Internet banking Sberbank Belarus personal account. Sberbank Online personal account - entrance

With the development of the banking sector, the Internet banking service has become widespread. Sberbank offers its customers a convenient system that allows them to make payments, transfers, and many other transactions without leaving their homes. Those who want to always have a bank at hand should get online banking.

What is the Internet banking service from Sberbank? This feature allows the customer to carry out most of the banking transactions that previously could only be performed through a bank branch or ATM. Internet banking is available today to get an entry through a personal computer or an application in the phone.

Internet banking BPS Sberbank was transformed in 2015 into Sberbank online, which operates today.

How to connect Internet banking BPS Sberbank?

To connect the Sberbank Internet banking service, you need to contact any branch of the bank. You should have a passport with you, since when filling out an application for connecting the service, you will need to fill out a questionnaire in which the client's data is indicated.

To gain access to Internet banking, you must:

- Come to the branch of Sberbank with a passport.

- Contact the cashier or the employee responsible for connection.

- The bank employee will draw up an application for connecting the Internet banking service to the client. This application must be signed.

- After the application is completed, an SMS notification will be sent stating that the Internet banking service is connected.

To gain access to the Internet banking service, you must have the Mobile Banking service activated to receive SMS notifications.

Internet banking is connected to one Sberbank card, even if the client has several of them. However, he will be able to receive information about all cards online.

How to register in BPS Sberbank Internet banking?

To register in the BPS Internet banking system of Sberbank, you just need to submit an application and connection at a bank branch. After all procedures are completed, the user will be automatically registered in the system and will be able to use the Internet banking service. However, the initial login and password are set automatically and are not considered secure. In order to make the use of Internet banking completely safe, it is better to change the login and set a new user password when you first enter your personal account.

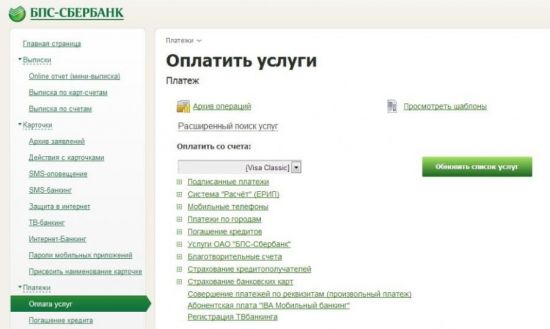

Internet banking BPS Sberbank: payment for services

Through the BPS Internet banking system, any user can pay for services. To do this, you need to enter your personal account by entering your login and password, as well as an SMS code. Since 2015, BPS Internet banking has been transformed into the Sberbank online system with improved protection using SMS alerts. That is why when paying for each service, confirmation SMS will be sent to the user's phone.

To pay for services using BPS Internet banking, you must:

- Log in to your personal internet banking account.

- Select the Transfers and payments tab.

- Go to the item of the type of payment for services that is required.

- Enter the details of the recipient and the amount of payment.

- Press the Done button.

- Confirm the correctness of the operation by SMS with a password.

- Get your payment receipt online.

It is necessary to enter payment details correctly and accurately and be sure to check them before sending funds.

Thus, every client of the bank can connect Internet banking to BPS Sberbank. To do this, it is enough to have a phone, a Sberbank card and a passport. Connection is free of charge. The presence of a personal account in such a system allows you to pay for services, transfer funds and perform a lot of banking operations from your own computer or phone.

To get modern tools for managing a current account, it is worth connecting BPS Sberbank Internet banking - BPS-Sberbank online banking, which allows you to perform a lot of operations and opens up opportunities for obtaining complete information about the balance of funds available for use.

Login to BPS Sberbank Internet banking and Login for business clients

> https://i.bps-sberbank.by<

Thanks to the advantages of Internet banking, you can track the movement of finances on a card or deposits. Special conveniences are felt by customers when paying for telephone, television, Internet, etc. The system's capabilities allow making payments on a loan issued by BPS Sberbank, making deposits and replenishing them.

The client can also independently block or unblock the card, change the password that provides access to the system. The Bank has the right to change and supplement the list of operations for which the Internet banking capabilities are used.

BPS Sberbank new user registration online

To use the service, you need to register, for which the cardholder will need to contact one of the representative offices of a financial institution and provide documents that prove his identity and personal data. To familiarize yourself with the provisions of the contract governing the provision of services, you need to visit the official information resource of the company. The user also needs to fill out an application that allows you to register the service and get at your disposal special tools for activation. The so-called session keys are used to carry out all the financial transactions envisaged.

The process of receiving the service implies activation, for which the cardholder needs to register at the point intended for this procedure. When performing these actions, the client must provide his personal number, the characters of which are entered exclusively in Latin capital letters. A correctly written password allows you to immediately appear on the main page of the system.

Important!

But you should be especially careful when entering a password, three unsuccessful attempts can lead to blocking the entrance for two hours. If the user cannot remember the password, it is worth using the provided service, which allows you to recover it. Simple and easy navigation provides speed and comfort in using the menu options. To ensure the security of information about finances, access to information about the password or session keys for third parties should be completely excluded.

BPS-Sberbank online is one of the types of remote banking services (RBS) from BPS-Sberbank OJSC in the Republic of Belarus. In terms of its functionality and organization of the service, BPS-Sberbank online is, with the storage of data on the bank's server, the entrance to your personal account for the operation, etc.

The main purpose of BPS-Sberbank online is to enable individuals to manage the funds of their own card accounts.

How to connect BPS-Sberbank online and what is required for this?

Any holder of an account with BPS-Sberbank OJSC can become a user of the BPS-Sberbank online service. Most often, the owners of the BPS-Sberbank payment card become the client of the service. They usually have a payroll card and use it for household payments.

To get access to the service, the cardholder must conclude an appropriate agreement with the bank in one of the branches of BPS-Sberbank OJSC. But registration is possible without a personal visit, through the website https://i.bps-sberbank.by.

To work with the BPS-Sberbank online service, you must have a computer and minimal skills in working with it. No special programs are required to receive the service. But the version of the Internet browser must be up-to-date for the current moment. For example - Internet Explorer is not "older" than the 9th release.

Functionality of BPS-Sberbank online

With the help of BPS-Sberbank online it is possible to:

Carry out financial transactions:

- Payments in the system - utilities, communications, Internet, etc.;

- Other payments to individuals and legal entities;

- Transfer of funds from a BPS-Sberbank card to another card;

- Repayment of loans;

Receive information about the balance of funds on the account, transactions, receipts and payments.

Generate bank statements.

View reference information (exchange rates, location of ATMs, etc.).

Activate some banking services:

- Notification by SMS about transactions with a card account;

- "One-click payment" - making periodic payments with one click according to the online form saved in the BPS-Sberbank service;

- "Automatic payment" - permission for the bank to make payments without a separate order from the client for a specific transaction. The list of such payments and their recipients is determined in advance by the client.

- "Verified by Visa and MasterCard SecureCode" - a way to provide additional security for payments by entering an additional, one-time password received via SMS.

Work with deposits:

- Open bank deposits and replenish them;

- Transfer funds to depersonalized metal accounts (exclusive BPS-Sberbank service).

Control the card account security system:

- Change the password for entering your personal account;

- Block and unblock a bank card;

- Choose a method for additional confirmation of operations with passwords;

Control the visibility of certain services.

How much does the BPS-Sberbank online service cost?

You can use the BPS-Sberbank service online either free of charge or for 7.5 rubles (BYN) per year.

Choosing a free service, the client significantly limits his options. He only has access to:

- Getting help information;

- Service "Automatic payment"";

- SMS notification;

- Verified by Visa and MasterCard SecureCode.

The last two points relate to the security system. Payment options are limited to automatic debiting. This option seems convenient only for periodic payments for utilities, etc.

Clients who have concluded an agreement on comprehensive banking services get access to all the features of the service.

It seems obvious that 7 rubles 50 kopecks is an acceptable fee for freedom of payments and other transactions during the year.

You can learn more about the service from the employees of BPS-Sberbank OJSC or on the bank's website, section "Private Persons", subsection "Payment for services using remote channels", item "Sberbank Online". On the same page, on the right, you can find the contract form, instructions for working with the service and answers to some questions.

If you notice a mistake in the text, please highlight it and press Ctrl+Enter

BPS Bank is a remote customer service system from BPS-Sberbank operating in Belarus. Internet banking gives Belarusian customers the opportunity to use all the services of the bank and control accounts and cards online. All operations are carried out in your personal account, below you will learn how to register, log in to your account and use it.

Login and register an account

Until 2015, bpsb had a different banking system, after which it switched to the same service that operates in Russia - Sberbank Online.

Access to the personal account will be received only by a client who has an account or card in the BPS. There are two ways to become a user:

- By signing an agreement with the bank. You only need to take your passport with you.

- Registration without visiting a branch on the lender's website.

In the case of visiting a branch, the bank manager will issue a temporary password and login after submitting an application.

When registering on the site, you need to click on "Register" and enter:

- Identification number of the card or account.

- Mobile number to which session codes and passwords will be sent in the future to confirm transactions.

By clicking on "Continue" a password will be sent to the specified number. By entering it into the line on the site, the identity of the client will be confirmed and access will be opened. Now you need to enter the LC.

The generated password is not secure. The user needs to change it in the future, creating a new, complex combination.

The entrance to the BPS personal account is carried out on the main page of the official website www.bps. sberbank. by. No special software or devices are required for authorization.

Recall that by entering the wrong password several times, access to the account will be blocked for several hours.

Using the BPS office

There are two options for connecting to the LC:

- For free.

- For 7.5 rubles per year (BYN version).

In the free subscription option, the client gets much fewer features. He can only:

- Get information about bank accounts and cards.

- Use auto payment and SMS notification.

- Confirm transactions by entering one-time passwords.

It is impossible to make payments on your own - only through automatic debiting of funds. This is only suitable for those who need to make periodic payments.

Therefore, paying such a small amount is worth it - the user will have access to all the functionality of the cabinet for a year.

The system is not much different from the Sberbank Online service operating in the Russian Federation. The account allows individuals to:

- Manage your accounts and cards.

- Transfer funds to individuals and legal entities to cards and accounts of BPS-Sberbank and other financial institutions.

- Open and replenish deposits, withdraw money to depersonalized metal accounts.

- Pay for services and purchases in online stores - housing and communal services, communications, the Internet, fines and taxes, etc.

- Arrange loans and make payments on them.

- View information about accounts, credit and debit cards, deposits, as well as information on the balance of funds and completed transactions.

- Receive payment documents and generate documentation from them.

- View background information about the exchange rate, the location of ATMs and branches of a financial institution, current promotions and programs, etc.

- Activate and deactivate bank services, order and block cards.

- Change account settings: personal account login data, make strictly defined services visible, view user authorization logs, etc.

- Take out insurance and make payments on it.

- SMS notifications about transactions.

- Auto-payment for specific transactions without the client's order (for this, the user must submit a list with payments and recipients).

- A service similar to the previous one - "Payment with one button". In one click, periodic payments are made, pre-set in the personal account, i.e. without visiting the bank.

- Approval of payments by entering one-time passwords sent via SMS to the user's number (for Visa and MasterCard cards, different service names are provided).

All operations are carried out in 4 sections:

- "Payments and transfers".

- "Deposits and Accounts".

- "Cards".

- "Credits".

Here you can not only carry out transactions, but also view information on currently issued banking products and already closed accounts. The main page of the cabinet already contains information about cards, deposits and accounts.

You can familiarize yourself with the terms of service for individuals on the bank's website by opening the "Individuals" section and going to the "Payment for services using remote channels" subsection. Here are instructions for working with the service, the procedure for maintenance, answers to basic questions and recommendations for ensuring the security of your account.

The work of the cabinet is protected by the SSL protocol. Check the address bar when you get to the site - a lock icon should appear. This means that the data transfer is secure.

By setting up the One Button Payment feature, you can make payments for similar transactions every month.

The function of adjusting the visibility of products is purely aesthetic, allowing you to remove unnecessary information from the cabinet interface.

Note that in the account you can get a mini-statement, for the formation of which you need to draw up a report on the personal account. To do this, you need to click on the “Statement” tab in the personal account and enter the following data in the fields that open:

- The beginning and end of the period for which the report is required.

- The card or account for which the statement is issued.

Checks and statements can be sent by email, saved as PDF and printed. The subsection “Payment sheets” will be useful for those who plan to conclude any deal in the near future. For example, if the employer signs an agreement with the BPS.

You can create template payments by entering the parameters in the "Quick Payments" subsection.

Important! You can link a Yandex.Money e-wallet to an account or card (this service is part of Sberbank). To do this, you will need to go through the identification procedure. Transfers from the wallet are possible to the cards:

- Visa.

- MasterCard.

- Belkart.

There is also a mobile application of BPS Bank. You can download it for Android and iOS from the PlayMarket and AppStore stores, respectively.

Important! A useful section called the financial manager can be found by opening the "My Finances" section. It will analyze the available profit on all active accounts, cards and loans.

If it is decided to terminate cooperation with the bank, the client only needs to submit an appropriate application for the closure of all products and services. After that, access to the LC will be closed.

So, access to the account is provided to persons who already have any banking product. The service is convenient and concise, offering all the possibilities for managing your funds and services.