How to pay travel allowances in 1s 8. Accounting info

In almost every organization, at least once an accountant had to send an employee on a business trip. In this article we will look at how to arrange a business trip in 1C 8.3 Accounting.

You will learn:

- Is it possible to make a business trip order in 1C 8.3 Accounting;

- how to spend travel expenses in 1C 8.3;

- how to calculate daily allowances and travel allowances in 1C 8.3 Accounting.

First, let's look at the questions that most often arise for users:

- Is it possible to make a business trip order in 1C 8.3?

- how to find the form travel certificate in 1C 8.3?

Unfortunately, there are no personnel documents - such as a business trip order or travel certificate - in Accounting 3.0. But they can be modified independently or with the help of a programmer.

Let's look at how to process travel transactions in 1C 8.3 Accounting, using an example.

Designer-designer P. A. Mikhailov was sent on a business trip from September 21 to 27. According to his work schedule, Saturday and Sunday are days off.

- railway ticket (Moscow-Samara) in the amount of 2,988 rubles. (including VAT 18% - 67.15 rubles);

- railway ticket (Samara-Moscow) in the amount of 2,240 rubles. (including VAT 18% - 67.15 rubles);

- receipt and SF for hotel accommodation in the amount of 4,248 rubles. (including VAT 18%).

Daily allowances in the Organization in accordance with the Regulations on Business Travel are paid at the rate of 700 rubles/day. - 4,900 rub.

On September 30, the accountant calculated wages Mikhailov for a month, including 5 working days of a business trip.

How to post travel expenses in 1C 8.3

Travel expenses in 1C 8.3 Accounting, incl. apply for daily allowances based on the employee’s advance report on the business trip in the section Bank and cash desk – Cash desk – Advance reports.

In the header of the document please indicate:

- Accountable person - from the reference book Individuals select the employee who is reporting for the business trip.

On the tab Prepaid expense by button Add select advance payment documents.

Reflect the calculation of daily allowances in 1C 8.3 Accounting on the tab Other. Here, show all other travel expenses (train tickets, accommodation, etc.).

Cost item select with Type of consumption - Travel expenses.

Postings

Acceptance of VAT for deduction

So that VAT allocated on tickets and SF presented by counterparties can be deducted in the following columns:

- SF- check the box if BSO or SF is presented.

- BSO- check the box for BSO documents.

- Invoice details - enter the number and date of the Federation Council. BSO details will be filled in this column automatically from the column Document (expense) .

As a result of registration, the BSO and SF will automatically be created:

- Invoice (strict reporting form) .

- Invoice received .

Documents can be found in the journal Invoices received through the section Purchases – Purchases-Invoices received or follow the links in the document Advance report .

How to calculate travel allowances in 1C 8.3 Accounting

Settings in 1C for calculating payment during a business trip

To calculate average earnings during a business trip, create an accrual type of the same name in the directory Accruals, which can be opened from the section Salary and personnel - Directories and settings - Salary settings - Payroll calculation - Accruals.

Please pay attention to filling out the fields:

Chapter Personal income tax :

- switch taxed ;

- income code - 2000 - remuneration for performing labor or other duties; salary and other taxable payments to military personnel and persons equivalent to them;

- Income category - Salary.

Chapter Insurance premiums :

- Type of income - Income fully subject to insurance premiums.

Chapter Income tax, type of expense under Art. 255 Tax Code of the Russian Federation :

- switch taken into account in labor costs under item : pp. 6, art. 255 Tax Code of the Russian Federation- the amount of average earnings accrued to employees, retained for the duration of their performance of government and (or) public duties and in other cases provided for by law Russian Federation about work;

- flag Included in the basic charges for calculating the “Regional coefficient” and “Northern surcharge” charges no need to install for Accruals Payment for time on a business trip, because to calculate the payment, these accruals have already been taken into account.

Chapter Reflection in accounting :

- Reflection method - not installed.

In 1C, the accrued amount will be reflected in the salary account with the BU and NU settings specified in the directory Employees in field Expense accounting .

Calculation of payment for time on a business trip

Accrual of travel allowances in 1C 8.3 Accounting does not have a special standard document. Therefore, the calculation of average earnings during a business trip is calculated manually and documented Payroll In chapter Salary and personnel - Salary - All accruals - Create button - Payroll.

In the document please indicate:

- Salary for- the month for which the employee’s salary is calculated;

- from- last day of the month.

By button Add select the employee who will be paid for time on a business trip. By button Accrue select:

- Accrual Payment according to salary- indicate the number of days worked at the workplace, minus days on a business trip (calculate manually). The program will automatically calculate the amount.

- Accrual Payment for time on a business trip- fill in .

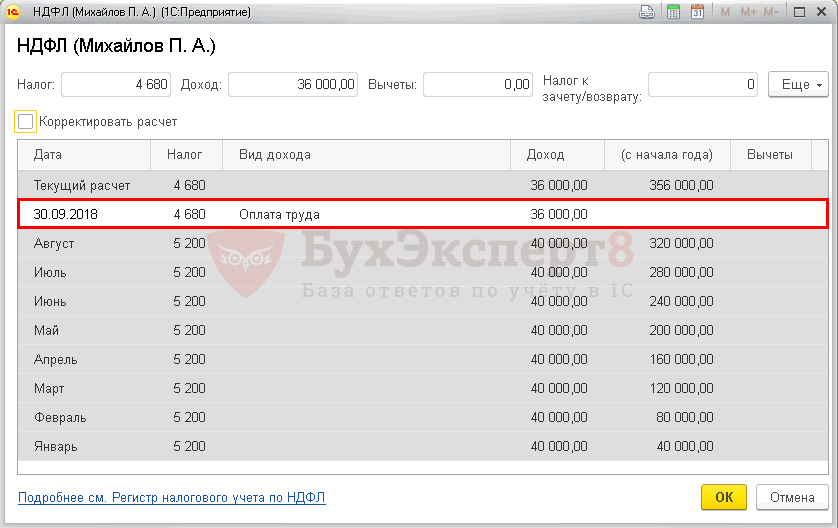

Check all amounts accrued to the employee and, if necessary, adjust in the form at the link Accrued .

- graph Personal income tax- the amount of calculated personal income tax.

How to arrange a business trip and pay travel allowances in the 1C 8.3 Accounting program?

Sending an enterprise employee on a business trip begins with an order from the director. The employee is informed about this, and if an agreement is reached, the order is transferred to the accounting department (the order of operations at different enterprises may be different).

The accounting department issues a travel certificate (based on the director’s order). These documents are not prepared in the standard configuration of 1C 8.3 “Enterprise Accounting 3.0”.

In the 1C program, registration of a business trip begins with the issuance of money and reporting.

Issuing travel allowances in 1C 8.3

As a rule, money is issued from the cash register. In this case, the issuance is issued by a “Cash Expenditure Order“. Although, especially recently, funds can be transferred bank payment to the employee's card. In this case, a document “Write-off from the current account” is created.

The amount is initially calculated approximately based on expected expenses:

- travel

- accommodation

- daily allowance

- other

To receive funds, the employee must write a statement indicating the amount and purpose of the expenses. In our case, these are travel expenses.

Let's consider the registration of an advance payment using the example of a “Cash outgoing order”.

You immediately need to set the type of issue (type of transaction) to “Accountable person”. Then fill in the details:

- organization (if there are several of them in the database)

- recipient

- sum

- In the transcript of the details of the printed form, indicate the employee’s application number

In the comment you can indicate that this is an advance payment for a business trip:

Now you can post the document and see the postings for the issuance of travel allowances, which 1C Accounting 8.3 will generate:

The employee has incurred a debt for which he must account.

Employee report for travel expenses

Upon returning from a business trip, the employee is required to account for the money spent. For this purpose, in 1C 8.3 the document “Advance report” is used.

An “Advance report” is created in the same section as “Cash documents”.

In the list form, click the “Create” button. A new document form will open.

First of all, we choose an accountable person. Then, on the “Advances” tab, click the “Add” button and in the “Advance document” column, select the expense order issued earlier (a window will first open where you need to select what type of document we need):

Then go to the “Other” tab and fill in the lines there where the employee’s expenses went. If cash went to purchase goods, these transactions should be reflected on the “Goods” tab.

An example of filling out the “Other” tab:

If we post the document and look at the postings, we will see that the company’s debt to the employee has decreased by 2,000 rubles:

Since the expenses have already been paid, they immediately go into the Book of Income and Expenses of the simplified tax system:

Based on materials from: programmist1s.ru

In almost every organization, at least once an accountant had to send an employee on a business trip. In this article we will look at how to arrange a business trip in 1C 8.3 Accounting.

You will learn:

- Is it possible to make a business trip order in 1C 8.3 Accounting;

- how to post travel expenses in 1C 8.3;

- how to calculate daily allowances and travel allowances in 1C 8.3 Accounting.

How to make a business trip order in 1C 8.3

First, let's look at the questions that most often arise for users:

- Is it possible to make a business trip order in 1C 8.3?

- how to find a travel certificate form in 1C 8.3?

Unfortunately, there are no personnel documents - such as a business trip order or travel certificate - in Accounting 3.0. But they can be modified independently or with the help of a programmer.

Let's look at how to process travel transactions in 1C 8.3 Accounting, using an example.

How to post travel expenses in 1C 8.3

Travel expenses in 1C 8.3 Accounting, incl. fill out the daily allowance based on the employee’s advance report on the business trip using the document Advance report in the section Bank and cash desk – Cash desk – Advance reports.

In the header of the document please indicate:

- Accountable person - from the reference book Individuals select the employee who is reporting for the business trip.

On the tab Prepaid expense by button Add select advance payment documents.

Reflect the calculation of daily allowances in 1C 8.3 Accounting on the tab Other. Here, show all other travel expenses (train tickets, accommodation, etc.).

Cost item select with Type of consumption - Travel expenses.

Postings

Acceptance of VAT for deduction

So that VAT allocated on tickets and SF presented by counterparties can be deducted in the following columns:

- SF- check the box if BSO or SF is presented.

- BSO- check the box for BSO documents.

- Invoice details - enter the number and date of the Federation Council. BSO details will be filled in this column automatically from the column Document (expense) .

As a result of registration, the BSO and SF will automatically be created:

- Invoice (strict reporting form) .

- Invoice received .

Documents can be found in the journal Invoices received through the section Purchases – Purchases-Invoices received or follow the links in the document Advance report .

How to calculate travel allowances in 1C 8.3 Accounting

Settings in 1C for calculating payment during a business trip

To calculate average earnings during a business trip, create an accrual type of the same name in the directory Accruals, which can be opened from the section Salary and personnel - Directories and settings - Salary settings - Payroll calculation - Accruals.

Please pay attention to filling out the fields:

Chapter Personal income tax :

- switch taxed ;

- income code - 2000 - remuneration for performing labor or other duties; salary and other taxable payments to military personnel and equivalent persons;

- Income category - Salary.

Chapter Insurance premiums :

- Type of income - Income fully subject to insurance premiums.

Chapter Income tax, type of expense under Art. 255 Tax Code of the Russian Federation :

- switch taken into account in labor costs under item : pp. 6, art. 255 Tax Code of the Russian Federation- the amount of average earnings accrued to employees, retained for the duration of their performance of state and (or) public duties and in other cases provided for by the labor legislation of the Russian Federation;

- flag Included in the basic charges for calculating the “Regional coefficient” and “Northern surcharge” charges no need to install for Accruals Payment for time on a business trip, because to calculate the payment, these accruals have already been taken into account.

Chapter Reflection in accounting :

- Reflection method - not installed.

In 1C, the accrued amount will be reflected in the salary account with the BU and NU settings specified in the directory Employees in field Expense accounting .

Calculation of payment for time on a business trip

Accrual of travel allowances in 1C 8.3 Accounting does not have a special standard document. Therefore, the calculation of average earnings during a business trip is calculated manually and documented Payroll In chapter Salary and personnel - Salary - All accruals - Create button - Payroll.

In the document please indicate:

- Salary for- the month for which the employee’s salary is calculated;

- from- last day of the month.

By button Add select the employee who will be paid for time on a business trip. By button Accrue select.

The “Business trip” document in 1C ZUP 8.3 is used for calculating and calculating payments to seconded employees based on average earnings, as well as for correctly reflecting working hours. The “Business trip” document log is available both in the “Personnel” section and in the “Salary” section.

To arrange a business trip for an employee, click the “Create” button. We enter the data into the document: the month of accrual, the employee, the date of the document, the start and end dates of the business trip; if necessary, a flag is set to exempt the rate for the period of absence of the employee.

After selecting an employee and a business trip period, the program automatically, without additional commands, calculates the employee’s average earnings (based on the data available in 1C ZUP), the amount of accrued travel allowances and withheld personal income tax. This data is displayed on the Main tab.

In the “Payment” field, you need to select from the drop-down list how travel allowances will be paid to the employee - with salary, with or during the interpayment period (that is, a separate payment). The date of payment is also indicated here.

By default, average earnings are calculated for 12 months. To use a different period for calculation, you must click the “Change” link next to the average earnings field. The “Data entry for calculating average earnings” form will open, in which you should check the billing period– “Set manually”, indicate the desired period and click “Reread”. Average earnings will be recalculated, to save you need to click “OK”.

Accrued travel allowances are reflected on the “Accrued in detail” tab. Here, if necessary, you can manually change the amount (unlike the “Main” tab, where the amount cannot be changed).

If an employee is sent to one of the regions, work in which entitles him to a preferential pension period, then he should open the “PFR Experience” tab and select the desired value in the “Territorial conditions” field.

Get 267 video lessons on 1C for free:

On the “Additional” tab, information about the business trip is indicated - the city and organization of the destination, the source of financing, the basis and purpose, the number of days on the trip.

The “Business trip” document is carried out in the usual way. The document provides for the printing of an order for sending on a business trip (form T-9), a travel certificate (T-10), a job assignment (T-10a), as well as the calculation of average earnings and accruals.

Accrual and calculation of travel allowances in 1C ZUP

If we create and fill out the document “” for the month, we will see that there are no business trips in it. This happens because the calculation of payment based on average earnings (travel allowances) in the program is carried out by the “Business trip” document itself; re-accrual is not required.

The travel payment includes:

Payment of travel allowances

If in the document 1C ZUP “Business trip” on the “Main” tab the payment “With salary” or “With advance payment” was selected, then when creating and automatically filling out a general statement for salary or advance payment, the program will include travel allowances in it.

If the payment “During the inter-settlement period” was selected, it can also be issued automatically. This can be done in two ways.

1) In the “Business Trip” document, click the “Pay” button:

The completed “Payment of accrued salary” form will open, containing data on the payment of travel allowances. It indicates the payment document - a statement to the cashier or to the bank, depending on the existing settings for the organization and for a specific employee. By clicking the “Edit” button, you can edit the statement if necessary.

By clicking the “Post and close” button, the statement will be posted.

2) Another way to reflect the payment of travel allowances during the interpayment period is to create a new one, select “Business Trips” in the “Pay” field, and use the link to indicate one or more supporting documents – “Business trip”. The payout amounts will be filled in automatically. Then process the payment as usual.

Organizing a business trip for a group of employees

In order to “send” several people on one business trip in 1C ZUP 8.3, you should click “Create T-9a” in the business trip log:

A document “Group trip” will be created, in which you need to enter lines and indicate in each of them the employee, the period of the trip and travel time, destination, purpose, source of funding:

Leave your name and phone number, an operator will contact you during business hours within 2 hours.

Moscow St. Petersburg Samara

A similar set of printed forms is issued based on the entry made. Immediately after entering data in all fields relating to the business trip, you will be able to print out an order to send certain employees on a business trip, a job assignment and a travel certificate (if necessary). In particular, the T-9 form (business trip order), generated automatically, will look like this.

After saving the document on the appointment of a new business trip and posting it in the database, you will be able to track the status of employees in the information register in the “Operations” menu, where the dates of the official trip will be indicated.

Such data will also be useful in the 1C Logistics transportation management program, which will allow you to track the movements of employees and their employment on business trips.