List of documents for obtaining a mortgage. What documents are needed to apply for a mortgage for an apartment in Sberbank - a list of documents for various lending programs

Sberbank, as one of the oldest and largest banks in the country, is famous for its demanding documents. In order not to get confused in the “paper intricacies” and avoid problems due to the lack of any document, let’s figure out in advance what we will need to get a mortgage from Sberbank.”

Stage one

Don't rush to take everything to the bank at once. First, wait for a positive decision. After all, certain types of mortgage documents have a limited validity period (we will indicate which ones). It was not enough to run for the same “piece of paper” several times more. We advise you to collect all the necessary papers, except for the “short-term” ones. Once you receive the bank's consent, you will have a full 120 days to provide them.

Basic application package

To submit your application, please prepare:

- Passport.

- Certificates confirming income (see below).

- Information confirming employment (see below). Not required if the income certificate contains information about the position and length of service. But such a certificate must bear the signature of a person who is authorized at your enterprise to certify information about labor activity.

- Application form (can be downloaded from the bank’s website).

- Collateral documents (see below).

To confirm your basic income you can provide:

- certificate 2-NDFL for 6 months (or for the number of months actually worked);

- a certificate based on the sample of a government institution (if this institution has restrictions on the issuance of 2-NDFL certificates to employees);

- certificate of the amount of pension (or other lifelong support);

- certificate of receipt of other monthly cash payments or compensation.

To confirm additional sources of income:

- a tax return with a mark from the tax office (or with a receipt, notification, notification or an incoming control protocol attached to confirm the sending of the declaration to the tax authority by mail or electronically);

- a lease (lease) agreement for residential (non-residential) premises with the simultaneous provision of information confirming the ownership of this premises, and a declaration in form 3-NDFL with a mark of acceptance from the tax office.

Documents confirming employment:

- a certified photocopy of the work record book or an extract from it indicating information about places of work for a period of at least the last 5 years;

- certificate from the place of employment indicating the position and length of service;

- a copy of the employment contract (if you are legally allowed not to have a work book by your type of activity);

- certificate of registration as an individual entrepreneur;

- order of appointment to the position of notary;

- lawyer's certificate;

- license to engage in your type of activity.

ATTENTION! All certificates and statements are valid for 30 days!

Mortgage under two documents

If you receive your salary into an account opened with Sberbank, then you do not need to provide documents confirming income and employment. Thus, it is enough to prepare:

- Passport.

- Application form.

- Documents for real estate provided as collateral (if the loan is secured by collateral of another property).

ATTENTION! If during the last 6 months the company you work for has been reorganized, then you must provide a complete package of information.

But, even as a salary client of the Bank, you can provide income certificates if you want the bank to take into account your additional income (the list of “suitable” documents for a mortgage at Sberbank is given above).

As part of the "Young Family" program

In addition to the main package of papers (see above), prepare:

- Child's birth certificate.

- Marriage certificate (not needed if the family is single-parent).

If you want your parents’ income to be taken into account when calculating your solvency, you will need information confirming your relationship (identity documents, marriage certificate, change of name, birth certificate, etc.).

Under the “Mortgage plus maternity capital” program

You will need a basic package of documents to apply for a mortgage loan at Sberbank and additionally:

- Maternity capital certificate.

- Certificate of maternity capital balance. Issued at branches of the Pension Fund of the Russian Federation. The certificate is valid for 30 calendar days from the date of issue, so we recommend that you first wait for the bank’s decision.

Under the “Military Mortgage” program

- Application form in the form established for this type of loan (can be downloaded on the bank’s website).

- Passport.

- Certificate of the right to receive a targeted housing loan within the framework of the housing support system for military personnel.

According to the provided collateral

For certain programs there is a special condition: for the period during which the loaned property will be pledged as collateral, it is necessary to provide other loan security. The following may serve as collateral:

- Rights of claim. We need certificates confirming the existence of such rights and a notarized consent of the spouse to transfer the rights as collateral (or a notarized statement that the client who is transferring these rights as collateral was not married at the time of their acquisition).

- Vehicle. You will need a title, registration certificate, CASCO insurance (policy or agreement) or a report on the valuation of the vehicle, and the consent of the spouse.

- Securities. Prepare an extract from the depositary or other document that confirms that these securities belong to you, and the consent of your spouse.

- Measured ingots of precious metals. Manufacturer's certificates and spouse's consent are required.

- Residential Properties:

- certificate of registration of ownership;

- title documents (sale and purchase agreement, exchange, donation, construction permit, certificate of inheritance, etc.);

- report on the valuation of the premises (valid for 6 months);

- extract from the Unified State Register (valid for 30 days) - issued by Rosreestr;

- cadastral passport and technical plan - can be obtained from the Cadastral Chamber of Rosreestr or the Multifunctional Center for the Provision of Public Services

- a certificate (or an extract from the house register) about the absence of registered residents;

- notarized consent of the spouse;

- permission from guardianship and trusteeship authorities;

- marriage contract;

- documents for the land plot on which this premises is located (the list of documents is similar, except for an extract from the house register).

- Non-residential premises and other real estate (dacha, garage, garden house, unfinished construction, etc.). The list of documents is similar.

If you are acting on behalf of a legal entity, then in addition to the specified information, attach photocopies certified by the head of the organization:

- charter (with all additions);

- extracts from the Unified State Register of Legal Entities (valid for 30 days);

- certificates that confirm the authority to conduct a transaction (minutes of a meeting of participants, decisions of collegial bodies, etc.).

Documents that have a limited duration (certificates, reports), as well as the consent of the spouse, can be provided immediately before concluding the contract.

Stage two

Now that the loan is almost in our pocket, we need to prove that we have the money for the down payment and assure that everything is in order with the chosen property. That is, you can bring the remaining information to the bank. Let us repeat that you can attach them when submitting an application, but, firstly, this is not necessary, and secondly, in case of refusal, picking up the papers given to the bankers is a big headache.

Documents for the loaned property

Sberbank has a wide selection of mortgage programs designed for the purchase of different types of real estate - from a construction loan to the purchase of an apartment in a new building. Of course, in each case you need your own package of information. In this article we will look at what documents are needed for the most sought-after piece of real estate - an apartment.

- Preliminary purchase and sale agreement (or agreement with deferred payment). That is, it is necessary to present an agreement that is the basis for the acquisition of this property. But please note that the preliminary agreement should not include an obligation to transfer funds to the seller in the amount of credit funds. This obligation must be fulfilled no earlier than the day on which the main purchase and sale agreement was registered. We recommend entrusting the drafting of the main contract to a specialist. First of all, real estate transactions are no joke. Secondly, Sberbank outlines specific conditions that must be specified in the agreement, and this must be taken into account.

- A copy of the seller's certificate of registration of ownership of the property. Or a copy of another document that confirms ownership (it is possible that at the time of registration of this property, certificates of a different nature than the registration certificate were issued).

- An extract from the Unified State Register or another document confirming that there are no encumbrances or restrictions on this property (mortgage, arrest, lease, etc.). Valid for 30 days.

- Notarized waiver of the share owner's right of first refusal if the property is shared.

- Copies of title documents (donation agreements, exchange agreements, purchase and sale agreements, privatization certificate, court decision, etc.).

- Cost Estimation Report. It is necessary if the market value of the purchased property is higher than that specified in the basis agreement. The report is valid for 6 months.

- Consent (notarized) of the seller’s spouse to alienate real estate. Required if the spouse can claim a share in the property. Otherwise, a notarized statement from the seller is provided that the ownership was acquired by him before marriage.

- Permission from the guardianship and trusteeship authorities to alienate or waive the pre-emptive right to purchase if there are minors among the owners.

- If the transaction is not carried out by the seller himself, but by someone else on his behalf, then a notarized power of attorney is required.

The documents from points 2-9 will be provided by the seller.

Confirmation of availability of funds for the down payment

- A bank statement showing the balance of your account or deposit.

- Information that confirms that you have paid part of the cost of the loan item.

- Housing certificate, certificate of right to a subsidy or right to receive a targeted housing loan, etc. That is, a document that confirms that you have the right to receive budget funds for partial payment of the cost of the property.

- If you receive a mortgage and at the same time sell your existing property, then prepare a document that reflects the value of the property being sold.

On a note

Sberbank reserves the right to request additional documents necessary to obtain a mortgage. It all depends on the specifics of the collateral and the property being purchased.

Anyone who is going to take out a mortgage loan must first prepare a fairly impressive package of documents. The article provides a list of all necessary papers. You probably already have some of the documents on hand. Some will have to be prepared in advance.When figuring out what documents will be required for a mortgage, it is necessary to prepare both certificates confirming the borrower’s solvency and papers for the house or apartment that will be issued with a mortgage.

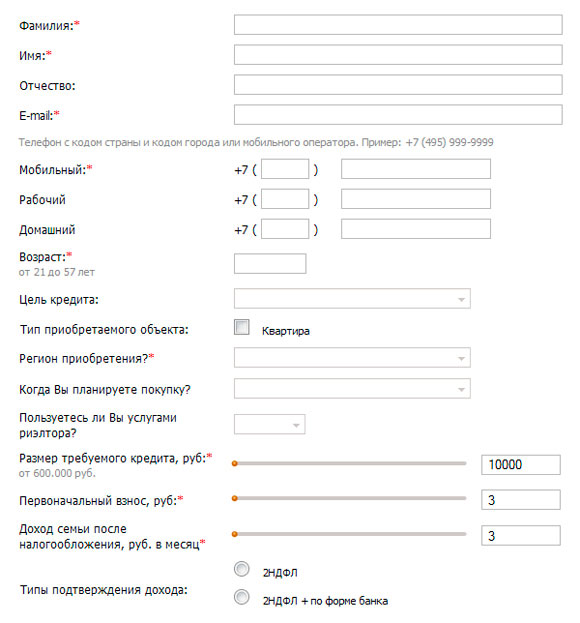

Application/questionnaire or otherwise an application for a mortgage loan. Application example:

Your passport is the main document proving your identity, citizenship, registration, etc.:

Taxpayer identification number or TIN.

If you don’t have the document on hand, you can obtain it upon request from the tax office of your city/district:

Military ID- for men. This document influences the bank’s decision on a loan, just like a passport.

A borrower of military age without a military ID in hand for the bank is a client from the “risk group”:

Certificate of income (form 2-NDFL).

A document indicating your official earnings at your main and/or additional place of work:

Copy of work book

Be sure to certify the copy with the signature and seal of the organization. Without certification, the bank will not accept paper:

State pension insurance certificate or abbreviated name SNILS.

The document is issued either by the Pension Fund or by the first employer:

Certificate of marriage or divorce

Marital status is an important factor when assessing a borrower. Even if you are in an unofficial, civil marriage, your chances of getting a mortgage loan increase:

Children's birth certificate.

You can provide a copy certified by a notary, or at the registry office:

Title documents for real estate.

A mortgaged apartment or house is an object of collateral - a guarantee for the bank to repay the debt:

Expert assessment of the cost of an apartment or house.

Often, a bank employee himself suggests contacting a specific law firm that provides real estate valuation services. However, you have the right to choose who to contact:

Certificate of absence of arrests and prohibitions(from the Unified State Register of Rights).

The paper is obtained from Rosreestr by paying the state fee:

Additional information that the bank may require

Each bank must specify its own list of documents. Thus, to obtain a mortgage you may need the following documents and/or copies (if available):

Valid driver's license:

Marriage contract between spouses:

Certificate of registration at your current place of residence:

Documents on education - higher, secondary specialized:

An employment contract concluded with your employer and certified in the form (with your and your manager’s signature and seal):

- It is necessary to collect the maximum number of documents that confirm your solvency. In addition to certificates of salary/pension/benefits, you can prepare documents for ownership of real estate, a car, and a deposit account in a bank. You will be able to get better terms on your mortgage loan.

- The preparation of some documents (certificate of income, expert assessment of the value of real estate, etc.) requires some time. Take this fact into account when planning your actions.

- It makes sense to send copies of documents to two or three banks at the same time. This saves time and, by comparing conditions, you can objectively evaluate the programs of different banks.

Solving the housing issue is one of the pressing problems of a conscious citizen. According to statistics, more than half of real estate transactions today are carried out using a mortgage. With loans you can buy a finished apartment or a detached house (cottage or town house), you can enter into shared construction, some banks even allow you to buy a garage or an underground parking space.

On Zanimaem.ru we wrote a lot about mortgage loans from banks, the requirements for borrowers, and the package of documents. In this article, we will systematize everything previously written and provide a detailed list of documents requested for obtaining a housing loan.

The package of documents can be divided into two parts: documents for the borrower (co-borrower and guarantors); documents on real estate purchased with a mortgage.

Borrower documents

What documents does the borrower, co-borrowers and guarantors need to collect? We will describe the complete list of documents, but make a reservation: for some banks a smaller package of documents is enough - it all depends on the lending program.

So, you will need the following documents.

1. Passport and second identification document.

Let's say right away that the loan is provided to persons over the age of 21, although in fact banks do not like to lend to young people under the age of 25, unless they have served in the army or have a deferment from service. There is a great risk that the young borrower will then be called into action - how will he pay the mortgage?

If the age of one of the borrowers does not exceed 35 years, then there are preferential mortgage lending programs such as “ » from Sberbank and AHML.

2. Certificates confirming income - this can be form 2-NDFL or a certificate in any form.

Having a certificate in hand, it’s easy to “estimate” the maximum loan amount you can count on. It is usually considered normal if the annuity size does not exceed 30% of the total income of the borrower and co-borrowers. AHML, by the way, has this limit of 45%. So consider...

3. A copy of the work record book certified by the employer.

Typically, banks require at least six months of experience at your last job, but there are loan programs where only four months of experience is allowed.

4.

Copyan employment contract from the main place of work with all amendments and additions to it. If you work part-time, employment contracts may be requested from both places of work.

5. A copy of the tax return for the last reporting period. This document is needed if you received income from some other sources besides your salary (for example, from renting out housing, cars, royalties, etc.).

6. Copies of documents confirming your education (diplomas and certificates).

7. Copies of documents on the ownership of expensive property (means vehicles and real estate).

8. Documents confirming ownership of securities.

9. Copies of loan agreements (both repaid and outstanding) with attached certificates of quality of debt performance.

10. A special package of documents for business owners: copies of constituent documents, statements from servicing banks on movements on current accounts for the last year, copies of real estate lease agreements, certificates from banks and leasing companies on the quality of debt performance, certificates of the absence of card files No. 2 k current accounts and debts to budgets of all levels, copies of executed contracts with main counterparties, copies of official tax reporting documents.

Documents on the purchased property

Ready apartment or house

Let's consider the list of documents that will need to be submitted to the bank to obtain a mortgage for a finished apartment or a finished house. Usually, by the time the property is put up for sale, the seller already has all these documents on hand:

1. Copies of documents confirming ownership of the purchased property. This could be a contract of sale, gift, privatization, or an appropriately formalized inheritance.

2. A copy of the cadastral passport for the property - it is issued by the Bureau of Technical Inventory (BTI). The validity period of this certificate is limited.

3. Certificate stating that no one is registered in the apartment (house). Usually such a certificate is issued by the passport office, but it can also be a copy of an extract from the house register. The validity period of this certificate is limited.

4. Copies of passports and birth certificates of the sellers-owners of the apartment.

5. If among the owners of the apartment being purchased (in the sense of being sold) there are minor children, then permission from the guardianship and trusteeship authorities will be required to alienate the property.

Share building

If you decide to participate in shared construction and you need a loan to fully pay the contribution, then you will be required to provide a different list of documents. Let’s make a reservation right away: banks, as a rule, only lend to accredited builders for whom they already have all the necessary documents, but if the bank does not have a relationship with this developer, they will ask you for documents:

1. Agreement on participation in shared construction. Typically, banks are content with a standard agreement from an accredited developer.

2. Copies of the developer’s constituent documents, including certificates of registration and registration with the tax office.

3. A copy of the decision (instruction, order, etc.) on the sale by a legal entity of an apartment to the borrower, indicating the technical characteristics and sale price of the apartment.

4. Documents confirming the developer’s rights to construct and sell the relevant facility.

Sthouse construction

1. Documents confirming ownership of the land plot on which construction will be carried out. Important: the land plot must be of the “individual development” category, and not “agricultural land”, for example. What documents are these: purchase and sale agreement, certificate of registration of ownership and cadastral passport.

2. Construction permit, duly issued by the relevant government agencies.

3. Agreement with a construction organization for the construction of a house and design and estimate documentation. However, these documents are not required by all banks.

This is a rather large list of documents that you will need to collect if you decide to take out a mortgage. Let’s make a reservation right away – it’s not a fact that the bank you choose will require absolutely all of these documents from you. Our advice is to immediately collect the maximum package of documents. Firstly, you will save a lot of effort and time when communicating with the bank. Useful when submitting applications to several banks, secondly.

The majority of the Russian population solves the housing problem by obtaining a mortgage. This form of lending involves the bank receiving the purchased property as collateral until the loan for its acquisition is fully repaid.

It cannot be ignored that such a product, due to the long-term nature of payments, has a significant overpayment. To minimize unnecessary costs, you need to find a bank that can provide the most attractive conditions. The Savings Bank of Russia is the most popular lender for individuals, because it is its employees who conclude more than half of the mortgage agreements in the country.

Conditions

Sberbank helps to purchase both housing under construction and finished housing. This could be an apartment, cottage, dacha, etc. The borrower can buy finished housing on the primary and secondary supply markets. There are separate offers for young families and military families. Provided to almost all solvent Russians.

The maximum mortgage size in the Moscow region and St. Petersburg is 15,000,000 rubles, for other regions – 8,000,000 rubles.

Let's consider the general terms of lending from Sberbank:

- issued only for the purchase of residential premises;

- minimum loan amount - 300,000 rubles;

- maximum duration - 30 years (military mortgage - 15 years);

- issuance is possible without confirmation by the borrower of receipt of income;

- down payment – 20% or more;

- 3 co-borrowers are allowed;

- It is mandatory to obtain insurance for the property being financed (with the exception of military mortgages).

It is worth noting that among the line of housing programs, the bank provides the most interesting conditions to young families and families of military personnel.

What is needed to apply for a mortgage at Sberbank

Mortgage lending occurs in a certain order. At the first stage, an application form is prepared and a corresponding package of documents is attached to it. After a positive response indicating the possible mortgage amount, they begin to search for suitable housing. At the third stage, documentation on the selected housing is submitted to the bank. If you have collected a complete package of documentation that is legally competent, then the next step is to sign a loan agreement and other documents for obtaining a mortgage. The fifth and final point of the entire procedure is registration of ownership in the State Register of Real Estate.

Requirements for a citizen applying for a mortgage loan:

- Ages at the time of receipt - from 21.

- Years at maturity - up to 75.

- Working time at the last place is from 6 months.

- Availability of entries in the work book for the last 5 years - 1 year or more.

In case of registration without proof of income and work experience, the maximum age for full repayment cannot be more than 65 years. If the borrower receives a salary on a Sberbank card, then he does not need to confirm his work experience. If the agreement is signed by several borrowers, then in the absence of a marriage contract, the wife (husband) of the title co-borrower necessarily acquires the status of a co-borrower. In the latter case, the age and solvency of the other half are not taken into account.

List of documents for a mortgage in Sberbank

What documents are needed for a mortgage at Sberbank, in case of lack of income and proof of work experience:

- Statement.

- Passport.

- Second identification document of your choice:

- driver's license;

- military ID;

- service ID of an employee of a federal government agency;

- military ID;

- international passport;

- SNILS certificate.

If you have documents confirming income and work experience:

- application from the client, client and co-borrower;

- passport of the person applying for the mortgage;

- confirmation of registration at the place of residence (in case of temporary registration);

- income certificates;

- certificates of employment from the place of work.

It is possible to provide another property for collateral. In this case, the banking institution is provided with a package of documents on the real estate proposed for collateral (registration certificate, documents on ownership).

For a product with maternity capital, it is necessary to present a certificate for this family capital and information about the availability of funds from the Pension Fund. The rest of the package of documents for a mortgage at Sberbank is for products for the purchase of finished or under construction real estate.

To use the promotional offer for young families you must present:

- Marriage registration document (except for single-parent families).

- Children's birth documents.

- For relatives-co-borrowers - documents that confirm family ties.

Interest

Base Option Interest Rates Fluctuate from 12.5 to 14 percent. They depend on the size of the initial contribution and the time for which the loan agreement is drawn up.

If a mortgage is issued for a property not built with the institution’s funds, the interest increases by 0.5 points. If the housing is not included in Rosreestr, then 1% is added to the interest rate until the mortgage is registered. The same supplement will apply in the event that the credited client refuses to take out life insurance. If the borrower uses a government-supported program, the interest rate is reduced to 11.9%.

Interest on the program for purchasing a finished property:

If you are purchasing ready-made housing, and the documents for a mortgage at Sberbank have been collected to a minimum, then the bottom line of the table is used. In this case, the client’s personal contribution cannot be less than 50% of the cost of the living space.

The interest rates when applying for a mortgage on a building under construction are similar to those given above, with the exception of registration using 2 documents. For this option, the investment amount is the same - 50%, and interest rates will increase taking into account the mortgage term to, respectively, 13.5; 13.75 and 14 points.

Building your own property will cost a little more:

The surcharges to the base rate are the same as for “ready meters” - described at the beginning of the section.

Types of lending programs

Although the situation in our country now is far from simple, many citizens still have a desire to improve their living conditions. Since not everyone has enough personal savings to purchase real estate, most transactions in the field of purchasing primary or secondary housing occur through mortgage loan programs. The main part of the mortgage agreements, drawn up when purchasing on the secondary market, is concluded within the walls of Sberbank.

Bank mortgage offers:

- Purchase of finished real estate.

- Purchase of real estate under construction.

- Mortgage + family capital.

- Real estate construction.

- Real estate outside the city.

- Mortgages for the military.

Let's look at the main differences between banking products in the table:

| Name | Minimum contribution, % | Maximum term, years | Summortgages, ₽ | Maximum base percentage |

| Ready housing | 20 | 30 | From 300,000 | 13,5% |

| Housing under construction | 20 | 30 | From 300,000 | 13,5% |

| Mortgage + maternity capital | 20 | 30 | From 300,000 | 13,5% |

| Home construction | 25 | 30 | From 300,000 | 14% |

| country estate | 25 | 30 | From 300,000 | 13,5% |

| Military mortgage | 20 | 15 | Up to 1,900,000 | 12% |

The maximum loan amount cannot exceed 80% of the price under the residential premises contract or the estimated value of the collateral property (whichever is less). There are no commission fees for obtaining a mortgage. If a residential building is pledged as collateral under a mortgage, a mortgage on the land plot where the building is built is also issued. The list of documents for a mortgage at Sberbank must include insurance of the collateral and the entire validity period of the mortgage agreement must be renewed.

For a program using maternity capital for up to 6 months, the client must contact the Pension Fund of the Russian Federation to write an application for the transfer of money for full or partial repayment of the mortgage. Housing under it is registered for the client, family or children in shares.

Additional options for a mortgage for real estate construction include the option of deferring payment of the principal portion of the debt or increasing the term of the loan agreement. This is possible provided that documentation is shown confirming the increase in the cost of real estate construction during construction, but not more than 2 years from the date of the loan.

By program "Country estate" You can purchase not only a dacha or a cottage, but also build one. It is also possible to purchase a plot of land for the construction of a summer house. There is a deferment for loan repayment. There is no registration position without confirmation of receipt of income and availability of a workplace. Bank special offers do not apply.

Product "Military mortgage" has the shortest validity period, which can be explained by the small loan amount. But the percentage, reduced compared to other products, will significantly save the family budget. Optional life and health insurance, confirmation of receipt of income. The time to repay the mortgage should not exceed the period for providing the Targeted Housing Loan (Federal Law No. 117-FZ of August 20, 2004).

Special Offers:

For a mortgage with government support, you can get a loan with an interest rate of 11.9% per annum. This program applies only to the primary housing market.

A special offer for young families reduces the loan rate to 12%, and in the case of the birth of a third child it is reduced by 0.25%. The main nuance is receiving your salary on a Sberbank payment card.

Advantages of a mortgage at Sberbank

The price and term of the mortgage remained at a level accessible to most citizens. The absence of commission payments for registration and prompt consideration of the application form makes it possible to purchase the desired square meters. If housing is purchased through an agency, then fraud on the part of its employees is excluded. The institution carefully studies the documents for a Sberbank mortgage on an apartment or other property pledged as collateral. This allows you to avoid concluding dubious contracts.

Flaws

Time from the moment the application is submitted for consideration until the completion of the mortgage and the transfer of funds to the client may take several weeks. Not every seller likes such a long wait. If you like an apartment or other residential property, then you need to discuss in advance with the seller the possibility of waiting for the mortgage to be issued. Sometimes the selling party slightly increases the price of the property to cover your risks.

Applying for a mortgage for the purchase of a private or country house has its own characteristics. It is more difficult to take out such a loan from a bank than to purchase an apartment. The home mortgage lending program occupies a small share of the bank's loan portfolio. Why are credit institutions reluctant to provide a mortgage for the purchase of a home? What requirements do banks have for this type of housing? What are the main reasons for being rejected for a home mortgage?

Bank requirements for purchased houses and reasons for refusal of a mortgage

Housing purchased with a mortgage, as a rule, becomes the subject of collateral for the loan. Banks are required to carry out a legal and construction assessment of the building. The main requirement is the liquidity of the collateral during the loan period. Attention is drawn to the materials from which the foundation, supports and load-bearing walls are made. The service life of a residential building depends on this.

The foundation and supports made of concrete, load-bearing walls made of brick or stone guarantee greater durability of the house than a bulk foundation and walls made of wood. Consequently, such buildings are considered the most liquid. The following factors are important to evaluate a home:

Availability of communications, roads and access roads.

The degree of infrastructure development in the locality.

Territorial distance from major cities.

The purpose of the land plot on which the house is located and the existence of ownership of the land. The site must have settlement status and be intended for the construction of individual residential buildings.

The bank makes a decision to issue a mortgage subject to compliance with all the above requirements, which are difficult for the borrower to satisfy in full. In the secondary housing market it is possible to purchase a house with a mortgage, but in the primary market it is very difficult. The bank needs to conduct a thorough analysis of legal and construction risks, and as the bank’s risks increase, the borrower is usually denied a mortgage for a house. If problems arise with repaying the loan, the collateral subject to sale. Selling a private or country house is more difficult than selling an apartment in a multi-storey building. The demand for such buildings is insignificant.

When deciding to buy a home, it is recommended that you familiarize yourself with the terms and conditions of mortgages on the official websites of different banks. Mortgage loan calculator, available on all sites, will help you independently calculate the repayment terms of your home loan, set the size of the monthly payment, choose the optimal loan terms and interest rate on the loan.

What documents are needed to apply for a mortgage on a house?

To obtain a mortgage loan, the borrower must provide the bank with documents confirming his income and solvency (form 2-NDFL certificate, copy of work record book, etc.), and an identification document - passport. Additionally, a package of documents for the purchased property is provided:

- registration certificate for the house;

- BTI certificate on inventory value;

- cadastral site plan and building passport;

- title documents;

- report of an independent expert on the assessment of the loan object.

Depending on the requirements and conditions of the selected bank, the list of required documents may be supplemented.

What should you know when applying for a mortgage on a home?

The mortgage lending program for the purchase of a house provides an interest rate that is 2-3% higher than the program for the purchase of an apartment. The average annual interest rate in the mortgage market when buying a home varies from 12% to 15%. In addition, the amount of the down payment is 40-60% of the total collateral value of the building. The maximum loan term when buying a house with a mortgage is up to 30 years. As collateral, the borrower can provide the bank with real estate they already own or a house purchased with a mortgage. The number of co-borrowers under a home mortgage agreement is limited - no more than 3 people, including the borrower.

The borrower can calculate the mortgage at the bank where you plan to take out a loan for a house and draw up an approximate payment schedule depending on your income level in advance. The main banks that finance mortgages for the purchase of a home include Alfa-Bank, Bank of Moscow, Bank Vozrozhdenie, Nordea-Bank, Sberbank and UniCredit. A mortgage loan calculator is available on all official websites of the listed banks.

An online application for a mortgage loan can be submitted to several banks at once. This will allow you to choose the best lending conditions, save time and costs on registration, and also increase the chances of receiving a positive decision on issuing a loan.