What does the individual entrepreneur pay? What taxes does an individual entrepreneur pay under different taxation regimes: types and amounts of taxes

Individual entrepreneur (IP)(obsolete private entrepreneur (PE), PBOYUL until 2005) is an individual registered as an entrepreneur without forming a legal entity, but in fact possessing many of the rights of legal entities. The rules of the civil code regulating the activities of legal entities apply to individual entrepreneurs, except in cases where separate articles of laws or legal acts are prescribed for entrepreneurs.()

Due to some legal restrictions (it is impossible to appoint full-fledged directors to branches in the first place), an individual entrepreneur is almost always a micro-business or small business.

according to the Code of Administrative Offenses

Fine from 500 to 2000 rubles

In case of gross violations or when working without a license - up to 8,000 rubles. And, it is possible to suspend activities for up to 90 days.

From RUB 0.9 million for three years, and the amount of arrears exceeds 10 percent of the tax payable;

From 2.7 million rubles.

Fine from 100 thousand to 300 thousand rubles. or in the amount of the culprit’s salary for 1-2 years;

Forced labor for up to 2 years);

Arrest for up to 6 months;

Imprisonment for up to 1 year

If the individual entrepreneur fully pays the amounts of arrears (taxes) and penalties, as well as the amount of the fine, then he is exempt from criminal prosecution (but only if this is his first such charge) (Article 198, paragraph 3 of the Criminal Code)

Evasion of taxes (fees) on an especially large scale (Article 198, paragraph 2. (b) of the Criminal Code)

From 4.5 million rubles. for three years, and the amount of arrears exceeds 20 percent of the tax payable;

From 30.5 million rubles.

Fine from 200 thousand to 500 thousand rubles. or in the amount of the culprit’s salary for 1.5-3 years;

Forced labor for up to 3 years;

Imprisonment for up to 3 years

Fine

If the amounts for criminal prosecution are not reached, then there will only be a fine.

Non-payment or incomplete payment of taxes (fees)

1. Non-payment or incomplete payment of tax (fee) amounts as a result of understatement of the tax base, other incorrect calculation of tax (fee) or other unlawful actions (inaction) entails a fine in the amount of 20 percent of the unpaid amount of tax (fee).

3. The acts provided for in paragraph 1 of this article, committed intentionally, entail a fine in the amount of 40 percent of the unpaid amount of tax (fee). (Article 122 of the Tax Code)

Penalty

If you were just late in payment (but did not provide false information), then there will be penalties.

The penalties for everyone are the same (1/300 multiplied by the key rate of the Central Bank per day of the amount of non-payment) and now amount to about 10% per annum (which is not very much in my opinion, taking into account the fact that banks give loans for at least 17-20 %). You can count them.

Licenses

Some types of activities an individual entrepreneur can only engage in after receiving a license, or permissions. Licensed activities of individual entrepreneurs include: pharmaceutical, private investigation, transportation of goods and passengers by rail, sea, air, as well as others.

An individual entrepreneur cannot engage in closed types of activities. These types of activities include the development and/or sale of military products, trafficking in narcotic drugs, poisons, etc. Since 2006, the production and sale of alcoholic beverages has also been prohibited. An individual entrepreneur cannot engage in: production of alcohol, wholesale and retail trade in alcohol (with the exception of beer and beer-containing products); insurance (i.e. be an insurer); activities of banks, investment funds, non-state pension funds and pawnshops; tour operator activities (travel agency is possible); production and repair of aviation and military equipment, ammunition, pyrotechnics; production of medicines (sales possible) and some others.

Differences from legal entities

- The state fee for registering individual entrepreneurs is 5 times less. In general, the registration procedure is much simpler and fewer documents are required.

- An individual entrepreneur does not require a charter and authorized capital, but he is liable for his obligations with all his property.

- An entrepreneur is not an organization. It is impossible for an individual entrepreneur to appoint a full and responsible director.

- Individual entrepreneurs do not have cash discipline and can manage the funds in the account as they wish. Also, the entrepreneur makes business decisions without recording them. This does not apply to working with cash registers and BSO.

- An individual entrepreneur registers a business only in his name, in contrast to legal entities, where registration of two or more founders is possible. Individual entrepreneurship cannot be sold or re-registered.

- A hired employee of an individual entrepreneur has fewer rights than a hired employee of an organization. And although the Labor Code equates organizations and entrepreneurs in almost all respects, there are still exceptions. For example, when an organization is liquidated, the mercenary is required to pay compensation. When closing an individual entrepreneur, such an obligation exists only if it is specified in the employment contract.

Appointment of director

It is legally impossible to appoint a director in an individual entrepreneur. The individual entrepreneur will always be the main manager. However, you can issue a power of attorney to conclude transactions (clause 1 of Article 182 of the Civil Code of the Russian Federation). Since July 1, 2014, it has been legislatively established for individual entrepreneurs to transfer the right to sign an invoice to third parties. Declarations could always be submitted through representatives.

All this, however, does not make the people to whom certain powers are delegated directors. A large legislative framework on rights and responsibilities has been developed for directors of organizations. In the case of an individual entrepreneur, one way or another, he himself is responsible under the contract, and with all his property he himself is responsible for any other actions of third parties by proxy. Therefore, issuing such powers of attorney is risky.

Registration

State registration of an individual entrepreneur carried out by the Federal Tax Service of the Russian Federation. The entrepreneur is registered with the district tax office at the place of registration, in Moscow - MI Federal Tax Service of the Russian Federation No. 46 for Moscow.

Individual entrepreneurs can be

- adult, capable citizens of the Russian Federation

- minor citizens of the Russian Federation (from 16 years of age, with the consent of parents, guardians; married; a court or guardianship authority has made a decision on legal capacity)

- foreign citizens living in the Russian Federation

OKVED codes for individual entrepreneurs are the same as for legal entities

Necessary documents for registration of an individual entrepreneur:

- Application for state registration of an individual entrepreneur (1 copy). Sheet B of form P21001 must be filled out by the tax office and given to you.

- A copy of the Taxpayer Identification Number.

- A copy of your passport with registration on one page.

- Receipt for payment of the state fee for registration of an individual entrepreneur (800 rubles).

- Application for switching to the simplified tax system (If you need to switch).

An application for registration of individual entrepreneurs and other documents can be prepared online in a free service.

Within 5 days you will be registered as an individual entrepreneur or you will receive a refusal.

You must be given the following documents:

1) Certificate of state registration of an individual as an individual entrepreneur (OGRN IP)

2) Extract from the Unified State Register of Individual Entrepreneurs (USRIP)

After registration

After registering an individual entrepreneur It is necessary to register with the pension fund and the Compulsory Medical Insurance Fund and obtain statistics codes.

Also necessary, but optional for an entrepreneur, is opening a current account, making a seal, registering a cash register, and registering with Rospotrebnadzor.

Taxes

Individual entrepreneur pays a fixed payment to the pension fund for the year, 2019 - 36,238 rubles + 1% of income over 300,000 rubles, 2018 - 32,385 rubles + 1% of income over 300,000 rubles. The fixed contribution is paid regardless of income, even if the income is zero. To calculate the amount, use the IP fixed payment calculator. There are also KBK and calculation details.

An individual entrepreneur can apply tax schemes: simplified tax system (simplified), UTII (imputed tax) or PSN (patent). The first three are called special modes and are used in 90% of cases, because they are preferential and simpler. The transition to any regime occurs voluntarily, upon application; if you do not write applications, then OSNO (general taxation system) will remain by default.

Taxation of an individual entrepreneur almost the same as for legal entities, but instead of income tax, personal income tax is paid (under OSNO). Another difference is that only entrepreneurs can use PSN. Also, individual entrepreneurs do not pay 13% on personal profits in the form of dividends.

An entrepreneur has never been obliged to keep accounting records (chart of accounts, etc.) and submit financial statements (this only includes a balance sheet and a financial performance statement). This does not exclude the obligation to keep tax records: declarations of the simplified tax system, 3-NDFL, UTII, KUDIR, etc.

An application for the simplified tax system and other documents can be prepared online in a free service.

Inexpensive programs for individual entrepreneurs include those with the ability to submit reports via the Internet. 500 rubles/month. Its main advantage is ease of use and automation of all processes.

Help

Credit

It is more difficult for an individual entrepreneur to get a loan from a bank than for a legal entity. Many banks also give mortgages with difficulty or require guarantors.

- An individual entrepreneur does not keep accounting records and it is more difficult for him to prove his financial solvency. Yes, there is tax accounting, but profit is not allocated there. Patent and UTII are especially opaque in this matter; these systems do not even record income. The simplified tax system “Income” is also unclear, because it is not clear how many expenses there are. The simplified tax system "Income-Expenditures", Unified Agricultural Tax and OSNO most clearly reflect the real state of the individual entrepreneur's business (there is an accounting of income and expenses), but unfortunately these systems are used less frequently.

- The individual entrepreneur himself (as opposed to the organization) cannot act as collateral in the bank. After all, he is an individual. The property of an individual can be collateral, but this is legally more complicated than collateral from an organization.

- An entrepreneur is one person - a person. When issuing a loan, the bank must take into account that this person can get sick, leave, die, get tired and decide to live in the country, giving up everything, etc. And if in an organization you can change the director and founders with the click of a finger, then in this case an individual entrepreneur can just close it and terminate the loan agreement or go to court. IP cannot be re-registered.

If a business loan is denied, then you can try to take out a consumer loan as an individual, without even disclosing your plans to spend money. Personal loans usually have high rates, but not always. Especially if the client can provide collateral or has a salary card with this bank.

Subsidy and support

In our country, hundreds of foundations (state and not only) provide consultations, subsidies, and preferential loans for individual entrepreneurs. Different regions have different programs and help centers (you need to search). .

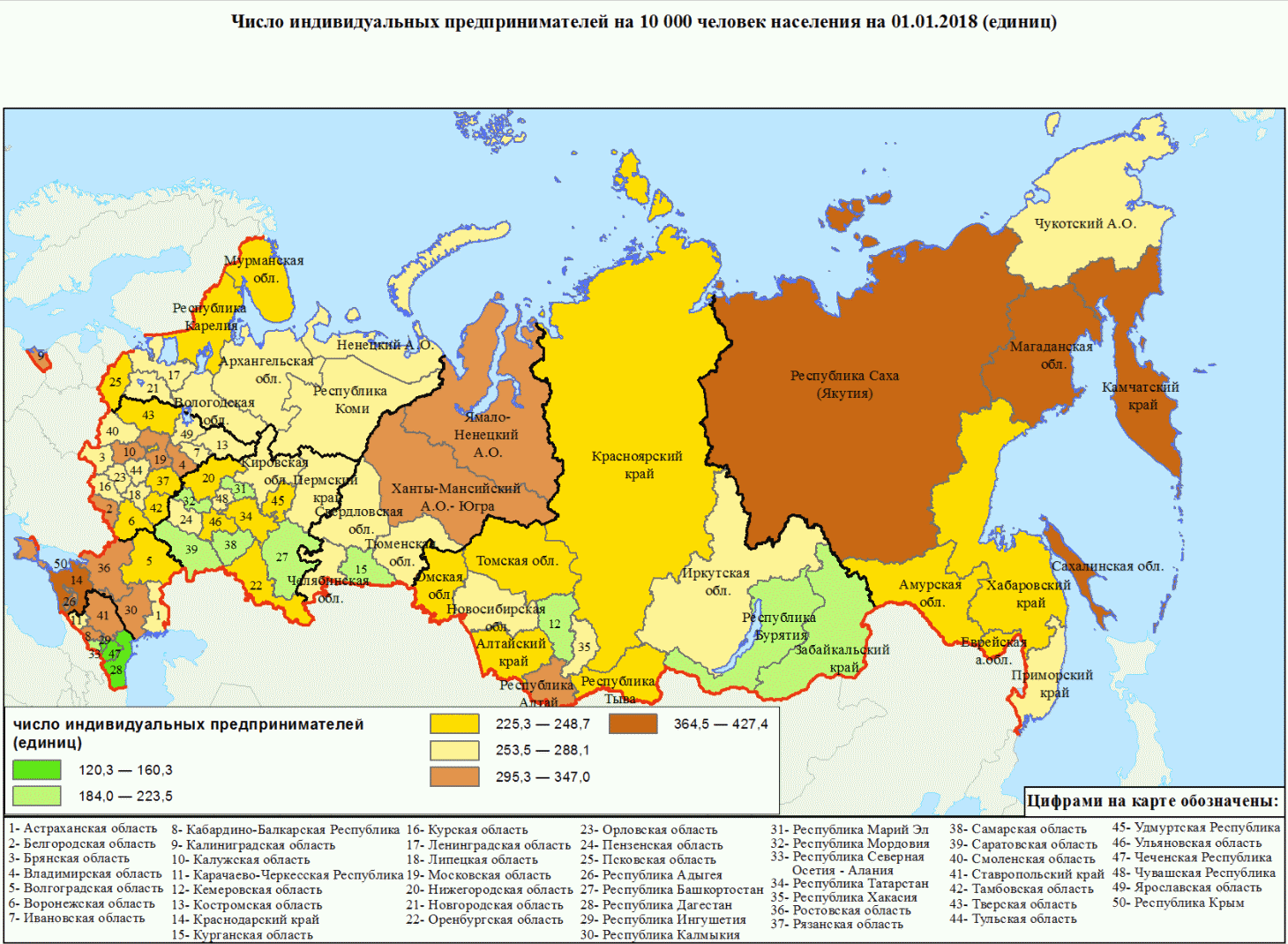

Rice. Number of individual entrepreneurs per 10,000 population

Experience

Pension experience

If the entrepreneur pays everything regularly to the Pension Fund, then the pension period runs from the moment of state registration until the closure of the individual entrepreneur, regardless of income.

Pension

According to current legislation, an individual entrepreneur will receive a minimum pension, regardless of how many contributions to the Pension Fund he pays.

The country is undergoing almost continuous pension reform and therefore it is not possible to accurately determine the size of the pension.

Since 2016, if a pensioner has the status of an individual entrepreneur, then his pension will not be indexed.

Insurance experience

The insurance period for the Social Insurance Fund only applies if the entrepreneur voluntarily pays contributions to the social insurance (FSS).

Difference from employees

The Labor Code does not apply to the individual entrepreneur himself. It is accepted only for hired workers. An individual entrepreneur, unlike a director, is not a mercenary.

Theoretically, an individual entrepreneur can hire himself, set a salary and make an entry in the work book. In this case, he will have all the rights of an employee. But it is not recommended to do this, because... then you will have to pay all salary taxes.

Only a female entrepreneur can receive maternity leave and only under the condition of voluntary social insurance. .

Any businessman, regardless of gender, can receive an allowance of up to one and a half. Either in RUSZN or in the FSS.

Individual entrepreneurs are not entitled to leave. Because he has no concept of working time or rest time and the production calendar also does not apply to him.

Sick leave is granted only to those who voluntarily insure themselves with the Social Insurance Fund. Calculated based on the minimum wage, the amount is insignificant, so in social insurance it makes sense only for mothers on maternity leave.

Closing

Liquidation of an individual entrepreneur is an incorrect term. An entrepreneur cannot be liquidated without violating the Criminal Code.

Closing an individual entrepreneur occurs in the following cases:

- in connection with the adoption of a decision by an individual entrepreneur to terminate activities;

- in connection with the death of a person registered as an individual entrepreneur;

- by court decision: forcibly

- in connection with the entry into force of a court verdict of deprivation of the right to engage in entrepreneurial activity;

- in connection with the cancellation of a document (overdue) confirming the right of this person to reside in Russia;

- in connection with a court decision to declare an individual entrepreneur insolvent (bankrupt).

Databases on all individual entrepreneurs

Website Contour.Focus

Partially free Contour.Focus The most convenient search. Just enter any number, last name, title. Only here you can find out OKPO and even accounting information. Some information is hidden.

Extract from the Unified State Register of Individual Entrepreneurs on the Federal Tax Service website

For free Federal Tax Service database Unified State Register of Individual Entrepreneurs (OGRNIP, OKVED, Pension Fund number, etc.). Search by: OGRNIP/TIN or full name and region of residence (patronymic name does not have to be entered).

Bailiffs Service

For free FSSP Find out about enforcement proceedings for debt collection, etc.

With help, you can keep tax records on the simplified tax system and UTII, generate payment slips, 4-FSS, Unified Settlement, SZV-M, submit any reports via the Internet, etc. (from 325 rubles/month). 30 days free. Upon first payment. For newly created individual entrepreneurs now (free).

Question answer

Is it possible to register using temporary registration?

Registration is carried out at the address of permanent residence. To what is indicated in the passport. But you can send documents by mail. According to the law, it is possible to register an individual entrepreneur at the address of temporary registration at the place of stay, ONLY if there is no permanent registration in the passport (provided that it is more than six months old). You can conduct business in any city in the Russian Federation, regardless of the place of registration.

Can an individual entrepreneur register himself for work and make an entry in his employment record?

An entrepreneur is not considered an employee and does not make an entry in his employment record. Theoretically, he can apply for a job himself, but this is his personal decision. Then he must conclude an employment contract with himself, make an entry in the work book and pay deductions as for an employee. This is unprofitable and makes no sense.

Can an individual entrepreneur have a name?

An entrepreneur can choose any name for free that does not directly conflict with the registered one - for example, Adidas, Sberbank, etc. The documents and the sign on the door should still have the full name of the individual entrepreneur. He can also register the name (register a trademark): this costs more than 30 thousand rubles.

Is it possible to work?

Can. Moreover, you don’t have to tell them at work that you have your own business. This does not affect taxes and fees in any way. Taxes and fees to the Pension Fund must be paid - both as an individual entrepreneur and as a mercenary, in full.

Is it possible to register two individual entrepreneurs?

An individual entrepreneur is just the status of an individual. It is impossible to simultaneously become an individual entrepreneur twice (to obtain this status if you already have it). There is always one TIN.

What are the benefits?

There are no benefits in entrepreneurship for people with disabilities and other benefit categories.

Some commercial organizations also offer their own discounts and promotions. Online accounting Elba for newly created individual entrepreneurs is now free for the first year.

The working life of a beginning businessman involves numerous worries and hassles, solving financial issues, searching for counterparties, establishing sales, etc. When the time comes to fulfill tax obligations, many entrepreneurs, immersed in the whirlpool of the organizational process, are faced with the fact that they have no idea .

Businessmen have a lot of questions: how much to pay? How often? Do I need to prepare a tax report? The intricacies of small business taxation often seem incomprehensible to beginners. If you want to get answers to these and other questions and generally shed light on the process of paying taxes for individual entrepreneurs, read on.

How often does an individual entrepreneur pay taxes?

The frequency of tax payments depends entirely on what taxation system the businessman uses. General is characterized by the most frequent payments, voluminous reporting and involves the payment of several mandatory taxes at once. Special regimes, on the contrary, make it possible to generally reduce the interaction of individual entrepreneurs with the tax service.

The World of Business website team recommends that all readers take the Lazy Investor Course, where you will learn how to put things in order in your personal finances and learn how to earn passive income. No enticements, only high-quality information from a practicing investor (from real estate to cryptocurrency). The first week of training is free! Registration for a free week of training

Frequency of making payments for individual entrepreneurs on OSNO

The application of a general tax regime in business obliges an entrepreneur to regularly pay 3 mandatory taxes:

- on income;

- for added value;

- for real estate that is used in business.

For all other individual entrepreneurs, a special tax reporting form is provided, approved by the Federal Tax Service and posted on the official resource of the service www.nalog.ru. Let's look at how to correctly submit taxes for individual entrepreneurs in different modes.

The general tax regime requires individual entrepreneurs to regularly submit the following documents to the Federal Tax Service:

- declaration 4-NDFL - it must be completed and submitted no later than five days after the expiration of the month in which the individual entrepreneur received income;

- Declaration 3-NDFL – prepared by the entrepreneur once a year. It indicates real income for the past tax period. The document must be submitted no later than April 30 of the following year;

- VAT declaration – must be completed and submitted no later than the 25th day of the month following the previous quarter (April 25, July 25, etc.).

Important! For untimely provision of these documents, individual entrepreneurs are subject to penalties.

A businessman pays property tax upon receipt of a notification from the Federal Tax Service. This type of payment does not require any reporting.

Obviously, running a business on OSNO requires the entrepreneur to have certain skills when submitting reports. If there are none, it is better to seek the help of a qualified accountant or use the services of special agencies when filling out the declaration.

Under special taxation regimes, the volume of reporting is significantly less.

Entrepreneurs using the simplified tax system submit a declaration under the simplified tax system no later than April 30 of the year following the previous tax period. Thus, a businessman registered in 2016 is required to report for this year in the prescribed form by 04/30/2017.

Individual entrepreneurs who are UTII payers submit a declaration of the appropriate form 4 times a year - no later than the 20th day of the month following the reporting quarter.

For the information of individual entrepreneurs, any of these declarations must be submitted only after paying the tax.

Important! If for some reason the activities of an individual entrepreneur are not carried out, this does not exempt the businessman from reporting. In this case, it is necessary to submit so-called zero declarations.

The declaration must be submitted to the Federal Tax Service office at the place of registration. For some taxpayers, it is possible to submit an application electronically.

Important! If an individual entrepreneur is an employer, he must report to the Federal Tax Service for taxes paid by the individual entrepreneur on the income of his employees. For this purpose, there previously existed a special reporting form 2-NDFL. Since 2016, the situation has changed, and an additional form 6-NDFL was introduced at the legislative level.

For those who have employees (or are planning to hire), we recommend watching the following video, which talks about the 2016 changes in the administration of personal income tax transferred to individual entrepreneurs for employees/

How to pay taxes as an individual entrepreneur - available methods

In order to fulfill their tax obligations, individual entrepreneurs have 2 ways.

The general tax regime for individual entrepreneurs provides that income from business activities will be subject to personal income tax (hereinafter - personal income tax) at the rate 13 % .

The tax base in this case is the difference between the amounts of income received from business activities and professional tax deductions.

Professional deductions are business-related expenses that you can document.

If it is impossible to document expenses, income may be reduced by the cost standard established by Article 221 of the Tax Code of the Russian Federation ( 20% from the amount of income received from business activities). However, this rule does not apply to individuals engaged in entrepreneurial activities, but not registered as individual entrepreneurs.

ExampleIncome from business activities amounted to 30,000 rubles. Expenses related to business activities and confirmed by documents - 20,000 rubles.

tax

base= 30,000 - 20,000 = 10,000 rub.

Income from business activities amounted to 30,000 rubles. Expenses associated with business activities are not supported by documents.

tax

base= 30,000 - (30,000 * 20%) = 24,000 rub.

Therefore, the tax is

24,000 * 13% = 3,120 rub.

When applying this tax regime, you must keep a book of income and expenses and business transactions of an individual entrepreneur and submit tax reports to the tax authority at your place of residence.

In this regard, it should be remembered that you, as an individual entrepreneur, are required to submit to the tax authorities a declaration on the expected income of an individual in form 4-NDFL. A declaration of form 4-NDFL is submitted if income from business activities is received during the year - no later than five days after the end of the month in which such income was received.

This declaration indicates the estimated amount of income from business activities that you plan to receive for the year and determine it yourself (clause 7 of Article 227 of the Tax Code of the Russian Federation).

Based on the submitted declaration of estimated income, the tax authorities calculate the amount of advance payments that are payable by entrepreneurs on the basis of tax notices sent by the tax authorities. Payment deadlines and amounts of advance payments established by Article 227 of the Tax Code of the Russian Federation:

- for January - June - no later than July 15 of the current year in the amount of half the annual amount of advance payments;

- for July - September - no later than October 15 of the current year in the amount of one fourth of the annual amount of advance payments;

- for October - December - no later than January 15 of the following year in the amount of one fourth of the annual amount of advance payments.

In this case, the total amount of personal income tax payable by individual entrepreneurs to the budget at the end of the year is calculated taking into account the amounts of tax withheld by tax agents when paying income to the taxpayer, as well as the amounts of advance payments for personal income tax actually already paid by him to the budget.

At the end of the year, the individual entrepreneur must submit no later than April 30 to the tax authority at your place of residence a tax return on income received during this period in form 3-NDFL.

Individual entrepreneurs should also be aware that in some cases they will be tax agents, for example, when paying income to their employees. In this case, the individual entrepreneur is responsible for calculating, withholding and paying the corresponding amount of personal income tax to the budget from such income.

ExampleYou paid wages to your employee monthly in the amount of 5,000 rubles. Therefore, you, as a tax agent, are required to calculate the amount of tax at the end of each month, which in this case will be 650 rubles, withhold it from the employee’s income when they are actually paid and transfer it to the budget.

5,000 * 13% = 650 rub.

Individual entrepreneur taxes Gusarova Yulia Find out what taxes individual entrepreneurs (IP) pay and how you will need to contact the tax office in 2019.Have you registered as an entrepreneur or are you just planning to do so and want to know what taxes and contributions an individual entrepreneur pays under the simplified tax system or another regime?

First of all, you need to decide on the taxation system. The tax burden of individual entrepreneurs and the composition of reporting will depend on this. Russian entrepreneurs have a choice of a general taxation system and 4 preferential regimes: simplified tax system, UTII, unified agricultural tax and PSN.

In this article we will talk in detail about the payments required for all entrepreneurs and about payments under different taxation regimes.

We start the article not with taxes, but with contributions, because insurance premiums are mandatory payments for all entrepreneurs, regardless of the type of activity, the amount of profit and the applied tax regime.

Any businessman who has the status of an individual entrepreneur must annually pay fixed insurance premiums for two types of compulsory insurance: pension and medical. In 2019, this is a total of 36,238 rubles. These contributions are transferred to the Federal Tax Service one-time or in several installments until the end of the year.

The obligation to pay such contributions ceases only when the individual entrepreneur is closed.

Sometimes the law allows not to pay fees if the entrepreneur did not conduct business. For example, when caring for a child under 1.5 years old, during military service, caring for a disabled person, etc. (Clause 7 of Article 430 of the Tax Code of the Russian Federation).

If you are lucky enough to earn a lot in a year, then from the amount of income that exceeds 300 thousand you will need to transfer another 1% of pension contributions until the first of July next year.

By making fixed and additional insurance premiums for yourself, you can reduce your tax burden. The order of reduction depends on the tax regime:

1. For OSNO, simplified tax system 15% and unified agricultural tax, contributions are included in expenses and thereby reduce the tax base.

2. If the simplified tax system is 6% and UTII, the amount of contributions is minus from the calculated tax amount. If an entrepreneur without employees has less tax contributions, then they do not pay it at all. Individual entrepreneurs with employees can reduce payments under the simplified tax system and UTII by no more than 50%.

When a businessman stops working alone and hires employees, he pays taxes and fees not only for himself, but also for them. These responsibilities also apply to all entrepreneurs, regardless of the taxation regime and type of activity:

Personal income tax in the amount of 13% is deducted from the employee’s salary and transferred to the budget no later than the next day after the salary is paid. That is, in this case, the employer acts only as a tax agent and does not bear any expenses.

Insurance contributions for social, pension and health insurance. In total, this is 30% of the accrued salary. The individual entrepreneur makes these contributions at his own expense. The deadline for transferring contributions is until the 15th day of the month following the month of accrual.

Contributions for accident insurance to the Social Insurance Fund. The contribution rate depends on the hazard class assigned to the Fund upon registration. Deadline - until the 15th day after the month of accrual.

Some entrepreneurs using the simplified tax system and special tax system can pay contributions for employees at reduced rates. Information on benefits on contributions is contained in Article 427 of the Tax Code of the Russian Federation.

Now let's talk about the taxes that individual entrepreneurs must pay. Basic payments depend on which tax regime is chosen.

In order to work under the general taxation regime, you do not need to do anything special - all individual entrepreneurs are automatically considered to be working under OSNO if they have not submitted an application to switch to another regime.

OSNO is beneficial for those entrepreneurs who work with large organizations, because such organizations are more willing to cooperate with VAT payers.

Personal income tax, VAT and property tax are paid on the general system.

VAT

The VAT rate is generally 20%.

The VAT paid by buyers must be paid by the individual entrepreneur to the budget minus the VAT amounts that the entrepreneur himself paid to suppliers.

There are a number of exceptions prescribed in the Tax Code when the rate is 10% or 0%.

VAT returns are submitted quarterly by April 25, July, October and January. VAT is paid over three months in equal installments. For example, for the first quarter you need to transfer the first part by April 25, the second by May 25 and the third by June 25.

Personal income tax

The rate is 13%.

The payment is calculated from the difference between income and expenses. If it is not possible to confirm expenses, then you can use a professional deduction - 20% of income. That is, income is reduced by 20% and the remainder is multiplied by 13%.

Being on OSNO, you will be able to use other deductions from income that are available to individuals: standard, social, property. That is, like employees, you can return or reduce personal income tax when buying an apartment, receiving paid education or medical services.

Personal income tax is paid in 4 stages throughout the year:

Advance payment for the first half of the year - until July 15.

Advance payment for 9 months - until October 15.

Advance payment for 12 months - until January 15 of the following year.

The final payment for the year is due July 15 of the following year.

The individual entrepreneur does not count advance payments himself, but pays according to notifications that come from the tax office. Tax authorities calculate advance payments based on income indicators for the previous year or on the basis of the 4-NDFL declaration. All newly registered individual entrepreneurs must send this form to the Federal Tax Service within five days after the end of the month in which the first income was received.

Attention! From January 1, 2020, amendments to Article 227 of the Tax Code of the Russian Federation come into force and the procedure for paying advance payments for individual entrepreneurs on OSNO is changing. Individual entrepreneurs will now have to calculate advances themselves based on actual income for the quarter, half a year, and 9 months. The deadline for paying advances also changes:

- for the first quarter - until April 25;

- for half a year - until July 25;

- 9 months before October 25th.

As far as annual payments and reporting are concerned, everything remains the same.

Property tax

Entrepreneurs on OSNO pay it according to the same rules as individuals. The rate is determined by local authorities and does not exceed 2.2%. Payment must be made by December 1 of the following reporting year.

Entrepreneurs do not need to calculate property tax themselves. The Federal Tax Service inspection itself will calculate and send a notification. Individual entrepreneurs also do not submit a declaration for this tax.

By choosing the simplified taxation system (simplified taxation system, or simplified tax system), you will be exempt from paying personal income tax, VAT and tax on property that you use in business activities. How much taxes an individual entrepreneur pays under the simplified method depends on which tax object you choose. There are two options:

1. All income is taxed at a rate of 6%.

2. Income minus expenses is taxed at a rate of 15%.

To decide which simplified tax rate is more profitable, you need to at least roughly understand the ratio of upcoming income and expenses. Typically, the second option of the simplified tax system is beneficial when the share of expenses in the total share of revenue exceeds 60%.

You need to pay advances and taxes on the simplified tax system according to the following schedule: before the 25th day of the month after the first, second and third quarters, you need to calculate and transfer advance payments, and by April 30 of the next year you need to calculate the total amount, pay the balance and submit a declaration under the simplified tax system.

This regime also exempts from VAT, personal income tax and property tax. But unlike the simplified tax system, only certain types of activities that fall under this special regime are transferred to UTII, and exemption from these taxes applies only to these types of activities.

The UTII regime differs in that the payment depends not on actual income, but on imputed income. It depends on the physical indicator. This could be the number of people involved in the business, square meters of retail space, units of transport - it depends on the type of activity.

The physical indicator is multiplied by the basic profitability for a specific type of activity, a deflator coefficient (1.915 in 2019) and an adjustment coefficient (set by local authorities). From the resulting amount, 15% is calculated - this is the amount of UTII for the month. The actual amount of income does not affect the amount of tax.

Declarations are also submitted quarterly, which takes 5 less days. You must report by the 20th after the end of each quarter.

For a list with physical indicators and amounts of basic profitability for all types of activities, see Article 346.29 of the Tax Code of the Russian Federation.

The patent system is very similar to UTII. Here, too, the tax does not depend on real income, but on potential income. The basic annual profitability for different types of business is set by local authorities.

The cost of a patent for a year is 6% of the basic annual return. A patent can be taken out for a period of 1 to 12 months within one calendar year.

The amount for the patent can be transferred at any time before the end of the validity period in full or in parts. But if the patent term is more than 6 months, then a third of the amount must be paid within 90 days, the rest - before the end of the patent term.

Payment for a patent replaces tax. There is no need to pay personal income tax, VAT and property tax within the framework of activities on a patent. There is also no need to report income, that is, submit a declaration, as an individual entrepreneur on the PSN.

This special regime is allowed to be used only by agricultural producers and those who provide them with services. Individual entrepreneurs on the Unified Agricultural Tax pay a single agricultural tax. Until 2019, Unified Agricultural Tax payers were exempt from VAT, but since 2019 this benefit has been abolished. Now, in general, all agricultural producers are required to charge and pay VAT, but can exercise the right to an exemption if they fall within the income limit:

- in 2018 - 100 million rubles;

- in 2019 - 90 million rubles;

- in 2020 - 80 million rubles;

- in 2021 - 70 million rubles;

- in 2022 and subsequent years - 60 million rubles.

The Unified Agricultural Tax rate is 6% of the difference between revenues and costs. Unified agricultural tax is paid in two stages: an advance for the first half of the year until July 25 and an annual payment until March 31.

All other taxes: transport, land, water, etc. They pay when the specific nature of the activity suggests it and is an object of taxation. Special regimes do not exempt you from them.

Remember that for every exemption there are exceptions - special cases when one or another tax still needs to be paid. For example, the VAT exemption does not apply to cases when it comes to the import of goods, personal income tax is always withheld from dividends, and the property tax exemption does not apply if the property is assessed at cadastral value and included in a special list.

How to pay taxes and fees correctly, keep records and not get confused, and at the same time not spend money on the services of an accountant?

The best option is to register with the service. This is a cloud service for accounting, tax accounting and HR document management, which saves you time and allows you to focus on business development.

is your reliable assistant. Take advantage of the free access and see everything for yourself.

This article is intended for those who are just making decisions about engaging in entrepreneurial activity. It will outline in general terms when it is best to start work, what is needed for this, and what difficulties may arise.

Start activity According to the legislation of the Russian Federation, a beginning individual entrepreneur is required from the moment of registration. Without it, you will not be able to enter into a lease agreement, officially hire people, or generally work within the legal framework. However, in practice, very often there are cases when an activity is already underway and due to various circumstances the need for registration arises. This must be done immediately to avoid problems with the law.

What is the simplified tax system for individual entrepreneurs?

Before registration, one of the important issues that a businessman must decide on is the choice of taxation system.

To understand the big picture, you need to know that there is:

- General system taxation, which is provided to a businessman by default when applying for registration. It is less popular than the next system.

- Simplified system taxation – represents a certain procedure for paying taxes and fees. Specifically designed to support small and medium-sized businesses. Let's look at it in more detail.

IMPORTANT!

For beginners IP simplified possible subject to the following conditions:

- The number of hired employees should not exceed 100 people. That is, you should immediately assume how many employees will help you when starting an individual entrepreneur’s activities.

- You also need to calculate your expected income. It should be no more than 60 million rubles.

- The residual value of fixed assets (which are subject to depreciation) should not exceed 100 million rubles.

If an entrepreneur has chosen a simplified taxation system, then he is exempt from paying such types of taxes (except for some exceptions), such as:

- for added value;

- on the income of individuals;

- on the property of individuals, which he will use in his business activities.

That is, you will only have to pay one tax. But no one has canceled the payment of contributions to the Pension Fund and the Social Insurance Fund, if there are employees.

Also keep in mind that if you initially did not apply for the simplified tax system during registration, then by default you will end up on OSNO and will be able to switch to the desired type of taxation only from the next calendar year.

For payment, you can choose, at your discretion, taxation objects:

- Income - and you will pay 6% on the amount of income received.

- Income minus expenses - 15% is paid on the difference between income and expenses.

To make a choice, you need to guess the percentage of your income and expenses. If the costs are exceed 60% of income and you can confirm them with documents, then choose the second type. Unprofitable activities will also require you to pay a minimum tax of 1% on the income received. If you cannot meet all these conditions, then the first one is better.

Keep in mind that individual entrepreneurs under the simplified tax system are not allowed to work in all types of activities. The full list can be found in the Tax Code, but today we note that, for example, if you produce excisable goods (alcohol, tobacco, gasoline) or sell them, then the simplified version is not for you.

Don’t forget about submitting the required reports. You must do this by April 30 of the following reporting year. Filling out the declaration will not be difficult, as long as you have an up-to-date form. And remember that even if you do not carry out activities or receive zero income, or are on tax holidays as a newly opened individual entrepreneur, it is mandatory to submit reports.

When to pay taxes for the first time after opening an individual entrepreneur, terms and dates of payment

The question of when an individual entrepreneur should start paying taxes is relevant and no less important. Payment deadlines depend on the tax regime you have chosen for yourself.

- Simplified taxation system.

Taxable period - calendar year. Advance payment based on the results of the reporting quarter is provided until the 25th. The single tax itself is calculated at the end of the year (taking into account all advance payments) and paid before April 30. It is impossible not to pay quarterly advance payments, otherwise penalties will be charged.

The amounts are calculated based on the income you actually received. If no activity was carried out, then you submit a zero declaration and do not pay taxes.

- Single tax on imputed income - this tax is imposed on estimated income and is paid quarterly by the 25th.

However, according to the Tax Code, payers of this type of tax are registered and removed from it within 5 days from the beginning and end of the activity. That is, it is believed that if you do not carry out activities or do not receive income, then deregister and that’s it. Change zero reporting on UTII not provided.

- Patent taxation system - in this case, tax refers to the amount paid for a patent.

- Unified agricultural tax - in this case, an advance payment is also provided, which is made no later than 25 days after the reporting period. The annual tax deadline is March 31st.

Pay insurance premiums it is necessary to start from the moment of acquiring the status of an individual entrepreneur, i.e. inclusion in the Unified State Register of Individual Entrepreneurs. Termination of activity is an exception from the above register. Insurance premiums begin to be calculated from the next day after registration (the date of registration in this case is not taken into account).

Contributions for pension and health insurance are carried out in any case, regardless of whether any business activity is carried out at all, and what mode you are in. Payment to the Social Insurance Fund is made only if there are employees.

What an individual entrepreneur may need to get started: current account, stamp, cash register, etc.

What does a beginner entrepreneur need:

- Register with the State Tax Service.

- Depending on the type of activity chosen, notify the relevant authorities. For example, you must notify Rospotrebnadzor about the start of an individual entrepreneur’s activities if you provide:

- hotel services;

- domestic services;

- catering services;

- retail or wholesale trade;

- production of garments, clothing, leather goods, etc.

The full list is specified in Resolution No. 584.

- If a license or special permit is required to carry out an activity, then issue it accordingly.

An individual entrepreneur for beginners should also know what he may need for work (this provision is advisory or for individual cases):

- Current account – opened by a businessman as necessary for non-cash payments to clients. This is a right, not an obligation. There is no need to notify the Federal Tax Service.

- Printing – its presence is also not necessary. But if a businessman thinks that the presence of a seal gives him respectability and additionally protects his documents, then he can produce it without any problems.

- The situation is slightly different with cash register equipment. According to Russian legislation, individual entrepreneurs making payments using cash or payment bank cards are required to use it. However, in this case there are exceptions. For example, if an individual entrepreneur provides services to the population using the simplified tax system, then he may not have a device, but must issue the buyer a strict reporting form.

What difficulties may there be in the work of an individual entrepreneur?

In addition to the above provisions, where to start a business For a beginner individual entrepreneur, you need to remember about the difficulties that may arise:

- Payment of taxes and fees must be done on time.

- It is necessary to maintain accounting records and provide reporting within clearly established deadlines.

- Conducting any business activity requires spending nerves, time, labor and financial resources.

In all of the above cases, a businessman must remember that he is responsible for his mistakes with all his property, which can be levied under the law.