The concept of return on investment. choice of interest rate (discount rate)

This compensation is expressed in the form of interest (credit), dividend (shares), rate of return (rate of return) of investments.

In order to obtain financial resources for the implementation of an investment project that will provide an effect to the enterprise, the enterprise must offer the investor (creditor) such a rate of return (profitability) that can compete with the best investment alternative that actually exists for the investor. This value of the return (profitability) of the best alternative is known as the "price of a chance" (in the domestic literature, the costs of lost profits, or feedback costs). The meaning of this concept: the rejection of some investments, due to alternative investments, leads to the loss of benefits associated with the first opportunity. When evaluating the second alternative, these losses (lost profits) are treated as costs.

Due to the paid nature of investments and entrepreneurial activities, it is necessary to take into account not only accounting (external) costs, but also internal costs that are not included in the financial statements. The totality of external and internal costs is economic costs (Fig. 6.10).

Internal costs - payment for investment and entrepreneurial ability (entrepreneurial activity). In terms of magnitude, internal costs are equal to lost profits in alternative options for using resources.

Determining the minimum level of lost profits The minimum investment fee for legal entities and individuals is determined by the income from keeping investments in a deposit account with a bank. Minimum business fee:

a) for a legal entity - normal profit. Norma

payment for the business activity of the bank is the current

Cost price

Rice. 6.10. Composition of economic costs

| External | Internal | |

| expenses | expenses |

taxes

the total bank margin (interest on loans - bank interest on deposits), which is taken as the minimum rate of payment for entrepreneurial activity;

b) for an individual, it is equivalent to the maximum possible earnings of an entrepreneur in a foreign (other) enterprise.

In general, the internal costs of a legal entity are equivalent in size and economic content to the payment for the use of financial capital (interest on a loan) and therefore are most often called the cost (price) of capital.

Thus, the return on the best alternative already available is the central determinant of the minimum acceptable interest rate (or rate of return) for any new investment considered by the investor (i.e., in a certain sense, required by him).

The profitability of the best investment alternative (the cost of lost profits, or "the price of a chance") depends on the company's actual long-term investment alternatives (from the total number of investment proposals of the corresponding level of efficiency). It reflects the assumptions made within the enterprise itself (takes into account the average level of return on assets or equity capital and the prospects for its change). In some cases, the cost of lost profits may be included in the project evaluation not through the profitability threshold, but directly as additional costs or revenues.

The return on investment shows what proportion of the initial investment will be returned to the owner of the capital in the form of net income. Therefore, the return on investment is determined by the ratio of the net income received for a certain period (life cycle, calculation horizon, year) to the value of the initial investment (capital):

l ^ - xd~u*

“"G-" No. 23)

where Dh - net income from investments (profit):

Ig - the total amount of initial investment;

ED - the total amount of cash receipts for the project.

Thus, the return on investment is the amount of profit received per 1 rub. investments (Di \u003d 0.2 -gt; profitability of 20 kopecks of net profit per 1 ruble of investments; invested 1 ruble of investments - we get 1 ruble 20 kopecks).

The discount rate (rate) E is the minimum return on investment that suits the investor, i.e. the minimum profit per 1 rub. investment, at which investments are considered profitable by the investor (below this level, investments are considered unprofitable). The discount rate can also be defined as the individual price of the project participant's capital based on the market interest rate, taking into account their own capabilities and the goals of capital allocation. The discount rate is an exogenously set economic standard used in evaluating the effectiveness of investment projects.

Types of discount rates. The commercial discount rate is used in assessing the commercial effectiveness of the project; it is determined by taking into account the alternative (ie related to other projects) capital efficiency. The discount rate of a project participant reflects the effectiveness of enterprises (or other participants) participating in the project. It is chosen by the participants themselves. In the absence of clear preferences, the commercial discount rate can be used as it. The social (social) discount rate is used in the calculation of indicators of social efficiency and characterizes the minimum requirements of society for the social effectiveness of projects. It is considered a national parameter and should be set centrally by the governing bodies of the national economy of Russia in conjunction with the forecast of the economic and social

161 We save, estimate inv.

development of the country. In the calculations of regional efficiency, the social discount rate can be adjusted by the economic authorities of the region. The budget discount rate is used in calculating budget efficiency indicators and reflects the opportunity cost of budgetary funds. It is established by the authorities (federal or regional), on the instructions of which the budgetary efficiency of the investment project is evaluated.

If earlier the rate of return on investment was set by higher organizations (the government), then in modern conditions each enterprise, investor and others independently sets an acceptable level of return on investment.

Since the result of evaluating the effectiveness of investments often significantly depends on the discount rate, an objective choice of its value is quite important. The higher the discount rate E, the more the performance indicators take into account the time factor (more distant costs and incomes have less and less influence on their modern assessment, i.e. assessment at the time of making a decision on the investment project) (Fig. 6.11) .

Coefficient

discounting

E= 10% ?=25% -±~- ?=50%

?=100% ?=200%

Figure 6.11 shows that at high E (more than 50%), the discount factor approaches zero already for 4-5 years, which can be a limiter for the value of the calculation period.

Factors influencing the choice of discount rate E: investor's views;

- type of investment project (commercial, social, etc.); deposit interest on deposits, the yield of government long-term bonds, etc. (yield of alternative, less risky investments); sources of financing (own, external, borrowed, etc.); financial condition of the participants of the investment project; goals and conditions for the implementation of the investment project; economic conjuncture; inflation rate; risk level of the investment project; the level of liquidity of the investment project, etc.

Factors that determine the choice of the threshold value of return (barrier rate) of investments can be summarized in two groups:

a) internal factors - an assessment by an enterprise, a firm of alternative investments;

b) external (market) factors - the value of the cost of capital mobilized by the firm.

The cost of capital (CC) is usually interpreted as the most appropriate measure of the barrier rate, which is used to discount cash receipts and payments within the estimated project. The cost of capital is determined by factors external to the firm (changes in the characteristics of supply and demand in the capital market, which, in particular, depend on the total number of investment proposals with a specific level of efficiency and the asking "price" (cost) of available funding sources).

In a market economy, the value of the discount rate E is determined based on the deposit interest on deposits, because if the base rate is taken below the deposit interest, investors will prefer to invest in a bank rather than in production. In practice, the base rate increases due to inflation, risk and liquidity of investments:

?-gt; E6 + EI + ?p + El, (6.24)

where Eb is the basic (risk-free) discount rate. Determines the level of return on investment that can be provided when placed in the public least risky financial

new mechanisms (deposit rates of banks of the first category, LIBOR rates, long-term government bonds, etc.), and not in this investment project;

Eu - inflation rate;

Er - risk premium (a higher interest rate should be used for investment projects with a higher level of risk), taking into account three types of risks: country risks, unreliability of project participants, non-receipt of project revenues;

Е„ - premium for low liquidity (a higher interest rate should be applied to investment projects with a longer implementation period, with a longer payback period).

There are many recommendations in the literature to substantiate the components of formula (6.24).

Abroad, as a standard for determining the minimum rate of return on investments, they usually take the yield of risk-free bonds of a 30-year government loan of the US government (4-5% per year). According to a survey of a number of US companies, when evaluating the effectiveness of investments, three variants of the norm are most often used: the average cost of capital (average payments for various types of borrowed capital, ordinary and preferred shares, interest rates for a loan, etc.); long-term loan rates; estimates based on company practice.

In Russian conditions, when choosing a discount rate, one can focus on the level of the refinancing rate of the Central Bank of the Russian Federation, which approximately reflects the average cost of capital in the financial market, and on interest on long-term loans of commercial banks.

The above estimate of the discount rate is valid for equity. If all capital is borrowed, the discount rate is the corresponding interest rate on borrowed funds (credit):

E = i, (6.25)

where i - interest on the loan (borrowed funds).

In general, when the capital is mixed, the discount rate can be approximated as the weighted average cost of capital (WACC). If there are n types of capital, the value of each of which (after taxes) is equal to? „ share in the total capital d„ then the discount rate is approximately equal to:

E^E,xdt.

і=і

When assigning a discount rate, two approaches are possible. To assess the national economic, i.e. economic efficiency, the discount rate should reflect not only the purely financial interests of the state, but also the system of society's preferences regarding the relative importance of income at various points in time, including from the point of view of social and environmental results. In this regard, this assessment is essentially a “social discount rate” and should be established by the state as a specific socio-economic standard that is mandatory for evaluating projects in which the state is invited to participate. To assess commercial efficiency, each business entity evaluates its own individual "price of money" (return on investment, discount rate), which can be used as: average deposit or loan rate; individual rate of return on investments, taking into account the level of inflation, the degree of risk and liquidity of the investment project; alternative rate of return on other possible types of investments; rate of return on current economic activity, etc.

For orientation, you can use the example of the typical division of investments into classes for European and American enterprises (see Appendix 1).

CONTROL QUESTIONS What is the main criterion for the effectiveness of investments from the point of view of the enterprise? What are the basic principles of investment analysis. What is cash flow? What is the settlement period of an investment project? Why is it necessary to discount income and costs associated with the implementation of an investment project? Name the static methods of investment efficiency. List the advantages and disadvantages of static investment efficiency methods. What is net present value? Name the types of yield index. Describe the internal rate of return. What are the modifications of the internal rate of return?

What is the payback period of investment? The essence of the system of capitalization for evaluating the effectiveness of investments. List its benefits. What indicators of investment efficiency in the capitalization system do you know? What is the economic effect for the billing period? Define the discount rate. Name the types of discount rate. How is the discount rate determined? Is the investment project effective if the NPV is CU 486? Is the following result NPV - 98 CU, ID - 0.94 CU/CU? Should an investor participate in an investment project with an economic effect of CU 1,234 for the billing period?

I have a full course in portfolio investing. I decided to arrange the information from this course in a series of articles. Articles will be useful for those who want to structure information on investments. The course touches upon the theoretical aspects of investing and the practical aspects of investing in the Russian stock market, foreign exchanges and cryptocurrency platforms.

Presentation video of the course:

Let's start with theory. If we want to increase or decrease something, then first we need to learn how to measure the indicator. Let's take a look at the various concepts of profitability.

Nominal yield

Nominal yield– nominal annual interest rate, the base rate under the agreement, on the basis of which interest is determined and accrued for intra-annual capitalization.

Profitability, which is indicated in all cases familiar to us.

Income, taking into account the rate, is calculated according to the formula:

Nominal Yield Formula

Example: invested 100,000 rubles. The nominal yield is 15%. Calculated once a year. At the end of the year we have 100,000 * (1 + 0.15) = 115,000 rubles

Income \u003d 100,000 * (1 + 0.15) -100,000 \u003d 15,000 rubles.

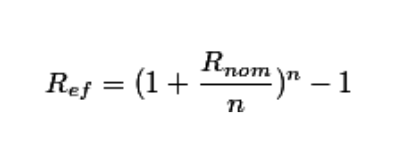

Effective yield

Effective annual rate- the annual rate, taking into account compound interest accrued for the year at a periodic rate. It is equal to the percentage of capital gain (net income) for the year and the initial amount of capital. It implies that the income accrued in the period is reinvested.

Effective Yield Formula

Example:

Nominal rate = 10%

Income is calculated once a quarter, that is, n=4.

Example of effective return calculation

The effective rate will be 10.38%

Why do we need efficient returns?

The effective yield shows the total growth of the portfolio, taking into account all capitalizations.

Also, when calculating the effective yield, you can take into account costs, commissions, dividends, and so on.

Economic sense: The effective return shows how much money an investor will have in the portfolio in the end. If the effective return for the investment period = 17.37%, and at the beginning of the period the investor had 350,000 rubles, then at the end of the period he will have:

P \u003d 350,000 * (1 + 0.1737) \u003d 410,795 rubles.

Effective return allows you to compare different ways of investing in terms of the final performance.

Real yield

The real return is the return adjusted for inflation.

It is necessary to take into account the final increase in the investor's portfolio and divide it by inflation.

Formula and Example of Real Yield

Why do we need real returns?

Real profitability shows how much a person has actually become richer, taking into account price increases.

For example, at the end of 2013, a standard grocery set cost 1,000 rubles. Inflation for 2014 was 11.36%.

Let the investor have 100,000 rubles. At the end of 2013, he could buy 100 sets. (100,000/1000).

Over the year, the grocery set has risen in price to 1,113.6 rubles.

Consider 3 use cases for money

Case 1: keep money at home. We still have 100,000 rubles left. Now we can buy:

Case 1: Keeping money at home

“Investor” became 10.2% poorer.

Case 2: invest money in the bank. The bank promised us 10% per year, capitalization once at the end of the term. As a result, we will be able to buy the following number of grocery sets:

Case 2: invest in the bank

In reality, the investor became poorer by 1.22%. Inflation “ate some of the money”. The bank could not increase the money. This is fine.

Case 3: we invest in the stock market. Suppose that as a result, the client's account became 115,780 rubles.

How to calculate return on investment?— this question interests every investor. The main thing is to generate income, so it is always interesting how much you have earned and what profitability you have. By profitability, stocks, bonds, deposits, real estate and many others are compared. Any investor, trader or manager is interested in its effectiveness. Banks, management companies and brokers, when they advertise their services, like to lure customers with high interest rates. Profitability is one of the most important indicators by which you can evaluate the effectiveness of investments and compare with other investment alternatives. So, let's figure out what is the return on investment and how to calculate it.

Yield(rate of return, level of return) is the degree of increase (or decrease) of the invested amount over a certain period of time. Unlike income, which is expressed in nominal terms, that is, in rubles, dollars or euros, profitability is expressed as a percentage. Income can be received in two ways:

- interest income is interest on deposits, coupons on bonds, rent on real estate;

- an increase in the value of purchased assets - when the sale price of an asset is greater than the purchase price - this is real estate, gold, silver, oil and other commodity assets.

Assets such as real estate, stocks and bonds can combine two sources of income. The calculation of profitability is needed to assess the growth or decline of investments and is a criterion for assessing the effectiveness of investments.

How to calculate return on investment?

Generally speaking, returns are always calculated as profit (or loss) divided by the amount invested, multiplied by 100%. Profit is calculated as the amount of the sale of the asset - the amount of the purchase of the asset + the amount of cash payments received during the period of holding the asset, that is, interest income.

Formula 1

An example of calculating the return on investment.

We bought a share at a price of 100 rubles (investment amount), sold a share at a price of 120 rubles (amount of sale), received 5 rubles of dividends (cash payments) for the period of holding the share. We calculate the yield: (120-100+5)/100 = 0.25 ∗ 100% = 25%.

Formula 2

There is a second formula, according to which the profitability is calculated as the amount of the sale of the asset + the amount of cash payments divided by the amount of investments, minus 1, multiplied by 100%.

Profitability calculation example: (120+5)/100 - 1 ∗ 100% = 25%.

How to calculate the yield as a percentage per annum?

The formula for calculating simple yield does not take into account such an important parameter as time. 25% can be obtained in a month, or even in 5 years. How then is it correct to compare the returns on assets with different holding times? For this, they consider . Yield as a percentage per annum is calculated in order to compare the performance of assets with different holding times with each other. The yield in percent per annum is the yield reduced to a common denominator - the yield for the year.

For example, a bank deposit gives 11% per year, and some shares brought 15% for 1.5 years of holding them, which was more profitable? At first glance, the shares, they brought more profitability. But the investor owned them for half a year more, so their profitability is, as it were, stretched out in time compared to the deposit. Therefore, in order to correctly compare the deposit and shares, the return on shares must be recalculated as a percentage per annum.

To do this, the coefficient 365/T is added to the formula, where T is the number of days the asset is held.

Example of yield calculation:

We bought a share for 100 rubles and sold it 1.5 years later for 115 rubles. 1.5 years is 1.5*365=547 days.

(115-100)/100 ∗ 365/547 ∗ 100% = 10%. In this case, the deposit turned out to be slightly more profitable than shares.

Like forex, management companies, brokers and banks manipulate annual returns.

In any profitability advertisement, pay attention to the footnotes, specify what profitability is indicated in the advertisement and for what period. For example, in advertising sounds a yield of 48% per annum. But it can be obtained in just one month. That is, the company earned 4% per month and now proudly advertises a product that gives 4 * 12 = 48% per annum. Even you, having earned 1% per day on the stock exchange, can brag that you have earned 365% per annum) Only this profitability is virtual.

How to calculate the average annual return

How to calculate the average annual return

The holding period of assets can be several years. At the same time, most assets do not grow by the same amount. Assets such as stocks can fall or rise by tens or hundreds of percent per year. Therefore, I want to know how much your investments grew on average per year. How then to calculate the average annual return? The average annual return is calculated by taking the root using the formula:

Formula 1

where n is the number of years the asset has been held.

An example of calculating the yield if we owned the stock for 3 years:

3√125/100 — 1 ∗ 100% = 7,72%

Formula 2

Another formula for calculating the average annual return is through exponentiation.

The yield using this formula is very easy to calculate in Excel. To do this, select the DEGREE function, in the Number line enter the quotient 125/100, in the Degree line enter 1/n, where instead of n specify the number of years, add -1 after the brackets.

In the cell, the formula will look like this =POWER(125/100;1/3)-1. To convert a number to a percentage, select the Percent cell format.

In the cell, the formula will look like this =POWER(125/100;1/3)-1. To convert a number to a percentage, select the Percent cell format.

How to calculate the average annual return if the annual returns are known?

If the returns of the asset by years are known, then the average annual return can be calculated by multiplying the annual returns and extracting the root from the product to a power equal to the number of years.

First, convert the returns from percentages to numbers.

For example, the first year yield + 20%, the second year -10%, the third year + 30%. In numbers it will be like this: 1.2, 0.9, 1.3. The yield is 3√1.2 * 0.9 * 1.3 - 1 * 100% = 11.9%.

These formulas take into account the effect of compound interest. The simple formula for calculating the yield does not take this into account and overstates the yield, which is not entirely correct.

Now you can calculate the return on your investments not only as a percentage per annum, but also as an average over several years. Next time I will write the correct and very simple way.

The payback period is the number of years required for a flat return on investment in real estate from the income generated.

Payback period calculation schemes:

· The discounted cash flow of income is determined in accordance with the period of occurrence;

· The accumulated discounted cash flow is calculated as the algebraic sum of costs and discounted income. The calculation is carried out up to the first positive value.

The payback period is determined by the formula:

T ok \u003d T i + NS / DDP,

where T i is the number of years preceding the payback year; HC - unreimbursed cost at the beginning of the payback year; DCF - discounted cash flow in the payback year.

Net Present Value of Income (ROI)

Net present value of income (NPV) - the sum of the current values of all predicted cash flows, taking into account the discount rate. Scheme for calculating the net present value (PTSD):

1. Determination of the present value of each amount of the income stream, based on the discount rate of the period, the occurrence of income.

2. Summing up the present value of future earnings.

3. Comparison of the total cost of income with the value of costs:

PTSD \u003d PD - PZ,

where NTSD is the net present value of income, PD is the total present income, and PV is the present cost of the project.

Investment rate of return

The rate of return of the project shows the amount of capital gain per unit of investment. This indicator reflects the effectiveness of compared investment projects, which differ in terms of costs and income streams. The rate of return of the project (FOR) is calculated as the ratio of the project's reduced income to the reduced costs:

SDI \u003d PTSD / PZ,

where CIR is the rate of return on investment, NTSD is the net present value of income, and PV is the reduced costs of the project.

Project internal rate of return

The internal rate of return of a project is the discount rate, equating the sum of the present value of future returns to the value of the investment.

Calculation of the internal rate of return (IRR) is carried out by the method of iterative selection of such value of the discount rate at which the net present value of the investment project becomes zero.

Calculation scheme using discount tables:

1. The choice of an arbitrary discount rate and on its basis the total present value of the project income is calculated.

2. The costs of the project are compared with the received amount of the present value of income.

3. If, the initial arbitrary discount rate does not give zero net, present value of income (PTSD), then we select the second discount rate according to the following rules:

if PTSD > 0, then the new discount rate must be greater than the original one;

if PTSD< 0, то новая ставка дисконтирования должна быть меньше первоначальной.

4. The second discount rate is selected until the option of the current value of income is obtained, both greater and lesser than the cost of the project.

5. The internal rate of return of the project is calculated by interpolation, making up the proportion and solving the equation:

(PD MAX - ZP) / PD MAX - PD MIN \u003d (C d1 - (C d1 + X)) / C d1 - C d2,

where PD MAX - maximum total reduced income, PD MIN - minimum total reduced income, RFP - project costs, C d1 - discount rate for PD MAX, C d2 - discount rate for PD MIN

6. The IRR is determined by the formula:

VSD \u003d C d1 + X

When calculating the IRR indicator, the full capitalization of all income received is assumed. This means that all generated funds are directed to cover current payments or reinvested with a return equal to IRR. This assumption is, by the way, one of the most significant shortcomings of this method.

The interpretative meaning of the internal rate of return is to determine the maximum cost of capital used to finance investment costs, at which the owner (holder) of the project does not incur losses.

Modified rate of return

Allows you to eliminate a significant drawback of the internal rate of return of the project, which occurs in the event of repeated cash outflows. If real estate expenses are carried out over several years, then temporarily free funds that the investor must invest in the future can be invested in another secondary project. A mandatory requirement for such investments is that they must be risk-free and highly liquid, since the invested capital must be returned exactly in accordance with the cost schedule for the main investment project. Discounting costs at a safe liquid rate makes it possible to calculate their total present value, by which it is possible to more objectively assess the level of profitability of an investment project.

Scheme for calculating the modified rate of return:

1. The safe liquid rate of return is determined.

3. A modified cash flow is compiled.

4. The MRR is calculated according to the scheme for determining the internal rate of return, but based on the modified cash flow.

Financial management rate of return

Improving the methods for assessing the investment attractiveness of projects requires an objective analysis of the effectiveness of the use of income generated by the acquired real estate. These funds will subsequently be invested in various new projects, based on the financial capabilities and policy of the investor. The acceptable level of risk for such projects may be higher than when investing temporarily free funds intended for the main project, in addition, diversification of investments is possible.

The scheme for calculating the rate of return of financial management:

1. The risk-free liquid rate of return is determined.

2. Project costs allocated to years of investment are discounted at the safe liquidity rate.

3. The circular rate of return is determined.

4. The total future value of income from the analyzed investment project, accumulated at the circular rate of return, is calculated.

5. A modified cash flow is compiled.

6. The rate of return of financial management is calculated according to the scheme for calculating the ARCF, but on the basis of a modified cash flow.