Separate VAT accounting. Document “Distribution of VAT

The need to distribute VAT is due to the fact that many companies combine several tax regimes. However, this process is often accompanied by some problems regarding the correctness of tax accounting and distribution. Errors can be very different and they are influenced by the “human factor” or simply uncertainty.

For example, it is not always known whether a particular object will be used in an activity for which income is not taxed. For this situation, the Tax Code of the Russian Federation determines that the payer, taking into account material assets, must submit VAT amounts for deduction. When the item is subsequently used in work, the income from which is not taxed, the amounts previously accepted for deduction are restored.

Correct configuration of the software solution will help you overcome all possible errors. If done correctly, the program will help the accountant in the most complex issues and help solve some dilemmas related to legislation and the rules established by it.

Maintaining separate VAT accounting in 1C using the example of the 1C: Accounting 3.0 configuration

There is a deviation from the obligation enshrined in the code to maintain the type of accounting we are considering when registering both taxable and non-taxable transactions. It is as follows: if the costs of carrying out preferential transactions in the reporting period do not exceed 5% of all costs of production or sales, separate accounting can be abandoned. But when the payer obliged to maintain it does not do this, then the input tax cannot be deducted, nor can it be taken into account as part of income tax expenses.

Each taxpayer is required to keep separate VAT records when:

- Simultaneous work on taxable and exempt transactions;

- Several types of activities, one of which has been transferred to a special tax regime.

VAT amounts submitted by organizations carrying out both taxable and tax-free transactions can:

- Included in the price of works/services, fixed assets, intangible assets used for VAT-free transactions;

- Be accepted for deduction for goods (services/work), including fixed assets, intangible assets, used for taxable transactions;

- Accepted for deduction or included in the cost in proportion to use in production and/or sale.

This proportion is derived from the share of income received from taxable transactions, as well as those exempt from it, in the total amount of income for goods (work, services) shipped during the reporting period.

How to set up separate VAT accounting in 1C

Error-free accounting guarantees the correct parameters of the accounting policy/UP for the corresponding reporting period. In the section “Main-Accounting Policies-Setting Up Taxes and Reports”, open the corresponding tab and mark the following sub-items:

Rice. 1 Accounting policy

Having checked the indicated points, we will have the option to indicate the procedure for accounting for VAT in the documents. He can be:

- Accepted for deduction

- Included in price

- Distributed

- For transactions at 0%

Thus, for each receipt there is a choice of determining VAT. This mechanism allows you to see input tax movements at any time, which makes VAT accounting clear and understandable.

At the next stage, in “Administration”, in the navigation we find “Accounting parameters - Setting up a chart of accounts”.

Fig.2 Setting options

Then check all the boxes.

Fig.3 Activating parameters

Admission and acquisition

As an example, let’s create “Receipt of goods” and fill it out in the usual way. When accounting in the program is maintained for several organizations, we find the one that has set up a software program with separate accounting.

After the necessary settings, an additional sub-account “Method of accounting for VAT account 19” appeared, for each individual item, including in the table field. So, we add a product item there, after which the “VAT Accounting Method” column will be displayed, where you need to indicate the correct option from the proposed list.

Rice. 4 Admission

The option we choose will be reflected in the postings as an additional subaccount on the account. It can subsequently be changed by setting another one in the “Movement” and “Request-invoice” documents.

In the latter, there is an option to set the tax accounting procedure completely for the entire document by selecting the one we need on the “Cost Account” tab. It is not necessary to indicate it in the table field.

Rice. 5 Creation of technical equipment

During the implementation process, the program will automatically check the relationship between the specified tax accounting option and its specified rate. It should be noted that changing the method is possible until the inventory is written off.

Let's look at the transactions generated by the receipt document in accordance with the choice of a new subaccount. The generated document with the indicator “Accepted for deduction” will add another subaccount to account 19. If you select the indicator “Considered in the cost”, VAT will be included in the cost of purchased assets and will pass through account 19, generating the following transactions:

- Dt41 Kt60

- Dt19 Kt60

- Dt41 Kt19

For transactions at 0%, you need to confirm this VAT rate. Here are the following accounting entries:

- Dt41 Kt60

- Dt19 Kt60

All VAT on account 19 will be distributed by the corresponding document (if the same sub-account is selected).

When registering for asset receipt accounting, in the “Equipment” tab, we indicate the method of VAT accounting, which depends on the future use of this tool.

Rice. 6. Receipt of OS

The selected option can be changed subsequently through “Acceptance for accounting of fixed assets”. When intangible assets arise in accounting, the accounting option is set in the same way.

Distribution of VAT for separate accounting

Let's see how the mechanism for posting VAT in the Turnover Balance Sheet/SALT works according to account 19.

Rice. 7 SALT according to Article 19

SALT according to account 19 is a separate accounting register, which reflects tax amounts with different accounting procedures. Before the start of operations for posting VAT and before entries are generated in the Purchase Book, the balance on account 19 is not closed, with the exception of VAT taken into account in the cost, since it is displayed on this account in transit.

If you generate SALT according to account 19 after posting the tax, then the additional subconto will indicate the unclosed balance at the end of the selected period. Then you can close it using the routine operation “VAT Distribution”. It is carried out on the basis of primary documents, which set all the parameters for correct accounting.

Rice. 8 Posting VAT

After automatic filling, click the “Fill” button and the data from the accumulation register “VAT on indirect expenses” for the period we need is reflected in the table field. After this, the costs will be reflected in accounting. By clicking the “Calculate” button, the necessary details are automatically filled in.

Wiring

Posting VAT generates transactions:

- Dt19 Subconto: deductible, included in the price for transactions at 0%

- Kt19 Subconto: distributed

- Dt20 Kt19 Subconto: included in the price

VAT included in the cost will be written off to cost accounts.

The above material allows us to conclude that the correct reflection of business transactions and the correct settings for the implementation of the process in question in 1C: Accounting 8 helps to avoid mistakes if you need to make the transition to separate VAT accounting.

Let's look at how to properly maintain separate VAT accounting and what settings to use for this in the 1C: Enterprise Accounting 8 program, ed. 3.0.Who maintains separate VAT accounting

Separate VAT accounting must be carried out by those organizations that combine types of activities subject to VAT, as well as types of activities not subject to VAT.

The most common reasons for the need to distribute VAT is the need to distribute incoming VAT between types of activities for organizations that combine SST with UTII, or for organizations engaged in export trade. This is a non-exhaustive list of cases.

There are exceptions to the requirement to maintain separate VAT accounting. Thus, if in an organization the share of revenue from activities not subject to VAT or taxed at a rate of 0% does not exceed 5% of all revenue, the organization has the right not to share input VAT. Or an organization that is engaged only in exports and does not conduct operations in the domestic market also has the right not to maintain separate accounting.

When maintaining separate VAT accounting, it is important that the software product allows for the distribution of VAT by type of activity: part of the amount is accepted for deduction, and part is included in the cost. Such opportunities are provided by the software product “1C: Enterprise Accounting 8”, ed. 3.0.

VAT accounting in 1C

Let's set up separate VAT accounting in 1C. After setting " Separate accounting of incoming VAT is maintained", when posting documents, the program will remember what subsequently happens with VAT in the context of each document. If VAT was accepted for deduction upon receipt, and in the future the organization makes a sale without VAT, then the VAT previously accepted for deduction will be automatically restored. When using this setting, batches of goods are automatically tracked for subsequent VAT accounting purposes.

This setting is set in the accounting policy using the hyperlink “ Taxes».

In version 3.0, it became possible to maintain additional analytical accounting on the account - according to the methods of VAT accounting. Thanks to this analytics, it is possible to determine the need to distribute VAT at the time of purchase. With this setting, you can distribute VAT not only for indirect costs, but also for direct ones. To do this, in analytics " VAT accounting method" set the value " Distribute».

With further movement of inventory in the organization, it is possible to change this setting for a batch of items. For example, the document for receipt of goods and services indicated the method “ Take for deduction", and at the time of inclusion in expenses it became clear that the inventories would be used for the activities of UTII, which means that VAT must be included in the cost. The document " Request-invoice", where the VAT accounting method will be set to " Include in price" After the invoice request is completed, the VAT amount will be automatically restored to the budget and included in expenses.

Consignments of goods for VAT accounting

It must be remembered that when selling goods, VAT is written off for a specific batch of documents - since for the correct calculation and distribution of the amount of incoming VAT, the program uses “ The consignment» each document. In order for accounting for VAT purposes regarding batches to coincide with regulatory accounting and cost calculation, it is necessary to use the FIFO method of accounting for PMZ.

In order to maintain batch accounting for inventory accounts, you need to set this option in the settings. This can be done in the menu " Administration” – “Accounting parameters” – “Setting up a chart of accounts” – “By item, batches, warehouses" In the settings menu that opens, you need to set the flag “ By batches (receipt documents).”15 pcs. 20 November.

If we maintain FIFO accounting, then for both VAT and costing purposes the chairs will be written off as follows:

10 pieces. from the batch at a price of 1180 rubles.

5 pieces. from the batch at a price of 1550 rubles.

And if an organization maintains accounting at average cost and separate VAT accounting, then for VAT purposes the program will write off data from batch documents, as described in the FIFO case, and for the purpose of calculating cost the following will be written off:

15 pcs. without batch, but based on the cost of 1365 rubles. (1180 + 1550= 2730 / 2 = 1365)

Thus, for the purposes of VAT accounting, the program will calculate based on batches, and for the cost price - based on other amounts. For sales transactions on the domestic market, this situation is not incorrect, but in the case of exports and the use of a 0% rate, difficulties arise, since confirmation of the zero rate will occur immediately for batches of all receipts stored on balances.

For this reason, those organizations that apply a 0% rate or without VAT are recommended to use the FIFO method instead of average cost accounting. If you change the method of accounting for inventories, do not forget to document this change in the form of an order for the accounting policy of the organization.

Distribution of VAT on fixed assets

In version 3.0, it became possible to distribute VAT on fixed assets. To do this, in the document " Acquisition of fixed assets"in the VAT accounting method, select the value " Distribute" After accepting the fixed asset object for accounting and posting the document “ VAT distribution» this VAT will be distributed in proportion to revenue. In terms of the percentage of VAT for non-VAT taxable activities, this amount of VAT will be included in the initial cost of the fixed asset item. After this, depreciation of the object, as well as all analytical reports on fixed assets, will display the cost of the object, taking into account the amount of VAT included in the price.

Example.

In organization A in the fourth quarter of 2016, revenue from activities subject to VAT amounted to 1 million rubles, revenue from activities subject to the payment of UTII amounted to 250,000 rubles. During the fourth quarter, services related to both types of activities were purchased in the amount of 50,000 rubles, VAT on top. An object of fixed assets worth 150,000 rubles was also purchased, VAT on top (Fig. 1).

To calculate the amount of VAT distribution, we calculate the percentage. Transactions excluding VAT accounted for 20% of total revenue. Accordingly, the VAT amounts are distributed as follows: 80% – “Accept for deduction”, 20% – “Include in price”. We calculate: 9000 * 20% = 1800 rubles, 27,000 * 20% = 5400 rubles. (Fig. 2).

In the document " VAT distribution» the amounts indicated by us were included. And after completing the document, the amount for services is 1800 rubles. will be reflected in the cost accounts (in our case this is account 44). Amount 5400 rub. will be reflected as part of the invoice, and then in correspondence Dt. 01 Kt. 08 will increase the initial cost of the fixed asset item (Fig. 3).

At the end of the quarter, the account amounts in the analytics " Take for deduction" - is accepted for deduction by the document " Generating purchase ledger entries" To analyze and evaluate the correctness of closing an account, it is convenient to use a balance sheet with analytics on VAT accounting methods (Fig. 4).

For a more detailed analysis of the SALT for the account, you can get analytics down to the counterparty and the movement document.

If your organization did not maintain separate VAT accounting in the program, but is required to do so, then to switch to separate accounting you need to set the settings indicated in the article and enter balances for batch accounting. You can enter batch accounting balances manually or with the help of a programmer.

Another situation where an organization can benefit from setting up “ Maintaining separate VAT accounting"- this is the need to write off inventories. Write-offs can be carried out for various reasons, for example, in the event of a identified shortage. In this case, since the goods are written off as a result of shortages (for activities not subject to VAT), the VAT previously accepted for deduction must be restored to payment to the budget. When using the specified setting, the program will automatically restore VAT for payment after posting the document “ Write-off of goods" If the separate accounting setting is not used, for correct accounting it is necessary to use the document “ VAT recovery» reflect this operation.

How to properly maintain separate VAT accounting in the 1C 8.3 Accounting program?

Starting with version 3.0, in the 1C 8.3 program it became possible to maintain separate VAT accounting. This is necessary if an enterprise carries out business transactions that are and are not subject to VAT in the same reporting (tax) period.

In addition, separate accounting must be maintained when carrying out activities taxed at a 0% rate.

In this article, let's look at what new VAT accounting mechanisms have appeared in the 1C Accounting 8.3 (3.0) program.

1C program settings for maintaining separate VAT accounting

First you need to change your accounting policy settings. It is necessary to indicate that in the current tax period, input VAT will be accounted for separately.

Let’s go to the organization’s accounting policy settings and on the “VAT” tab, check the following boxes:

In the “Main” – “Accounting Options” menu, in the VAT tab, you need to check the “By accounting methods” checkbox:

Example of document execution “Receipt of goods”

Let's create a new goods receipt document. Let’s select an organization that has set up an accounting policy for maintaining separate VAT accounting and add the product to the tabular section:

As you can see, in the line of the added product you can choose how VAT will be recorded. The selected value will be the third subaccount of the 19.03 account in the posting.

Attention! If you do not see columns with accounting accounts and the choice of accounting method in the tabular part, go to the “Main” menu, then “Personal settings” and check the “Show accounting accounts in documents” checkbox:

Adjusting the VAT accounting method

The accounting method specified in the process of generating the receipt document may later be changed by other documents. For example, after posting a receipt document with the accounting method “Accepted for deduction”, you can make a movement of goods with the attribute “Taking into account in cost”.

You can also adjust the accounting method using the “Demand-invoice” document. Moreover, you can specify the method of accounting for VAT not only in the line of the tabular section, but also for the document as a whole on the “Cost Account” tab:

When posting a document for the sale of goods, the program will check for compliance with the currently established accounting method and the VAT rate established in the document.

The method of accounting for VAT can change until the inventory value is written off.

Attention! If VAT has already been distributed, it is no longer possible to adjust the accounting method!

Distribution of VAT in 1C 8.3 when using separate accounting

For clarity, we will form OSV according to account 19 in 1C 8.3. This is what it looks like before VAT is distributed:

With the advent of the third sub-account, VAT is displayed clearly and simply. You can easily determine by what accounting method the balance at the end of the period is not closed (before the regulatory procedures for the distribution of VAT are completed).

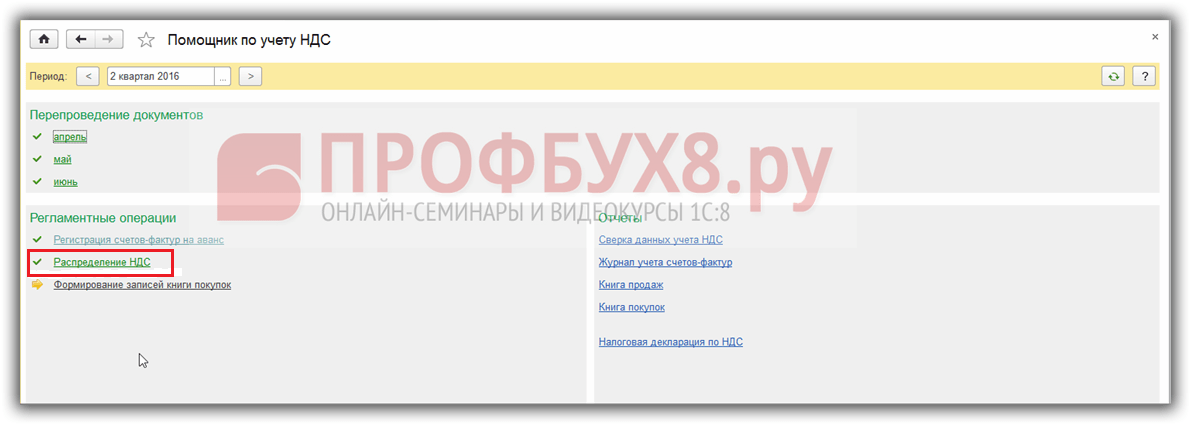

Therefore, distributing the tax is now not difficult. In fact, the distribution is taken over by the primary documents, and the “VAT Distribution” document in 1C is minimally loaded. After all, the distribution base is now known and, accordingly, the amount to be distributed is known:

Based on materials from: programmist1s.ru

Let's look at an example. The organization received 50 pieces of materials from suppliers. Separate VAT accounting is not maintained, since the main products produced are subject to VAT:

In the first quarter, 10 pieces of materials were used for production. At the end of the first quarter, all VAT on materials is accepted for deduction. The following entry was created in the Purchase Book for the 1st quarter:

In the balance sheet for account 19 we see that the entire amount of VAT is reflected as deductible:

Step 1. Settings for maintaining separate VAT accounting

In the second quarter, the organization began to produce products that are not subject to VAT, in our example new products. Therefore, changes are made to the accounting policies for the purpose.

We copy the accounting policy in 1C 8.3, set the start date from 04/01/2016:

Check the required boxes on the VAT tab:

The 1C 8.3 program also makes changes to the accounting parameters:

However, if we now try to reflect the write-off of materials for production in the 1C 8.3 program, the document will not be processed:

This happens because the 1C 8.3 program “does not see” the data in the accumulation register Separate VAT accounting.

Step 2. Enter balances

Thus, when switching to separate VAT accounting during the reporting year, it is necessary to enter balances in accumulation registers. To do this, use the Balance Entry Assistant:

In our case, we enter account balances 10.1 Raw materials:

Moreover, the mode Entering balances using special registers is selected:

In the invoice data we indicate the method of accounting for VAT Accepted for deduction:

If you look at the movements of the document using the DtKt button, you can see that the corresponding entry has appeared in the accumulation register Separate VAT accounting:

Step 3. Separate VAT accounting

In the second quarter, materials were used to produce core and new products. It is interesting to look at the entries when generating the Production Report for a shift for new products, when VAT is included in the price:

We see that in this case, VAT on materials is in the amount of 1,800 rubles. is first recovered and then written off as expenses:

VAT is restored through the corresponding amount:

Part of the materials, in the amount of 20 pieces, was used for general economic needs, that is, VAT on them should be distributed between products subject to and not subject to VAT. In the Request-invoice document, select the VAT accounting method – Distributed:

We check the movement of the document using the DtKt button. If necessary, we make manual adjustments to the VAT amounts:

We check the movement of the document on the Separate VAT accounting tab:

An entry was created in the Sales Book for the restoration of 3,600 rubles. VAT in the total amount of restored VAT according to the receipt of materials document dated February 12, 2016:

The balance sheet for account 19 is as follows:

Step 4. Distribution of VAT in 1C 8.3

We will carry out a routine operation to distribute VAT before and at the end of the month:

The VAT Distribution document is filled in using the Fill command:

On the Distribution tab, you can see how VAT on general business materials is distributed between types of products in proportion to revenue:

If in 1C 8.3 the Distribution tab is not automatically filled in, then you can add the required invoice manually and select the Distribute command.

The balance sheet for account 19 now looks like this:

Let's check the result. The amount of VAT accepted for deduction for the six months is 5,200 rubles. This amount is determined as the difference between the entries in the Sales and Purchases Book. We will find the relevant documents for the six months for our supplier Tekhstroy LLC.

In the Purchase Book:

In the Sales Book:

The resulting difference is 5,200 rubles = 10,600 – 5,400. Thus, separate VAT accounting in the 1C 8.3 Accounting database is organized correctly.

Practicing and novice accountants often face the problem of understanding the sequence of actions associated with complex VAT accounting in 1C systems, especially in new 1C solutions. Therefore, in this article we will look at the main functionality for complex VAT accounting in the new configuration of the 1C company - 1C:ERP Enterprise Management 2.1 (hereinafter referred to as 1C:ERP).

To begin with, we present the basic principles for implementing the functionality for VAT accounting in 1C:ERP:

- Maximum use of data from other subsystems and at the same time a minimum number of “own” objects of the VAT accounting subsystem and regulatory tasks. This allows you to eliminate the entry of duplicate information for different VAT accounting purposes.

- Integration with batch accounting of inventories and costs to reflect changes in VAT accounting activities.

- All VAT transactions are reflected in regulated reporting that fully complies with legal requirements.

General scheme for VAT accounting in 1C:ERP:

Figure 1 - General scheme for VAT accounting in 1C:ERP

Complex VAT accounting- this is VAT accounting, if the enterprise has activities at VAT rates “Without VAT” and “0%”. This requires:

- Do not deduct input VAT on goods (services) purchased for activities without VAT, but include it in the cost or expense it;

- Keep separate records of incoming VAT by type of activity with different VAT rates;

- Input VAT on goods used for activities at the rate of “0%” can be deducted only after receiving confirmation of the zero VAT rate.

In 1C:ERP, to maintain complex VAT accounting, you need to enable the option Separate accounting of goods for VAT taxation(Administration – Financial results and controlling).

Figure 2 - Enabling the option Separate accounting of goods for VAT taxation

This will allow you to indicate the type of VAT taxation in documents when:

- receipt of goods (Purchase for activity attribute in the document Receipt of goods and services);

- write-off of materials for production (the Consumption attribute for the activity in the document Transfer to production);

- assembly of goods (the Assembling for activity attribute in the document Assembly (disassembly) of goods);

- when moving between warehouses (the Move for activity attribute in the document Movement of goods);

- at the time of sale (Taxation details in the document Sales of goods and services).

Also, production, procurement and sales documents inherit the type of taxation from the orders on the basis of which they are entered:

Figure 3 - Scheme for entering primary documents based on orders

All actions for the distribution of VAT by type of activity are carried out in a document. This is the only regulatory document in VAT accounting in 1C:ERP.

It is generated automatically as part of the procedure for closing the reporting period in the Month Closing workplace and performs the following actions:

- Generating purchase ledger entries for fixed assets (monthly)

In documents Acceptance for registration indicates the method of separate accounting of VAT on fixed assets. If a specific type of taxation is selected, then the entire amount of VAT will either be deducted or included in the cost of this fixed asset. Otherwise, the amount of VAT is subject to distribution in proportion to revenue by type of taxation, incl. on sales documents at a 0% VAT rate.

Revenue by type of taxation is filled in using the Fill button and is available for manual editing, with the exception of revenue at the VAT rate of 0% (since in this case the distribution is performed not for the activity as a whole, but for each sales document). When you reopen the document, the program will warn you if the revenue does not match the infobase data.

If a fixed asset is taken into account in the first or second month of a quarter, then revenue is taken for this month, if in the last month of the quarter - for the quarter.

- Distribution of VAT on indirect expenses by type of activity for VAT accounting.

VAT distribution is carried out only on values written off to expense items with the distribution option “For line of business” and the established value “VAT is distributed by type of taxation in proportion to revenue.”

If VAT on the batch was not initially accepted for deduction, then part of the amount allocated to VAT-taxable activities is accepted for deduction. If VAT was previously accepted for deduction, then the part of the amount allocated to “VAT Free”, “UTI Taxable” and “VAT Taxable 0%” activities is restored in the sales book.

- Formation of purchase ledger entries for batches allocated for sales at a 0% VAT rate. (if there is confirmation of a zero VAT rate).

Confirmation of the 0% rate on sales is carried out using special processing Confirmation of zero VAT rate.

If the VAT rate is not confirmed, the VAT amounts will also be deducted, but on an additional sheet for the sales period.

Figure 4 - VAT distribution

Thus, in 1C:ERP, regulatory operations for VAT are automated as much as possible. Users only need to enter primary documents; all other actions are performed automatically. This is a significant advantage, as it reduces the likelihood of manual entry errors. But at the same time, the user’s ability to manually control the distribution process is reduced. For example, there is no tabular part in the VAT Distribution document and you can only adjust the document settings, and not the distribution result itself.

System integration. Consulting