Posting and write-off of overalls in 1s 8.2. Accounting info

Special clothing is designed for individual protection of workers, for example, when working in hazardous industries or for protection against pollution, we will analyze how workwear is accounted for in 1s Accounting 8, ed.2.

Accounting for workwear in 1s depends on the period of its operation and cost. So overalls with a useful life of less than 12 months will be considered as part of material costs in both accounting and tax accounting. Overalls with a service life of more than 12 months and a cost of less than 40,000 rubles are accounted for differently in accounting and tax records. In accounting, it is taken into account as part of the inventory, but its cost is repaid on a straight-line basis depending on the useful life. In tax accounting, such overalls are written off immediately to material costs. In this case, there is a temporary difference. And overalls with a service life of more than 12 months and a cost of more than 40,000 rubles are accounted for as fixed assets, and in tax accounting as depreciable property.

Accounting for overalls in 1s Accounting 8

Let's consider how to take into account workwear with a period of use of less than 12 months in 1s Accounting 8, rev.2.

For example, LLC "Veda" purchased a janitor's suit of 2 pcs. at a price of 2,000 rubles. (VAT on top 18%). Then the janitor's suit was put into operation in the amount of 2 pieces.

The first document is the Goods and Services Receipt document, which can be found on the Purchase tab. Type of operation "Purchase, commission". In the new document, we indicate the counterparty, contract and warehouse. At the bottom of the document, add or select the name of the overalls, in our example, “janitor suit”. This is a new element for us, so to add it to the "Nomenclature" directory, go to the "Overalls" folder. Account 10.10 “Special equipment and special clothing in stock” is “linked” to this folder. Next, specify the quantity, price, VAT rate and post the document. If the supplier has provided an invoice, indicate its number and date.

Postings are generated according to the document:

Dt 10.10 Kt 60.01 Janitor's suit arrived without VAT

Dt 19.03 Ct 60.01 VAT

When the overalls are put into operation, on the basis of the document "Receipt of goods and services", it is possible to generate the document "Transfer of materials into operation".

Here you need to specify the unit where the overalls are transferred, the individual, the purpose of use and the quantity.

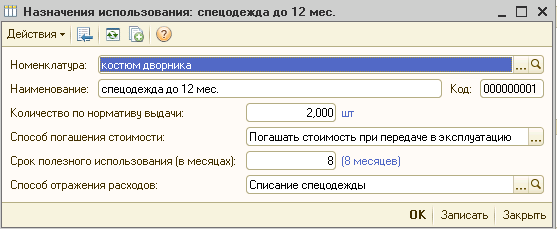

In our example, the service life of overalls is 8 months, therefore, in the purpose of use, we indicate the name “Working clothes up to 12 months”, the method of repayment of the cost is Repay the cost upon transfer to operation, the useful life is 8 months. and the method of reflecting expenses - write-off to account 20.

We carry out the document and look at the postings:

Dt 10.11.1 Kt 10.10 overalls were handed over for operation

Dt 20.01 Ct 10.11.1 the cost of overalls is paid off

According to Art. 221 of the Labor Code of the Russian Federation, at work with harmful and (or) dangerous working conditions, as well as at work performed in special temperature conditions or associated with pollution, employees are issued free of charge certified special clothing, special footwear and other personal protective equipment, as well as washing and (or) neutralizing agents in accordance with standard standards, which are established in the manner determined by the Government of the Russian Federation.

Special clothing These are personal protective equipment for employees of the organization. These include:

- special clothing;

- special shoes;

- safety devices (overalls, suits, including insulating ones, jackets, trousers, dressing gowns, sheepskin coats, sheepskin coats, various shoes, gloves, goggles, helmets, gas masks, respirators, face protection, hearing protection, eye protection, and other types of special clothing and safety devices).

The employer, at his own expense, is obliged, in accordance with the established norms, to ensure the timely issuance of special clothing, special footwear and other personal protective equipment, as well as their storage, washing, drying, repair and replacement (part 3 of article 221 of the Labor Code of the Russian Federation).

Accounting workwear

Order of conduct accounting workwear is determined by the Methodological Guidelines for the Accounting of Special Tools, Special Devices, Special Equipment and Special Clothing (approved by Order of the Ministry of Finance of Russia dated December 26, 2002 No. 135n) (hereinafter referred to as the Methodological Guidelines).Depending on the cost and useful life, overalls can be divided into three categories:

- First category: workwear with a useful life of less than 12 months.

- Second category: overalls with a useful life of more than 12 months, which are not included in fixed assets according to the cost criterion in accordance with PBU 6/01 "Accounting for fixed assets" (paragraph 4, clause 5 PBU 6/01) and the accounting policy of the enterprise.

- Third category: workwear, which is part of fixed assets (useful life of more than 12 months worth more than 40,000 rubles).

Overalls, which belong to the second category, are accounted for as part of inventories, but cannot be written off to cost accounts at a time. Its cost is repaid on a straight-line basis based on the useful lives provided for in the standard industry norms for the free issue of overalls, as well as in the rules for providing workers with overalls (clause 26 of the Methodological Instructions).

To ensure control over the safety of workwear after it is put into operation, it is taken into account on an off-balance account (clause 23 of the Methodological Instructions). In the program "1C: Accounting 8" for these purposes, the off-balance account MTs.02 "Overalls in operation" is used.

Overalls, which belongs to the third category, are accounted for in the manner used for accounting for fixed assets.

Tax accounting for workwear

The cost of overalls belonging to the first and second categories is included in the material costs at a time as they are put into operation (clause 3, clause 1, article 254 of the Tax Code of the Russian Federation).note: As a result of accounting for the second category of workwear, a temporary difference arises, because in accounting, the cost of such workwear is written off gradually (in a linear way), and in tax accounting, the write-off is carried out at a time (material costs).

Accounting for overalls in software "1C: Enterprise Accounting 8"

The procedure for accounting for overalls in the warehouse, release into operation and write-off of its cost to production costs should be reflected in the accounting policy.In the program "1C: Accounting of the enterprise 8", accounts 10.10 "Special equipment and special clothing in stock", 10.11.1 "Special clothing in operation", as well as the off-balance account MTs.02 "Overalls in operation" are used to account for workwear.

In this article, we will look at three ways to pay for the cost of workwear:

- repay the cost upon transfer to operation;

- linear;

- in proportion to the volume of products (works, services).

Let's analyze the features of accounting using the example of this situation:

On June 15, 2013 Voskhod LLC purchased 5 overalls from the supplier Tekstilshchik LLC at a price of 1,180 rubles. (including VAT), rubber boots in the amount of 7 pairs at a price of 590 rubles. (including VAT) and gloves in the amount of 15 pairs at a price of 33.6 rubles. (including VAT).

The organization has established the following norms for issuing overalls: overalls - 1 piece per year, rubber boots - 1 pair for two years.

Receipts of workwear

The receipt of overalls, as well as any acquired material value, is reflected using the document "Receipt of goods and services". The header of the document says:- the warehouse to which the purchased overalls are received;

- counterparty-supplier;

- the contract under which the purchase is made.

On the basis of the document "Receipt of goods and services", the data of the invoice presented by the supplier are entered. To enter an invoice, you can follow the hyperlink, which is highlighted in blue at the bottom of the document "Receipt of goods and services", or use the "Invoice" tab. In the invoice, you must specify the incoming number and date (Fig. 2).

As a result of posting the document "Receipt of goods and services", entries are formed that reflect the receipt of workwear to the warehouse and the occurrence of debt to the supplier, as well as the amount of incoming VAT (Fig. 3).

Transfer of overalls into operation

The issuance of overalls is reflected using the document "Transfer of materials for operation" (see Fig. 4). You can go to the journal of documents through the menu: Nomenclature and warehouse - Overalls and equipment - Transfer of materials to operation.

When adding a new document on the tab " Overalls» indicates the list of overalls issued to employees (in our case, these are overalls, rubber boots and gloves) (Fig. 5).

In the column " Purpose of use» information on the method of repayment of the cost of workwear and the issuance rate. Let us consider in detail what information is indicated in the destination card.

Note: The purpose of use is set for each item separately (field " Nomenclature”), so the created use assignment for overalls cannot be used for gloves later on. In the name of the purpose of use, you can indicate how the overalls will be used, the useful life (up to a year or more than a year). The destination card indicates the quantity according to the issuance standard, the method of repayment of the cost (according to accounting data), the useful life in months (important when using the “Linear” repayment option) and the method of reflecting expenses (i.e. cost account and analytics, to which the workwear will be written off). (see pictures 6, 7, 8):

As mentioned earlier, the cost of workwear with a useful life of less than a year is written off to expenses immediately at the time of issuance for operation (in our case, to account 20 "Main production") both in accounting and in tax accounting, as a result of which there are no permanent and temporary differences. For such overalls, the method of repayment of the cost is established " » (Fig. 6).

Note: « Payment method” specified in the use assignment card reflects the setting for accounting. In tax accounting, the cost is written off as expenses automatically. For overalls with a useful life of less than a year (for which the write-off in accounting and tax accounting is carried out simultaneously), the indicator " Useful life» contains auxiliary information for analysis that does not affect the results of the document.

Let's create a usage assignment for the boots (Figure 7). As noted earlier, if the useful life of workwear is more than 12 months, then in accounting the cost of such workwear will be written off as expenses gradually over the entire useful life in equal shares (in a linear way), and in tax accounting the write-off is made at a time, resulting in a temporary difference.

note: In the purpose of use, it is possible to specify also the method of repayment of the cost " In proportion to the volume of products (works, services)”, but it is not applicable to workwear. It can only be applied to special equipment.

With the write-off method in proportion to the volume of products (works, services), the amount of repayment of the cost of special equipment is determined based on the natural indicator of the volume of products (works, services) in reporting period and ratios actual cost object of special equipment to the estimated volume of output of products (works, services) for the entire expected useful life of the specified object.

The use of the write-off method in proportion to the volume of products (works, services) is recommended for those types of special equipment, the useful life of which is directly related to the amount of products (works, services) produced, for example, dies, molds, rolling rolls, etc.

We will also create a use assignment for gloves issued in excess of the norms (Fig. 8).

When workwear is issued in excess of the norm, a permanent difference (PR) arises in the assessment of expenses, since workwear is written off according to accounting data, and in tax accounting, the write-off value is not subject to income tax. The permanent difference occurs once in the current period. Thus, when write-offs of workwear in excess of the norms, the income tax adjustment is made once in the period of issuance of workwear.

What should I pay attention to when adding a purpose of use for such workwear?

- IN " Payment method» indicates the option « Repay the cost upon handover”, so that in accounting the cost of overalls was immediately charged to expenses (in our case, account 91.02) (Fig. 8).

- Filling " Ways to reflect expenses» (Fig. 9, 10).

When adding a new way of reflecting expenses for the selected cost account, the analytics must be indicated - “Cost item” or “Other income and expenses” item, depending on the selected cost account (Fig. 10).

As "Subconto 1" for account 91.02, there is an item of other income and expenses. Let's create a new article with the name "Overalls in excess of the norms." When adding a new article, it is important to indicate that in tax accounting, expenses for this article are not accepted when calculating income tax: in the column " Acceptance to NU» uncheck the box (Fig. 11, 12).

As a result of such a setting in accounting, the cost of workwear will be completely written off to account 91.02 “Other expenses”, and in the tax account there will be a permanent difference that will affect the calculation of income tax.

As a result of the document “Transfer of materials into operation”, the following postings will be generated (Fig. 13):

Let's analyze the postings formed during the document.

Posting Dt 10.11.1 Kt 10.10 reflects the release of workwear from the warehouse into operation.

The cost of overalls "Overalls", for which the method of repayment of the cost " Repay the cost upon handover", written off in Dt20.01 fully in both accounting and tax accounting (entry No. 4) in the amount of 1,000 rubles.

The cost of overalls "Rubber boots" with a linear method of repayment of the cost is written off as expenses at a time only in tax accounting in the amount of 500 rubles. At the same time, the occurrence of a taxable temporary difference is recorded on accounts 20.01 and 10.11.1 (entry No. 5). The repayment of the cost of this workwear in accounting and the repayment of the temporary difference that has arisen will be carried out monthly during the entire useful life when carrying out the regulatory transaction “Repayment of the cost of workwear and special equipment”.

Gloves that were issued in excess of the norms (entry No. 6) in accounting immediately in full amount(20 rubles) were written off to other expenses (account 91.02), and a permanent difference has formed in tax accounting, with which the tax will be adjusted when calculating income tax.

To control the availability of overalls in operation, the cost of the overalls put into operation when posting the document is entered in the debit of the off-balance account МЦ.02 “Overalls in operation” (postings No. 7, 8 and 9).

Important! On all balance accounts, the equality BU = NU + PR + VR must always be fulfilled (except for accounts 90 and 91, on which this equality may not be fulfilled by the amount of VAT).

To analyze the fulfillment of this requirement, when generating the balance sheet in the report settings, you need to enable " Control» fulfillment of this equality (Fig. 14).

We will pay off the cost for the next month (July).

To start a scheduled operation, you need to go to the menu: Accounting, taxes, reporting - Closing the period - Scheduled operations (Fig. 15).

As a result of the document, a transaction will be generated for the redemption of the cost of boots (Fig. 16).

When posting a document to a debit account 20.01 "Main production" in accounting, the cost of overalls is written off, calculated as follows: 500 rubles. / 24 months = 20.83 rubles per month. Also fixed is the repayment of the taxable temporary difference that arose at the time of putting into operation in the amount of 20.83 rubles.

Let's return to the month of the transfer of workwear into operation and consider what postings will be generated at the close of the month. We will reflect the proceeds from the sale by providing a service worth 11,800 rubles. (including VAT=18%) (Fig. 17).

When posting the document, the proceeds from sales and the accrual of VAT will be reflected (Fig. 18).

In our example, there are expenses from the transfer of workwear into operation and revenue from the provision of a service. Let us find out how the formed permanent and temporary differences affect the calculation of income tax. To do this, start processing Closing the month».

Menu: Accounting, taxes, reporting - Closing the period - Closing the month (Fig. 19).

Let's analyze the postings generated by the routine operation " Income tax calculation» (Fig. 20)

From the value of accounting profit (8,980 rubles), a conditional income tax expense is calculated:

8,980 * 20% = 1,796 rubles.

Dt 99.02.1Kt 68.04.2 RUB 1,796

When transferring boots into operation (with a useful life of 2 years), the cost of boots was 500 rubles in tax accounting. In accounting, this cost will be repaid during the useful life (2 years), and therefore, at the time the boots are put into operation, a taxable temporary difference (TDT) in the amount of 500 rubles arises, from which the deferred tax liability is calculated at the end of the month.

Dt 68.04.2 Kt 77,500 rubles * 20% = 100 rubles.

Starting from the month following the month of commissioning, the cost of the boots will be paid off in accounting and the deferred tax liability that arose in the month of putting into operation will begin to be paid off. The resulting ITW will be repaid over the remaining useful life in equal installments:

Dt 77 Kt 68.04.2 500 rubles / 24 months * 20% = 4.17 rubles.

Since in the current month the organization issued overalls in excess of the norms, a permanent difference arose during the formation of the wiring Dt 91.02Kt 10.11.1. From the resulting constant difference, a permanent tax liability (PNO) is calculated in the amount of 20 rubles * 20% = 4 rubles.

Dt 99.02.3 Kt 68.04.2 4 rub.

Calculated income tax in the amount of 1,700 rubles. distributed by type of budget: federal and regional.

1 700 rub. / 20% * 2% = 170 rubles. V Federal budget(wiring No. 1)

1 700 rub. / 20% * 18% = 1,530 rubles. to the Regional budget (posting No. 2)

170 rub. + 1 530 rub. = 1,700 rubles.

Consider what postings will be generated next month. For convenience of calculation, we will again reflect the proceeds from sales in the amount of 11,800 rubles. (including VAT=18%).

When carrying out a routine operation " Income tax calculation» For July, the following postings will be generated (Fig. 22).

From accounting profit (9,979.15 rubles), a conditional income tax expense is calculated (1,995.83 rubles):

9,979.15 * 20% = 1,995.83 rubles.

Dt 99.02.1 Kt 68.04.2 RUB 1,995.83

In July, the deferred tax liability 77Kt 68.04.2 begins to be repaid in the amount of 4.17 rubles. Income tax is adjusted for this amount, which, taking into account the deferred tax liability, amounted to 2,000 rubles.

The calculated income tax in the amount of 2,000 rubles is distributed to the Federal budget (2%) and the Regional (18%).

2 000 rub. / 20% * 2% = 200 rubles. (wiring No. 1)

2 000 rub. / 20% * 18% = 1,800 rubles. (wiring #2)

Postings generated at the close of July will be generated over the next 23 months (until the cost of the boots is paid off), provided that there are no additional permanent and temporary differences.

Help-calculation of tax assets and liabilities

The report "Reference-calculation of tax assets and liabilities" is designed to analyze the amount of permanent and temporary differences in the valuation of assets and liabilities.The printed form of the report is an accounting document that approves the procedure for recognizing permanent and temporary differences in the valuation of assets and liabilities in the month in which the report is generated.

You can go to the help through the menu item: Accounting, taxes, reporting - Closing the period - Closing the month - Help-calculations.

The information in the report is divided into two blocks:

- the section on permanent differences on which permanent tax assets and liabilities are calculated;

- a section reflecting temporary differences from which deferred tax assets and liabilities are calculated (Fig. 24, 25).

Let's analyze the report data for June. In Figure 24, we see that in June a permanent difference of 20 rubles was recognized, which arose when writing off workwear in excess of the norms (gloves). After the closing of the month in column 7 of Figure 21, a permanent tax liability was calculated from the resulting constant difference in the amount of:

20 rub. *20% = 4 rubles.

Figure 25 reflects the amount of the recognized temporary difference in the amount of 500 rubles. from the handover of boots, on which the deferred tax liability is calculated:

500 rub. * 20% = 100 rubles.

Let's generate a statement-calculation of tax assets and liabilities for July (Fig. 26).

As can be seen from Fig. 26, in July the reference-calculation was formed only in the part “Deferred tax assets and liabilities” (in July, the deferred tax liability is repaid).

The second column of Fig. 26 (“Recognised earlier”) reflects the recognition of a temporary difference in the amount of 500 rubles that arose last month. The recognized taxable temporary difference is settled on a monthly basis in the amount of:

500 rubles /24 months=20.83 rubles

Settlement of deferred tax liability.

There are at least two options for accounting for workwear, this is when workwear is used by employees of the organization and when workwear is transferred to employees of a contracting organization.

In any case, the posting of overalls is carried out in the same way, the usual document for the receipt of goods and services. Admissions will be as follows:

By consignment note from supplier:

Dt 10.10 ct 60.01 - in the amount of the cost of overalls without VAT

Dt 19.03 ct 60.01 - for the amount of VAT from the supplier

By invoice from supplier:

Dt 68.02 ct 19.03 - for the amount of VAT

Then, as the issuance of overalls, employees need to draw up documents. When transferring overalls and special equipment to employees, it is necessary to rely on the Decree of the Ministry of Labor No. 51 of December 18, 1998, Order of the Ministry of Finance of the Russian Federation No. 135n of December 26, 2003, internal local acts of the enterprise.

The fact is that workwear and special equipment have useful lives during which the cost of workwear should be written off in equal parts (in a linear way) to cost accounts. A one-time write-off of the cost of workwear is allowed if the STI is less than a year.

In any case, the program draws up a document:

/Warehouse/ - /Overalls and equipment/- Transfer of materials to operation, press the button create

In the document that opens, using the "Add" or "Selection" button, fill in the nomenclature, the individual and the purpose of use, in which it is necessary to register the option of writing off the cost of workwear as expenses.

If in parts - choose the linear method and prescribe SPI

If the full cost per month of transfer - the method of repayment of the cost upon transfer to operation

Write-off of the cost of overalls and special equipment for tax accounting purposes.

Overalls, as a rule, have a value of less than 100,000 rubles and are classified as non-depreciable property. Such property can be written off for expenses in full at the time of transfer, and by letter of the Federal Tax Service it is allowed to write off the cost of overalls in equal installments during the SPI. Which method to choose is decided by the organization itself and fixed in the accounting policy.

Document commissioning workwear formed wiring:

Dt 10.11.1 (or 2) ct 10.10 - in the amount of the cost of overalls

Write-off of the cost will be reflected at the end of the month wiring:

Dt 20 ct 10.11.1

In parallel, a posting is formed on the off-balance account on the Debit of the account MC.02 overalls are assigned to the employee of the organization.

After posting the document, it is necessary to print out the MB-7 statement (or the requirement - an invoice when writing off the entire cost of workwear for expenses).

After the end of the useful life of the issued overalls, it disposal is reflected in the document:

/Warehouse/ - /Overalls and equipment/ - Write-off of materials from operation, press the create button.

To fill in the tabular section, use the "Fill" button, then it will be possible to automatically fill it out, on the "Write-off of expenses" tab, select the option of attributing the cost to expenses.

If, under a contract, your organization is responsible for providing overalls and special equipment to the employees of the contractor involved in the performance of contract work for your organization, then there is no sale of the specified overalls, since your organization remains the owner of the specified property.

In this case, the transfer and return of overalls and special equipment, after use, occurs on the basis of an acceptance certificate drawn up in any form.

The write-off of the cost of overalls and special equipment occurs in the usual manner, based on established standards.

/ "Accounting encyclopedia "Profirosta"

21.07.2017

Information on the page is searched for by queries: Courses of accountants in Krasnoyarsk, Accounting courses in Krasnoyarsk, Courses of accountants for beginners, Courses 1C: Accounting, Distance learning, Education of accountants, Training courses Salary and personnel, Advanced training of accountants, Accounting for beginners

Accounting services, VAT declaration, Profit declaration, Accounting, Tax reporting, Accounting services Krasnoyarsk, Internal audit, DOS reporting, Reporting in statistics, Reporting in Pension Fund, Accounting services, Outsourcing, UTII reporting, Bookkeeping, Accounting support, Provision of accounting services, Assistance to an accountant, Reporting via the Internet, Drawing up declarations, Need an accountant, Accounting policy, Registration of individual entrepreneurs and LLCs, Taxes of individual entrepreneurs, 3-NDFL, Organization of accounting

By law, all organizations must provide their employees with protective clothing, as it is necessary to protect against undesirable environmental influences in the performance of duties.

Accounting for overalls in 1C 8.3 Accounting 3.0 is carried out in accordance with the order of the Ministry of Labor No. 997n. In this step by step instructions we will consider in detail the entire process of writing off workwear in 1C with different useful lives due to the fact that the accounting standards for them differ.

First of all, you must reflect the purchase of the workwear itself in the program. To do this, go to the "Purchases" section and create a new document "Receipt (acts, invoices)".

Fill in the header of the document, indicating the standard details of the supplier, your organization and where the purchased goods will be listed.

In our case, the organization purchases rubber boots, blue cotton robe and cotton gloves. As you can see, in the figure above, all stock items have an accounting account of 10.10. 1C 8.3 filled it in automatically.

If this did not happen for you, go to the card of the corresponding stock item and make sure that "Overalls" is set as the item type.

We will also check the rules for determining the accounts of the rubber boots we buy. The priority for her is the score 10.10.

We will not fill out anything else in this document. Now it can be carried out and check the correctness of the formation of movements.

Transfer to operation

After reflecting in 1C 8.3 the fact of receipt of overalls, it began to be listed in the main warehouse on account 10.10. Now you can issue it directly to the employees of the organization. For this, the document “Transfer of materials into operation” is used. You can create it on the basis of the workwear receipt that we just created.

1C Accounting automatically filled in all possible fields, but suppose we want to put into operation only rubber boots in the amount of 10 pieces. In the tabular part, we indicate physical. face - Abramov Gennady Sergeevich. It is for him that rubber boots will now be listed.

Pay special attention to filling in the "Purpose of use" box, which is marked in the image above. It contains an element of a special reference book, which indicates the procedure for paying off the cost of overalls and special equipment.

You can complete this guide yourself. As part of our example, a linear method of repaying the cost was chosen. We are going to reflect expenses on the 25th account.

Assume that the useful life for the rubber boots in this assignment example is 11 months. In accordance with the law, such overalls can be written off immediately if this period does not exceed 12 months.

After entering all the data, the document can be posted.

Write-off of overalls

On the basis of the transfer of materials into operation, this workwear can be written off.

The document was filled in automatically, and we only had to change the number of decommissioned rubber boots.

After posting the document in the postings, you can make sure that all boots in the amount of 10 pieces were debited from the MC.02 account.

Return from service

Sometimes in practice there are cases when overalls need to be returned from service. There can be many reasons for this phenomenon, for example, dismissal, sick leave, business trip or transfer of an employee.

The return document for their operation can be created on the basis of the transfer of materials into operation.

In this case, as in the previous example, it is enough to specify the quantity. The image below shows an example of returning one pair of rubber boots.

After posting the document, we see that one pair worth 150 rubles has been debited from the MTs.02 account. The boots account has changed from 10.11.1 (in use) to 10.10 (in stock).

Redemption cost

We will add one more item to the previously introduced transfer of overalls into operation - "Cotton blue robe" in the amount of 5 pieces. In the purpose of using the bathrobe, we indicate that its useful life will be 18 months, that is, one and a half years.

The cost of the bathrobe will be paid at the end of the month. In our example, all documents were posted from September 2017. In this regard, the operation we need to pay off the cost of the bathrobe will be made already at the close of October 2017. A similar scheme is applied to the depreciation of fixed assets.

Consider the postings that were created by the operation of paying off the cost of workwear and special equipment in October 2017. As shown in the figure below, for the bathrobe, a write-off was made in the amount of 97.22 rubles. This amount will be used to repay the cost of this position within 18 months.

In accordance with the specified data in the intended use, the calculation turned out as follows:

- 5 (number of bathrobes) * 350 (price of one bathrobe) / 18 (useful life) = 97.22 rubles.

Reporting

We will form a balance sheet for account 10.11.1 for October 2017. Please note that to clarify the availability of overalls and special equipment in the warehouse, you need to use account 10.10.

In the figure below, we see not only how much was on the dressing gown at the end and beginning of October, but also repaid 97.22 rubles.

Special equipment - a special kind material assets, which must be written off when put into operation in a certain order. A more familiar name for them is quick-wearing and low-value items.

Let's take a closer look at how to arrange operations for the movement of special equipment and workwear using the new 1C Accounting 3.0. Consider how operations for the movement of workwear are formalized.

We make the purchase of special equipment and workwear

The acquisition of special equipment and overalls occurs with the help of the document "Receipt of goods and services", type of operation "Purchase, commission".To add an item to the document itself, you must enter a new component of the reference book "Nomenclature" in the group "Special equipment" or "Overalls" (it all depends on what is being purchased). It is not an obligation to place new components of the directory in previously defined groups, but it is desirable to perform such actions so that later, when carrying out operations with such nomenclatures, the accounting accounts for the nomenclature are substituted automatically.

We carry out the transfer of special equipment and workwear into operation

Operations for the transfer of special equipment and workwear directly to production are recorded by the software environment using a document called “Transfer of materials to operation”.At the same time, the issuance of overalls occurs with an indication of the individual who receives these overalls.

Fig.2

The tabular part of the line is responsible for specifying the account for the transfer of workwear for use (by default, it is automatically substituted from the general settings for accounting accounts for the entire range).

In order to transfer the set equipment into operation, the same document is used, but for the special equipment, a separate tab “Special equipment” is used.

Fig.3

As you can see, this bookmark does not have the props " Individual". But a new attribute “Location” appears - it is intended to indicate the workshop to which a certain special equipment is transferred.

Separately, you need to familiarize yourself with the props "Purpose of use". Its purpose is to reflect the way in which the cost of special equipment and workwear is paid off for expenses; it is mandatory to fill in in any of the cases.

Methods of repayment of the cost of special equipment and overalls are described in the reference book with the title "Purpose of use".

Fig.4

Basically, overalls are written off as expenses that occur during the transfer to operation, and to describe its purpose, the props “Cost redemption method” are used, which will “Repay the cost upon transfer to operation”.

The requisite referred to as "Quantity according to the issuance standard" is necessary for automatic substitution in the data of documents for the transfer of materials for use.

The order depends on the useful life full repayment cost of special equipment (overalls). If such a period is more than one year, then in accounting the full cost of overalls should be written off as material expenses using the straight-line method, and in tax accounting such a cost is written off as material expenses.

The main feature of the special equipment is its long service life at a cost of less than 40,000 rubles, this fact makes it impossible to attribute it to fixed assets.

The method of full repayment of the cost of special equipment is either proportional to the volume of work performed (products, services), or linear. In the first case, it is necessary to enter the document “Production of materials” on a monthly basis, the main purpose of which is to register the volume of manufactured products to pay off the entire cost of special equipment when used.

Fig.5

The determination of the debit of the posting for the write-off of the total cost of special equipment (overalls) is made using the requisite “Method of reflection of expenses”. It describes the production account (25 or 20), the cost division, as well as the analytics - the cost item and the item group.

Fig.6

The debit of off-balance accounts when accounting for material assets, as well as the posting of balance accounts 10.11 and 10.10, forms a document.

Fig.7

We carry out the repayment of the cost of special equipment and workwear

If it is necessary to write off the cost of workwear as expenses during its transfer for use, then the document “Transfer of materials for operation” simultaneously generates a posting for its write-off.If the write-off of the cost of special equipment and workwear occurs during the period of its use, then the formation of postings for the repayment of the cost occurs at the very end of the month, with the full closing of the month. Also, to pay off the cost of special equipment and workwear, there is a separate procedural operation “Repayment of the cost of workwear and special equipment”.

Fig.8

When performing a scheduled operation, it generates the following postings:

Fig.9

As can be seen, the amount related to tax accounting, has to do with timing differences.

Complete write-off of special equipment and overalls from operation

To reflect the write-off operations from the use of special equipment and workwear, the program provides for the document “Write-off of materials from operation”.It is introduced based on the document "Transfer of materials into operation". There is also the possibility of introducing separately.

Fig.10

In the event that a document is entered based on the transfer to operation, all tabular parts of this document are automatically filled in from the base document.

If the input is performed separately, then the lines of the document are filled in by selection, or using the special "Fill" button. This can be done by the remaining low estimate in production, or by the remains of special equipment (overalls) that have not been written off from use, but have expired.

To write off special equipment, all the same actions can be performed using the “Special equipment” tab. To do this, you must fill in the "Location" attribute to select the unit from which the special equipment is deducted.

The “Write-off of expenses” tab is needed if the cost of the write-off workwear has not been paid off, and its repayment is required when writing off.

Fig.11

By default, there is a method of writing off the costs that are specified during the transfer in the purpose of use. But if there is a need, then it can be easily changed, while indicating the required cost account. For this purpose, the method for writing off expenses "To the debit of the account specified in the document" is selected. The necessary details of the debit account, as well as its analytics, will appear on the tab.

When posting, the document will generate a posting on the credit of account MTs.03 (MTs.02). In the event that special equipment (overalls) that is not written off for costs is written off, a posting is generated to write off the remaining amount.

Fig.12

As you can see, in our example, the cost of special equipment is written off this month, to the account specified in the purpose of operation. The remaining cost is written off to the account indicated in the write-off document (the “Write-off of expenses” tab).

Also, a posting is generated for writing off special equipment from the account MTs.03 and a posting is generated for writing off special equipment from the off-balance account "Special equipment in operation" MTs.03.

.JPG)