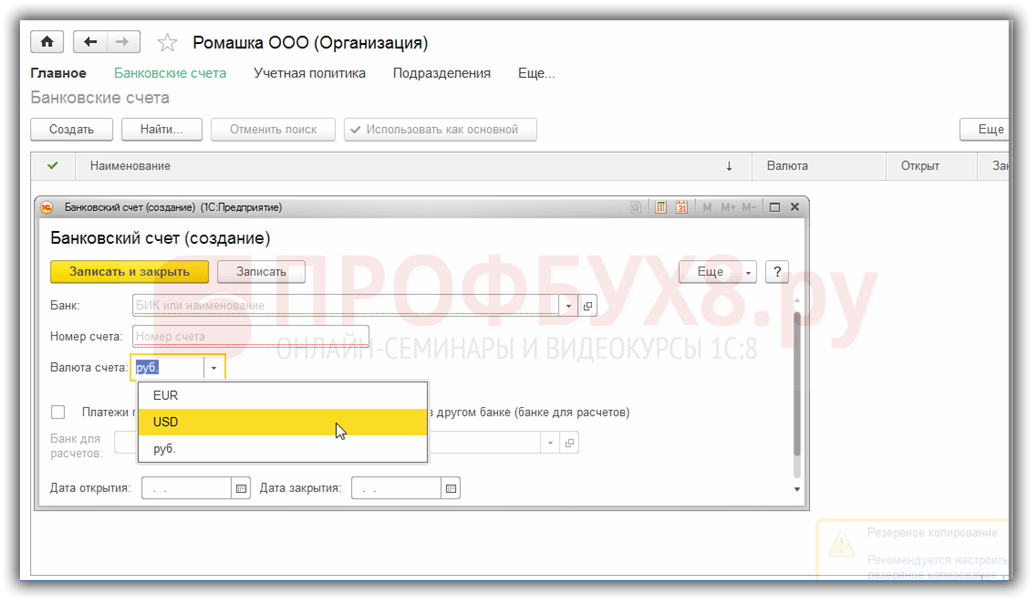

In the organization card in the top panel, select the item "Bank accounts":

In the list of accounts that opens, click the "Create" button and fill in the current account card as follows (account number and BIC are given as an example; be sure to select the account currency USD):

Click "Save and Close".

We make the receipt of funds from the buyer

To do this, go to the "Bank and cash desk" section and select the "Bank statements" item there ():

We press the "Receipt" button and fill out the bank statement as follows (receipt of $ 01 on 01/01/2014; from any counterparty under any contract; accounting account - 52; bank account - the one that we just created):

Click "Submit and Close".

We look at the postings of the document (the DtKt button in the statement log):

We see that 1 dollar was credited to account 52 at the rate of 01/01/2014 (how to look at exchange rates on a specific date in 1C: Accounting).

We make the closing of the month for January

We go to the "Operations" section and select the "Closing of the month" item there ():

Select the period January 2014 and click "Perform closing of the month".

Then we find the item "Revaluation of foreign exchange funds", click on it and select "Show transactions":

Here it is our exchange rate difference for 2.58 rubles:

Let's go back to the closing of the month for January 2014 and find the "Reference-calculations" button there. Click it and select the item "Revaluation of currency funds":

The program will generate a report with calculations for the revaluation of currency funds:

Similarly, close the month for February to make sure that our preliminary calculations match the behavior of the program.

We are great, that's all

If this does not help, then it is very likely that the account on which you expect the calculation of the exchange rate difference is listed in your list of accounts with a special revaluation procedure.

As a result of the revaluation of the value, the value of which is expressed in the currency of another state at the exchange rate of the Central Bank, there is an exchange rate difference in the values. Accounting for transactions with such assets in the balance sheet is carried out on the basis of RAS 3/2000 "Accounting for assets whose price is indicated in foreign currency" and Law No. 3615-1 "On currency regulation". Let's consider in more detail how the revaluation of currency balances in 1C 8.2 is formalized in accounting.

Buying currency

Organizations may purchase dollars and euros for various purposes, such as importing material assets. In this case, the following postings are formed in the balance sheet:

- DT57 "Transfers", KT51 "Settlement account" - transfer of funds from the account for the purchase of foreign currency.

- DT52-1-3 "Accounts in foreign currency", KT57 - the purchased currency is credited to a special account.

- DT10 "Materials", КТ57 - reflects the revaluation of currency balances between the exchange rate of the Central Bank of the Russian Federation and the purchase rate.

- DT10, KT57 - bank commission is taken into account.

- DT51, КТ57 - unused funds are credited.

Now let's consider how to reflect the purchase of foreign currency in the balance sheet for operations not related to imports:

- DT57, КТ51 - transfer of funds for the purchase of foreign currency.

- DT52-1-3, KT57 - crediting money to a transit account.

- DT91-2, KT51 - payment of remuneration to the bank.

Next, reflect financial results from the deal. If the exchange rate of the Central Bank of the Russian Federation is less than the purchase rate, the resulting difference is taken into account as an expense: DT91-2, КТ57. This amount reduces the profit of the enterprise, which is calculated when calculating the NPP. If the rate of the Central Bank of the Russian Federation is greater than the purchase rate, then there is an operating income: DT57, КТ91-1. This amount increases the profit of the enterprise, which is calculated when calculating the NPP.

Example #1

In order to cover the expenses of employees on business trips abroad, the CJSC purchased $5,000. To do this, the company transferred 145.8 thousand rubles to the bank. The credit institution purchased foreign currency at the rate of 28.8 rubles/dollar. For this operation, the bank wrote off a commission in the amount of 1.8 thousand rubles. On the day of the transaction, the exchange rate of the Central Bank of the Russian Federation was 28.5 rubles / USD. Consider how the revaluation of currency balances is formalized in 1C 8.2. Wiring:

- DT57 KT51 - 145.8 thousand rubles. - transferred money to buy dollars.

- DT52-1-3 KT57 - 142.5 thousand rubles. (5,000 x 28.5) - the purchased currency is credited to the transit account.

- DT91-2 KT57 - 1.8 thousand rubles. - the bank commission is taken into account.

- DT91-2 KT57 - 1.5 thousand rubles. ((28.8 - 28.5) x 5000) - the exchange rate difference is reflected.

Receipt of currency from buyers

If an enterprise has received dollars or euros from foreign customers as payment for goods, it must credit funds to a transit account: DT52-1-2, KT62. The organization is obliged to sell half of the amount received on the domestic market. For violation of this requirement, a fine is provided in an amount equal to unrealized foreign exchange earnings.

Use of funds

The organization can direct the purchased dollars or euros for the following purposes:

- Payment for contracts with foreign partners - DT60 KT52-1-3.

- Payment for travel abroad of their employees. The amount of currency received at the cash desk is reflected in the posting DT50 KT52-1-3.

- Repayment of loans in dollars or euros: DT66 KT52-1-3.

Sale of currency

Article 6 of the Law provides that the organization must sell dollars and euros without fail:

- 50% of the proceeds received from a transaction with a foreign partner.

- If the purchased dollars or euros were not transferred to the counterparty within 7 days as payment for materials.

Both transactions are reflected in the balance sheet in the same way:

- DT57 KT52-1-1 - the currency is sent for sale.

- DT51 KT91-1 - funds from the sale are credited to the account.

- DT91-2 KT57 - the sold currency was written off.

- DT91-2, KT51 - sales costs are taken into account.

Revaluation of currency balances on the last day of the month is documented by posting DT91-9 KT99 (profit) or DT99 KT91-9 (loss). Unsold dollar proceeds must be credited to the account: DT52-1-KT52-1-2.

Example #2

The CJSC's transit account received proceeds from the export of goods in the amount of $10,000. On that day, the bank received an order from the enterprise to sell 50% of this amount, and transfer the rest to the organization's account. The obligatory sale of the currency was carried out by the bank at the rate of 29.37 rubles/dollar. The official dollar exchange rate on the day of receipt of funds amounted to 29.47 rubles / dollar. The bank's commission for conducting transactions amounted to 1.2 thousand rubles.

- DT52-1-2 KT62 - 294.7 thousand rubles. (10,000 x 29.47) - export earnings credited to the account.

- DT57 KT52-1-2 - 147.35 thousand rubles. (5,000 x 29.47) - 50% of the amount is directed to the mandatory sale.

- DT51 KT91-1 - 146.85 thousand rubles. (5,000 x 29.37) - funds have been credited to the account of the organization.

- DT91-2 KT57 - 147.35 thousand rubles. - the realized currency is written off.

- DT91-2, KT51 - 1.2 thousand rubles. - the bank commission is taken into account.

- DT52-1-1 KT52-1-2 - 147.35 thousand rubles - the rest of the proceeds were credited.

- DT99 KT91 - 1.7 thousand rubles. (147.35 - 146.85 + 1.2) - reflected the loss from the operation.

Revaluation of currency balances

PBU 3/2000 states that the value of such valuables, expressed in foreign currency, is subject to conversion into rubles:

- banknotes available at the cash desk;

- funds in bank accounts;

- payment documents;

- financial investments;

- funds in settlements, including for loan obligations, fixed assets, intangible assets, minimum wages, etc.

Translations may result in exchange rate differences. All funds in accounting records are reflected in rubles. Therefore, a revaluation of currency balances in tax accounting and accounting is carried out.

Recalculation is carried out:

- on the day of crediting or debiting funds from the company's account;

- on the day of reporting;

- as exchange rates change.

WELL

The income received from the exchange difference is not a profit from the sale of products. Therefore, it cannot be subject to VAT. Revaluation of currency balances is carried out depending on the chosen method of accounting for values. The table shows how exchange rate fluctuations are reflected in NU.

If the accrual method is used, then the currency received and the debt to the supplier is subject to recalculation into rubles at the official exchange rate on the day of the transaction or the closing of the reporting period. It all depends on which date comes first. By the same principle, the date of occurrence of non-operating income and expenses is determined.

Example #3

CJSC entered into a contract for the supply of goods with LLC. The transaction amount is 100 thousand dollars. Settlements are made in foreign currency, since the supplier is not a resident of the Russian Federation.

The contract provides for the transfer of 50% of the advance payment by February 2 and the shipment of goods on February 8. The buyer must transfer the remaining amount on February 15. The supplier transfers ownership on the day of shipment.

The dollar exchange rate was:

- as of 02.02 – 35.41 rubles/USD;

- as of 08.02 – 36.37 RUB/USD;

- on February 15 - 34.55 rubles / USD.

Consider how the revaluation of currency balances in 1C 8.2 is displayed in tax accounting:

- DT60 KT52 - 1770.73 thousand rubles. (50,000 x 35.41) - advance payment to the seller.

- DT41 KT60 - 3589.72 thousand rubles. (50,000 x 35.41 + 50,000 x 36.37) - goods have been credited.

- DT60 KT52 - 1727.89 thousand rubles. (50,000 x 34.55) - the balance of the debt has been repaid.

- DT60 KT91-1 - 91.1 thousand rubles. (50,000 x (36.37–34.55) - exchange rate difference is reflected.

The buyer uses the accrual method to calculate the NPP. On the closing day of the transaction, the accountant of the LLC includes a positive difference in the amount of 91.1 thousand rubles in income in NU.

Settlements in foreign currency

Let us consider in more detail how the revaluation of currency balances in 1C 8.2 is carried out under contracts that have already been closed. In BU and NU, the proceeds from the sale of such transactions is determined by the amount of the advance payment received and the debt. Prepayments are non-recalculable.

But when calculating tax base for VAT, these rules are not taken into account:

- the seller calculates the amount of tax at the rate on the date of receipt of the prepayment;

- the seller charges VAT on the value of goods on the date of shipment and deducts VAT accrued from the advance.

Example #4

LLC entered into a deal for the supply of goods with a foreign organization in the amount of 11.8 thousand dollars. The cost of production is 200 thousand rubles. On October 10, 2015, the partner transferred $5,000 in advance to the LLC. On October 20, 2015, LLC shipped the entire batch. The final payment was made on 11/25/15. On the same day, ownership of the product was transferred to the buyer. Supplier uses common system taxation, NPP pays quarterly.

The dollar exchange rate is:

- on October 10 - 29.4 rubles / dollar;

- as of October 25 - 29.70 rubles/dollar;

- on 25.11 - 30.00 RUB/USD

In BU, advance payment and shipment are made out by postings:

- DT52 KT62 - 147 thousand rubles. (5,000 x 29.4) - an advance payment for the goods has been received.

- DT76 KT68 - 22.424 thousand rubles. - VAT charged on the advance.

- DT62 KT90-1 - 348.96 thousand rubles. (147+ 6.8 x 29.7) - sale proceeds are taken into account.

- DT62 KT62 - 147 thousand rubles. - Advance paid.

- DT90-3 KT68 - 53.46 thousand rubles. (10,000 x 29.7 x 0.18) - VAT has been charged.

- DT68 KT76 - 22.424 thousand rubles. - the amount of tax is accepted for deduction.

- DT90-2 KT41 - 200 thousand rubles. - the cost of production is taken into account. The same amount applies to non-operating expenses.

Since the contract provides for an advance payment and the final settlement is carried out after shipment, an exchange rate difference arises in the BU in relation to the second part of the payment, i.e. 6.8 thousand dollars. It is reflected in the statements on the date of receipt of funds:

- DT52 KT62 - 204 thousand rubles. (6.8 x 30) - the second part of the payment has been received.

- DT62 KT91-1 - 2,040 thousand rubles. (6.8 x (30–29.7)) - exchange rate difference is reflected.

Revaluation of currency balances in 1C 8.2

Valuables, the value of which is expressed in dollars and euros, are recalculated in the balance sheet at the exchange rate. The data for the calculation is pulled from the directory of the same name. This is how currency balances are revalued in 1C 8.2. What is the document for this transaction? "Regulated operation" with the type "Revaluation of funds" or "Closing of the month". Let's consider this scheme using the example of transferring funds by a resident to a foreign counterparty as payment for goods.

First you need to create a transit account for the organization itself in the program, indicating its number, BIC and currency. Next, you need to load exchange rates into the directory of the same name. To do this, specify the date and click on the "Download" button.

The transfer of funds is carried out by a credit institution. Therefore, in the card of a particular bank, you need to create a new agreement with the “Other” type and indicate the name, for example, “Purchase and sale of currency”. All documents under this agreement must be carried out in rubles. The transfer of funds from the current account to the bank itself is executed by an “outgoing payment order”. In the document, you need to select a bank, indicate the agreement, amount and purpose of payment.

The next stage is the transfer of the purchased currency to the bank account. This operation is also documented as an "Incoming Payment Order", the type of document is "Purchase of currency". Since the exchange rate on the date of debiting rubles and crediting dollars to the account is different, you need to check the box “Reflect the exchange rate difference as part of income (expenses)” in the document. When posting the document, the indicated amount will be converted into rubles at the indicated exchange rate (DT52 KT57, DT91 KT57).

The detailed movement of funds can be viewed in the Balance Sheet report for account 57. In the settings, you need to specify the details of information on counterparties and contracts. This is how the revaluation of currency balances is made.

An organization may have accounts not only in rubles, but also in the currency of other states. Such accounts are opened when, according to the type of activity, a company needs to make settlements with foreign partners, purchase raw materials and materials for foreign currency, import other material values. The law does not impose restrictions on businessmen to open such accounts.

However, since all financial obligations, as well as tax and accounting records in the territory Russian Federation performed exclusively in national currency, due to exchange rate fluctuations, the readings of foreign currency accounts change periodically, and these changes must be monitored and taken into account.

Consider the features of the revaluation of balances in foreign currency accounts of organizations, the subtleties of accounting and tax accounting for this operation.

Purpose of currency settlements

Banking operations with currency involve depositing or withdrawing currency from accounts. These procedures are fixed bank statements and settlement documentation attached to them. It is on the basis of these documents that the accounting of foreign exchange funds takes place in the dynamics of the organization's activities.

Why a company may need a foreign currency account:

- purchase of foreign currency funds by a resident from a resident (within the limits permitted by law);

- payments in foreign currency;

- currency transactions between a resident and a non-resident (purchase of currency and/or valuable papers, alienation, use as a means of payment);

- crossing the border of the Russian Federation by currency values;

- repayment of a foreign currency loan;

- payment for foreign business trips;

- receipts from an account not opened in the Russian Federation.

The meaning of currency revaluation

It does not matter in the currency of which country the account is opened and transactions are made. When performing accounting, it is necessary to be guided exclusively by the provisions Russian legislation. This means that foreign exchange funds for accounting must be recalculated in ruble equivalent at the current exchange rate. Central Bank RF.

Thus, revaluation of currency balances- this is the periodic establishment of the ruble equivalent of foreign currency on the account of the organization at the rate of the Central Bank of the Russian Federation.

NOTE! The organization should display the rules for the production of revaluation of currency balances in its accounting policy in the form of an internal regulation.

Possible revaluation results

Due to exchange rate fluctuations, deviations will inevitably occur, which can be calculated by comparing the previous revaluation figure with the last calculation made. The result obtained in the form of a specific amount may be:

- positive - the exchange rate difference exceeds the previous indicator, which means that the company has formed additional income(accounting item "Other income");

- negative - due to fluctuations in the exchange rate, the company has lost a certain share of the funds (reflected in "Other costs").

Time frame for revaluation

- on the day when the operation of depositing or withdrawing currency was made;

- on the day when the accounting report is drawn up;

- on the last day of each calendar month.

The exchange rate of the Central Bank of the Russian Federation on the indicated date is the basis for calculating the revaluation of the currency balance on the account of the organization.

Accounting for currency revaluation

For the implementation of accounting accounting operations concerning the movement of currency, there is an account 52 "Currency accounts", which has 2 sub-accounts for settlements within the country and abroad of the Russian Federation. Let's consider how the balance sheet is formed for various currency transactions: we recall that they must be reflected exclusively in rubles.

Transactions when buying a currency

Organizations can buy the currency of other states for various purposes by crediting it to their currency account. At the same time, in accounting entries the following entries will be made:

- debit 57 "Transfers", credit 51 "Settlement account" - funds are transferred from the organization's account for the purchase of currency;

- debit 52.1 "Currency accounts", credit 57 "Transfers on the way" - crediting the purchased currency to the special account of the company;

- debit 10 "Materials", credit 57 "Transfers on the way" - a reflection of the result of the revaluation of the currency balance on the account (the difference between the exchange rate of the Central Bank of the Russian Federation and the purchase rate), as well as a separate entry - accounting for the banking commission;

- debit 51 “Settlement account”, credit 57 “Transfers on the way” - crediting unused funds.

If a currency is bought not for import settlements, then the posting is simpler:

- debit 57 "Transfers", credit 51 "Settlement account" - transfer of money for the purchase of foreign currency;

- debit 52.1 "Currency accounts", credit 57 "Transfers on the way" - crediting funds to a transit account;

- debit 91.2 “Other expenses”, credit 51 “Settlement account” - funds paid to the bank as a fee.

On the last day of the month, the revaluation of currency balances is reflected:

- in case of profit - for debit 91.9, credit 99;

- in case of loss - for debit 99, credit 91.9.

Postings when receiving currency from counterparties

If the firm has received currency as payment for goods or services from foreign partners, this money must be credited to the transit account (debit 52.1, credit 62).

IMPORTANT INFORMATION! The organization is obliged to sell 50% of the foreign exchange funds received in this way within the country. Violation of this requirement is fraught with a fine in the amount of unrealized currency.

Postings for settlements in foreign currency

Having bought a currency, a company can use it for purposes permitted by law:

- pay obligations under foreign contracts (debit 60, credit 52.1);

- issue foreign travel allowances (debit 50, credit 52.1);

- repay foreign currency loans (debit 66, credit 52.1).

Realization of foreign exchange earnings

As mentioned above, half of the foreign exchange earnings must be sold on the domestic market if these funds are not spent on settlements with foreign partners within a week. This should be reflected in the balance sheet as follows:

- debit 57, credit 52.1 - direction of foreign exchange funds for sale;

- debit 51, credit 91.1 - crediting the amounts received for currency to the account;

- debit 91.1, credit 57 - write-off of realized foreign exchange funds;

- debit 91.2, credit 51 - accounting for selling expenses.

The unrealized part of the foreign exchange earnings is deposited into the account by posting: debit 52.1, credit 52.1.2.

Tax accounting for revaluation of currency balances

Even if income is generated as a result of the revaluation, it cannot be recognized as profit from the sale, therefore it does not have the right to be taxed. It should be taken into account in non-operating income, which will slightly increase income tax and tax payments on the simplified tax system.

In the event of a loss (negative exchange rate difference), these funds should be attributed to non-operating costs, which again will affect income tax. In case of losses for USN payers, there will be no changes in the tax base (based on a letter from the Ministry of Finance of the Russian Federation dated July 25, 2012).

SO, the importance of accounting and tax accounting for the revaluation of currency balances is due to the possibility of additional profit or loss in the organization on a certain date.

Sometimes organizations need to buy or sell foreign currency. The situation can be many. For example, you import or export goods, send employees on business trips abroad, pay off a loan in foreign currency, etc.

The current legislation obliges organizations to revalue currency balances in rubles at the established rate. In the event of an exchange rate difference in a positive direction for you, it is reflected as other income in accounting records and as non-operating income in NU. The amount of the negative difference is taken into account in the same way, only for the expense.

In this article, we will take an example of how currency conversion operations are performed in 1C 8.3 and consider their postings, namely, the purchase and sale of currencies.

Before you start working with the currency, you need to configure the program.

In the event that a transfer between a foreign currency and ruble account takes more than a day, you will need to use an intermediate account 57.

From the "Main" section, go to.

In the window that opens, find the item called "Account 57 "Transfers on the way" is used when moving Money” and mark it with a flag. This add-on does not need to be enabled.

It is also recommended to check the installation of another add-on. From the Administration menu, select Functionality. In the settings window that appears, open the “Settlements” tab and check if the flag is set on the “Settlements in currency and USD” item. We already have it set by default.

In the "References" section, select "Currencies".

You will see a list of all currencies added to the program with their rates. In this form, click on the button "Download exchange rates ...".

The program will prompt you to select those foreign currencies for which you want to download rates. Check their boxes and click on the "Download and Close" button. The default is the current date, but you can change it.

Now you can proceed directly to our example of selling and buying currency in 1C 8.3.

Sale of currency

Write-off of foreign currency

Consider an example where our organization needs to sell $7,000 to Sberbank for rubles. Initially, 1C creates payment order and based on it. We will not consider the payment order itself, and we will immediately proceed to the execution of the write-off, since it is it that makes the necessary postings.

Specify "Other settlements with counterparties" as the type of operation. The recipient in our case is PJSC Sberbank. We have already concluded an agreement with him with settlements in USD. It is selected in the card of this document. The figure below shows the card of this agreement.

Also, in the write-off, we indicate accounting account 52 (Currency accounts) and settlement account 57.22 (Foreign currency sales). In addition, you must specify your organization and bank account.

Let's go through the document and look at its postings. You can see that not only the write-off itself was reflected, but also exchange rate differences.

If the currency has changed its value since the last currency transaction, 1C will also add a transaction for calculating the revaluation of currency balances (if the revaluation is configured).

Receipt to the current account

After the bank receives $7,000, it will transfer it to us in ruble terms. The program takes into account the document.

The receipt is filled in automatically after unloading from the client-bank. Nevertheless, it is recommended to check the filled details, especially the account and the amount.

The movements of this document are shown in the figure below.

Buying currency

In the case of buying currency in 1C 8.3, you need to perform the same steps as in the previous example.

In this situation, the write-off will look like "Other settlements with the counterparty". In transactions for the purchase of currency, instead of 57.22 there will be 57.02 (Purchase of foreign currency). Receipt to the settlement account will have the form “Purchase of foreign currency”.

Let's start with legislative framework RF. In it we will see that according to PBU 3/2006, if the value of assets and liabilities is expressed in foreign currency, then for reflection in accounting this value is converted into rubles on the date of the transaction in foreign currency and on the reporting date, that is, the last day of the month.

How is currency accounting and currency revaluation implemented in 1C 8.3 Accounting 3.0?

To be able to keep currency records in the 1C 8.3 program at the beginning of operation, you must configure Functionality, allowing . Menu Main - Settings - Functionality:

Also needed in the handbook. Currencies:

add the foreign currencies required for work in 1C 8.3:

and ensure timely regular updates of values exchange rates in the eponymous information register:

Accounting for currency transactions in 1C 8.3

If the enterprise has a foreign currency bank account, data on it must be entered in directory Bank accounts of the organization:

For reference currency transactions in the program 1C 8.3 Enterprise Accounting 3.0 in the chart of accounts there are special accounts that have the sign of currency accounting:

This feature allows you to see the balances on these accounts in the standard reports of the 1C 8.3 program not only in the regulated currency - rubles, but also in the desired foreign currency:

Revaluation of foreign currency in 1C 8.3

Nothing stands still and exchange rates change. Accordingly, the amounts of the ruble equivalent of balances on foreign currency accounts should be recalculated with the same amount of the foreign currency balance. Depending on whether the exchange rate rose or fell, the organization will have other income or expenses during the revaluation.

Where in 1C 8.3 currency revaluation

As soon as in the information base of the program 1C 8.3 Accounting 3.0 there are currency accounts with balances on them, in processing Closing of the month line will appear transactions Revaluation of foreign currency. This operation is precisely designed to analyze the balances of the currency accounts of the chart of accounts and revaluate the currency amounts with the recognition of other income or other expenses, generating the corresponding entries automatically.

Let's say that in April, the Romashka LLC organization opened a foreign currency current account and a payment from a client in the amount of $ 1,000 was credited to it (rate 68.2724). Reflecting the receipt of currency in the program 1C 8.3, in processing Closing of the month appeared operation Currency revaluation:

although it was not in March:

So, now knowing all of the above, let's return to the 1C Accounting 3.0 program and use examples to figure out how the currency is revalued automatically.

Example 1. If the exchange rate has decreased

As of April 19, 2016 the dollar exchange rate was 68.2724 rubles, as of the reporting date 04/30/2016. it fell to 64.3334 rubles. Nothing has changed in the currency amount, but the ruble equivalent has decreased, and, accordingly, the enterprise has incurred an expense, which is reflected operation Currency revaluation at the end of the period in April:

Example 2. If the exchange rate has increased

For the month of May, no transactions were made on the account, respectively, on the next reporting date, on May 31, 2016, the need for revaluation arises again. The dollar exchange rate, in comparison with the previous revaluation, increased by 31.05.2016. amounted to 66.0825 rubles. Thus, the organization has received other income, which is reflected in Currency revaluation for May:

Example 3. Revaluation at the time of the transaction

As for the currency revaluation in 1C 8.3 when making a transaction, the mechanism is similar to that discussed above, only the currency conversion rate is taken according to the day of the transaction:

Relative to the previous revaluation date 05/31/2016. the exchange rate fell and on 06/10/2016. amounted to 63.7402 rubles. The organization must register the expense, which we see in the postings:

It is worth saying a few words about information register Accounts with a special revaluation procedure. You can get to this register through the menu Main - Chart of accounts - More - Accounts with a special revaluation procedure:

Chart of accounts accounts that require a different revaluation method from the one described above are entered here. If the chart of accounts account is included in this list, then there will be no automatic revaluation of balances when performing operations on the reporting date as a scheduled operation. Revaluation must be done manually using document Transactions entered manually:

For example, 05/06/2016. the organization provided a service in the amount of 2000 c.u.,

thus, a debt was formed on account 62.31:

If information register Accounts with a special revaluation procedure left blank, then at the end of the May period in transactions Currency revaluation there will be a revaluation of the balance of account 62.31:

If account 62.31 is included in this list:

then in Closing of the month the balance will not be revalued for it:

Thus the program accounting families is able to help the user who is faced with the difficult issue of accounting and. The accountant just needs to set everything up correctly and control the generated transactions.