But under the President of the Republic of Tajikistan we are building the future. Socipoteka under the President of the Republic of Tatarstan - personal account

In the conditions of modern economic realities, the Government of the Russian Federation is developing new mechanisms to support vulnerable and needy segments of the population. The governments of republics, territories and regions do not stand aside and, in turn, create programs of benefits and subsidies at the local level. Most programs are designed to allow various segments of the population to improve their living conditions. An example of such a successful program is the social mortgage under the President of the Republic of Tajikistan.

Social mortgages in Tatarstan replaced the program for the resettlement of owners of residential premises recognized as unsafe or dilapidated, which ended in 2004. The social mortgage program allows borrowers to purchase housing on more favorable terms than the national average, which became possible thanks to the participation of the State Housing Fund under the President of the Republic of Tajikistan (SHF).

Social mortgage in the Republic of Tatarstan allows the borrower:

- Reduce the down payment amount to 10% of the cost of the residential premises. At the same time, the down payment has restrictions on the maximum amount - no more than 30%. In addition, when considering each individual borrower, the State Housing Fund may decide not to provide a down payment (for example, if the borrower is a single mother and meets all the necessary criteria). We have already talked about the possibility of taking out a mortgage without a down payment in 2019.

- With an average mortgage interest rate of 7.4%, a social mortgage allows you to become the owner of a residential property by receiving a mortgage at 7% per annum.

- The maximum term of a social mortgage cannot exceed 28 years and 6 months. The loan agreement allows the borrower to fully repay the loan ahead of schedule, without penalties or interest.

- If during the validity period of the mortgage agreement the first-born child appears in the family, the borrowers will receive 200 thousand rubles for partial repayment of the debt obligation. Upon the birth of a second child and receiving maternity capital, the validity of which has been extended until the end of 2021, the borrower can use maternity capital to repay the mortgage.

- This type of mortgage loan under the President of the Republic of Tajikistan is unique in that the borrower can pay not only with cash, but also with labor or farm products. In the event of a difficult life situation, the borrower does not have to be afraid of losing his home - each specific case is considered by the State Housing Fund and a solution that is convenient for the borrower and lender is developed (deferred payment);

- If the borrower pays part of the amount, he is obliged to pay rent for the remaining part of the residential premises (deferment of mortgage loan payments does not relieve the borrower of the obligation to pay rent).

When obtaining the opportunity to purchase an apartment under the program, the borrower must comply with certain restrictions:

- For 10 years, the borrower does not have the right to change his job at his own request (dismissal by decision of the employer or layoff is not taken into account). If the condition is violated, the balance of the mortgage loan is recalculated with the loss of all benefits and an increase in the interest rate relative to the original by 2 times.

- If the borrower took advantage of a preferential mortgage while being a public sector employee, he loses the right to use any other program to support public sector employees (for example, Decree of the Government of the Russian Federation of January 27, 2009 No. 63).

In this connection, before applying for a social mortgage, it is necessary to calculate all types of possible benefits and subsidies and choose the most profitable one for the borrower.

Who can get a social mortgage

The following groups of citizens can count on receiving a social loan under the President of the Republic of Tajikistan:

- Public sector employees (doctors, teachers, law enforcement officers, etc.);

- Citizens living in residential premises recognized as unsafe, as well as citizens with living space less than the standard (less than 18 sq.m. per person). To obtain the status of a “need”, a citizen must contact the Social Service at his place of residence;

- Employees of commercial enterprises that are investors in the construction of residential complexes participating in the program. This category of citizens has no restrictions on the total area of housing, while the rest cannot apply for apartments with an area exceeding the standards:

- 1 person – 33 sq.m.;

- Family of 2 people – 44 sq.m.;

- Family of 3 or more - based on 18 sq.m. for each subsequent family member.

Where do they give apartments in Tatarstan?

The conditions of a social mortgage depend on many factors, the main one of which is the purchase of residential premises in certain residential complexes. Apartments on preferential terms are provided in houses under construction by those developers who are participants in the program. The list of residential complexes is available on the State Housing Fund website and on the websites of developers, as well as on the websites of banks participating in the program.

A mandatory criterion for the construction of residential square meters is complex development, so the borrower has the opportunity to purchase new housing in an area with developed infrastructure.

Since the list of residential complexes is limited, it is possible to purchase an apartment using social mortgage funds only in large cities.

Kazan

The list of possible borrowers for obtaining a social mortgage in Kazan corresponds to the general list. If a citizen fully meets the program requirements, he needs to collect a complete package of documents:

- Passport of the borrower and family members;

- Confirmation of “needy” status;

- Confirmation of child benefits and birth certificates;

- A copy of the marriage certificate;

- Copy of education diploma;

- Application form.

After submitting all documents to the State Housing Fund and making a positive decision by the City Housing Commission regarding the borrower, the citizen can only wait for a suitable apartment to appear. The most in demand today is the Salavat Kupere microdistrict, designed to solve the housing problem of 14 thousand families.

In addition to social mortgages, branches of large banks in Tatarstan offer a number of programs to improve housing conditions.

Naberezhnye Chelny

In Naberezhnye Chelny, the list of possible borrowers under the social mortgage program includes the same groups of citizens. The main condition for obtaining the opportunity to participate in the program is documentary confirmation of the family’s status as needy. The total cost per square meter of housing includes benefits for children.

Residential complexes located on the outskirts of the city are more popular, since the cost per square meter here is lower than in the central areas of the city, and the environmental situation is much more comfortable. The most popular are the Yalshek - 2 area, the construction of which is ongoing, and the 63 complex.

Residents of Naberezhnye Chelny also have the opportunity to take advantage of the “Building the Future” program, which allows them to purchase their own housing on favorable terms.

Partner banks

The number of banks participating in the program is limited, since not many are present in individual localities.

The program involves not only banking organizations of the Republic of Tatarstan, but also partner banks operating throughout the Russian Federation:

- Sberbank;

- AK Bars;

- Rosbank;

- Kara-Altyn.

For the current period, a social mortgage agreement in Tatarstan is concluded by the borrower directly with the representative office of the State Housing Fund under the President of the Republic of Tatarstan. The borrower opens an account with the program’s partner bank, to which he undertakes to transfer a minimum amount monthly during the payment period, which is formed from at least 11% of the cost of 1 sq. m. meters of housing area. The State Housing Fund has the right to terminate the contract unilaterally if the borrower fails to fulfill payment obligations.

In addition to social mortgages, the Republic’s banks offer borrowers to improve their living conditions by taking part in the “Young Family” program. The main criterion for the borrower is the age of the spouses (at least one of them should not be older than 35 years). This program allows you to purchase housing at a lower interest rate (on average 7.4%) both in new buildings and in the secondary housing market.

The creation of the non-profit organization “State Housing Fund under the President of the Republic of Tatarstan” was determined by Decree of the President of the Republic of March 30, 1995 No. 213. The main idea of creating the organization is to search and attract extra-budgetary funds for the development of housing construction in the Republic and create the opportunity for citizens of the Republic of Tajikistan to purchase their own housing.

The initial task of the State Housing Fund was the implementation of a program for relocating citizens of the Republic from housing that does not meet the required standards (dilapidated, unsafe). In addition to the construction of residential premises, the Foundation was engaged in the construction of socially significant facilities (clinics, schools, kindergartens and other facilities). Upon completion of the program in 2004, the Foundation switched to the implementation of the program formulated in the Law of the Republic of Tatarstan dated December 27, 2004 No. 69-ZRT.

The housing stock under the President of the Republic of Tajikistan creates conditions under which housing becomes more accessible to potential owners, and the construction of residential space becomes profitable for commercial developers. The balance is achieved by providing the developer with commercially successful land plots in exchange for the developer allocating 50% of the housing stock to a social mortgage. The developer has the right to sell the remaining 50% at the market price, thereby receiving a financial profit.

Personal page

When receiving approval for a social mortgage under the President of the Republic of Tajikistan, the borrower can wait for proposals for suitable apartments from the Housing Fund, or can create a personal page on the State Housing Fund website. It will display the borrower's rating, which depends on the amount of accumulated funds for the proposed housing. An important criterion is the degree of need of a particular family.

When ready-made apartment options become available, the possibility of obtaining housing is higher for those program participants whose ratings are higher. Experience has shown that obtaining an apartment based on a rating is faster.

In conditions of economic crisis, the Government of the Russian Federation is offering new mechanisms to support socially vulnerable citizens. To improve their quality of life, housing loan programs with state support are being developed. Borrowers who meet the conditions of a specific project will be able to use a social mortgage.

The programs cover many categories of the population: low-income citizens, young families, public sector employees (doctors, teachers, young scientists), military personnel.

The social mortgage program was prepared by the Department of Housing Policy and is aimed at fulfilling the instructions of the Government of the Russian Federation. The Housing Fund has approved the procedure for providing residential real estate with a social mortgage. Applicants can purchase an apartment under a purchase and sale agreement with registration of the document in the Department of Housing and Housing Policy.

To receive a preferential loan, socially vulnerable citizens can apply to any state or commercial bank that provides mortgages with government guarantees.

According to the department, over the past five years, every seventh participant in state programs has been able to take advantage of the presidential social mortgage and improve their living conditions with the help of government subsidies and mortgage lending.

Under the terms of social programs, low-income borrowers can purchase real estate on the primary and secondary markets, as well as social housing at reduced prices, which is owned by local authorities.

Mortgages under the president have many options: they provide a subsidy for part of the cost of the purchased apartment or a subsidy for the interest rate. Municipal housing is sold to participants in social programs at an affordable price. Which type is used in a particular region depends on the initiative of local authorities.

A good example in this matter can be the Republic of Tatarstan, where since 2004 they have successfully implemented a bill on social housing lending developed at the local level, which differs significantly from the standard version.

How to get

The implementation of the program is controlled by the State Housing Fund (SHF) and the President of the Republic of Tatarstan.

The peculiarities of the presidential program are that the borrower and the State Housing Fund enter into an agreement, according to which the project participant undertakes to regularly contribute a certain amount to form a reserve. Savings are necessary to partially pay the cost of purchased housing. A mortgage is issued for the remaining amount.

The contract term is up to 28.5 years. The bank's tariff (7%) is fixed, set for the entire lending period. A down payment (10-30%) is required. You can use:

- Maternity capital;

- Savings generated during the period of participation in the project;

- State support for young families (the amount of the subsidy can reach 40% of the cost of the apartment);

- By own means.

Sometimes, to pay the down payment, they take out an additional loan, leaving the existing housing as collateral (if the borrower or co-borrowers are its owners).

Under the terms of the project, mortgages are also provided to childless families. If a child is born during the contract period, the spouses are provided with financial assistance in the amount of 200 thousand rubles. The funds must be used to pay off mortgage obligations.

The peculiarity of the presidential project is that participants can make monthly contributions not always in the traditional way - they are paid with labor or products produced in their personal household.

Where can I get housing?

The difference between a presidential mortgage is that the applicant can choose an apartment only from the real estate that was built as part of this project. Such housing complexes (LCs) are built mainly in large cities and some small towns. In addition to the limited choice, apartments also differ in price: square meters in the capital will be more expensive than in the periphery. These factors also influence the loan size and rating points.

An exact list of areas where construction is being carried out by partner companies of the project can be found on the website of the state housing fund. There is information on the websites of banks and developers. An important requirement for the latter is to build housing in a comprehensive manner, so the program participant receives an apartment in microdistricts with normal infrastructure. After submitting the documentation to the State Housing Fund and approving the application by the housing commission, the participant waits for his option of real estate.

- Kazan. Social houses are being built in Aviastroitelny, Kirovsky, Privolzhsky, Pakhitovsky and Sovetsky districts. The most popular microdistrict is “Salavat Kupere”, where it is planned to solve the housing problems of 14 thousand families. More than 350 hectares are being built up with residential complex houses to accommodate about 40 thousand people. The Raduzhny MK is also located in an ecologically clean area, but there are more apartments there for commercial sale. A school for a thousand children is being built.

- Naberezhnye Chelny. The most popular complexes are located on the city outskirts: the cost of housing here is significantly lower, and these areas are noticeably cleaner environmentally. Among the complexes actively under construction are Yalyshek-2, as well as the 63rd complex. In addition to the presidential mortgage, city residents can participate in the “Building the Future” project, which also helps to purchase real estate on terms favorable to the participant.

The contract for the selected apartment is preliminary and has no special legal force. If a program participant violates the debt repayment schedule or does not score enough points, other applicants may be moved into the selected apartment.

If the borrower got a part-time job or left the public sector altogether, he no longer has the right to demand an apartment under a social mortgage. During the crisis, many building materials have even become cheaper, so the developer sees no reason to increase the cost of housing.

Who can participate in the project

Social mortgage under the President of the Republic of Tajikistan covers many segments of the population:

- Budget workers - teachers, scientists, doctors, young specialists, cultural and social security workers;

- Military personnel, combatants;

- Citizens who live in unsafe or unsuitable premises for living;

- Young families (age limit - up to 35 years) with and without children;

- Applicants whose living space does not meet the standards (18 sq. m per tenant);

- Large families;

- Disabled people and families with disabled children;

- Single-parent families if their income has fallen by 30%;

- Employees of investor enterprises, participants in the presidential mortgage program.

Participants in the project can be solvent working citizens with a stable income and a normal credit history, who meet the program criteria and have the funds for the first payment. The applicant must also have the status of a person who needs to improve their living conditions.

Families with an income above the subsistence level can apply for social housing if they can make regular contributions to repay the loan.

State employees must have at least three years of work experience in their specialty. Citizens aged 18 to 54 years with continuous work experience in their last place of 6 months can apply. For the military, the minimum service life is 10 years. Applicants must live and work in the Republic of Tatarstan for at least 10 years.

Applying for a home loan

To obtain the status of a program participant, you must contact the administration with an application. Here you can consult on the chosen program and make a preliminary calculation. Employees of companies sponsoring the program can apply through their manager.

While waiting for your application to be pre-approved, prepare all necessary documentation. Officials have 1 month to make a final decision. If the decision is positive, a social mortgage agreement is signed, after which monthly contributions are made to the State Housing Fund (the amount depends on the family budget).

All that remains is to wait for one or more offers of living space from the State Housing Property Fund, which can be purchased as part of the project.

You can participate in a competition similar to a rating auction. To do this, you need to register on the GZhF website and gain access to your personal account, from where applications for participation are sent. The higher the rating, the more chances the contestants have to win. Points are generated based on the amount of savings each participant has made and the length of stay in the program.

There is another option for obtaining a mortgage, when state support is provided out of turn. Each case is studied individually in the shortest possible time.

What documents to prepare

Applicants for a presidential mortgage must submit documentation:

- Passports of family members;

- TIN and SNILS;

- Certificate of marriage or divorce (if any);

- Birth certificates of children (if available);

- Military ID (for those liable for military service);

- Education documents;

- Certificate of income;

- Documents on real estate rights;

- Confirmation of the status of a person who needs to improve their living conditions.

The completed application form is attached to the documents. The commission has the right to request additional confirmation of the applicant’s solvency.

Pros and cons of a presidential mortgage

A presidential mortgage in the Republic of Tatarstan is an opportunity to purchase an apartment on terms that are more favorable than in the country as a whole.

The participation of the GJF allowed applicants to receive a number of advantages:

- Reduce the down payment to 10% of the apartment price (maximum limit – 30%).

- For single mothers and some other categories on an individual basis, a complete exemption from the down payment is possible.

- With a base rate of 7.4%, a social mortgage is given at 7% per annum.

- The maximum repayment period (28.5 years) can be reduced and the loan can be closed early without overpayments.

- At the birth of a baby, the family receives 200 thousand rubles. to pay off mortgage obligations.

- After the birth of your second and subsequent children, you can contribute funds from maternity capital to repay the loan.

- You can pay for a mortgage not only with money, but also with labor and agricultural products.

- There is no additional insurance - only the purchased apartment and the participant’s liability are insured.

If a difficult financial situation arises in the family, the borrower is afraid of losing the apartment - the State Housing Fund considers all cases individually, developing a convenient option for repaying the debt (deferment, restructuring, etc.). Deferring payments does not relieve the bank client from having to pay apartment rent.

In any state support program there are details that the participant does not pay due attention to at first. But later such nuances can create additional difficulties.

After purchasing housing as part of the project, the participant does not have the right to stop working or leave the public sector for 10 years. If the condition is violated, the balance of the debt will have to be repaid at double the rate. It is possible to terminate an employment relationship with an enterprise without penalties if the dismissal was by agreement of the parties.

After receiving an apartment, a program participant will no longer be able to take part in other social projects aimed at improving living conditions. With a presidential mortgage, housing can be purchased only once in a lifetime, so it makes sense to study all the possible benefits and subsidies that a family can count on and choose the best option for state assistance. The total price of square meters of housing also includes children's benefits.

Standards for the size of mortgage living space have been developed:

- Singles - 33 sq. m;

- For a childless family (2 people) – 42 sq. m;

- A family of 3 people – 18 sq. m per resident.

There is another important point: until full payment is made for the mortgaged housing, the borrower uses the living space under a social tenancy agreement. He also pays rent (at minimum state tariffs). He will be able to receive a certificate of ownership only after the final repayment of the debt.

Partner banks

The number of financial institutions participating in the program is limited, since many have representative offices only in large cities. Among the program participants there are not only banks of the republic, but also partners providing services throughout Russia: Sberbank, Kara-Altyn, Rosbank, Ak Bars.

According to the terms of the presidential mortgage, borrowers enter into an agreement with the representative office of the housing stock under the president. And in the bank that is a partner, you need to open an account for monthly payments, taking into account the cost of 1 sq. m of social housing (from 11%). If a bank client violates the payment schedule for mortgage obligations, the State Housing Fund has the right to terminate the agreement on its own initiative.

In parallel with the presidential mortgage, the republic’s banks offer their clients to solve housing problems with the help of the “Young Family” program. The first requirement for candidates: one of the spouses must be under 35 years of age. The project makes it possible to purchase housing at a base rate (from 7.4%) on both the primary and secondary markets.

In accordance with the bill, the social mortgage under the president in the Republic of Tatarstan will operate until 2019. We can only hope that after its completion, regional authorities will develop even more effective measures to provide socially vulnerable citizens in need with housing.

The State Housing Fund under the President of the Republic of Tatarstan explains:

How to register?

Those in need of improved housing conditions are recognized as:

Citizens of the Republic of Tajikistan registered at their permanent place of residence;

- occupying less than 18 sq.m. total area per family member (for state employees), for employees of organizations (not state employees) the norm is 18 sq.m. not installed, i.e. there may be more, but it is necessary that your the organization participated in the financing of social mortgages. A list of organizations participating in the financing of social mortgages is available from representatives of the Consumer Cooperative “Building the Future” and on the website www.kooperativrt.ru/

- living in unsuitable housing, recognized as such in accordance with current legislation (dilapidated, unsafe, etc., etc.).

Applications for registration are accepted:

- at the place of residence - in local governments(usually in housing commissions under city and district administrations). List of addresses and performers of representatives of PC “Building the Future” (for public sector employees);

- at the place of work - by officials appointed by order of the Head of the legal entity (if your organization is on the list of social mortgage financiers - you need to contact to the administration of the organization with an application for registration), if there is no housing commission at the enterprise, you need to contact the city or district administration.

To make sure whether you are on the list of those in need of improved housing conditions or not, you can:

- at the place of application, in the lists approved by the State Housing Fund under the President of the Republic of Tatarstan;

- on the website www.kooperativrt.ru (you need to know the registration file number of your family);

- from representatives of PC “Building the Future”.

As a general rule, confirmation of registration can be obtained within 3-4 weeks from the date of filing the application at the places where primary documents are submitted (ask for your family’s registration file number). If there is more than one family at the place of residence, they are subject to separate registration. Citizens are registered and receive the right to participate in social mortgages only after the family is accepted into the Consolidated List of the State Welfare Fund under the President of the Republic of Tajikistan, i.e. in fact, after the approval of your application by the State Housing Fund under the President of the Republic of Tajikistan. If for some reason you are denied registration, and you consider these reasons to be unfounded and illegal, then you can contact the State Housing Fund under the President of the Republic of Tatarstan at the address: RT, 420043, Kazan, Gorky St., building 8/9 , tel./f.: 70-58-66, to local authorities and the prosecutor's office with a statement about violation of the procedure for implementing the Law of the Republic of Tajikistan “On state support for construction in the Republic of Tatarstan No. 69-3RT dated December 27, 2004. and Resolution of the Cabinet of Ministers of the Republic of Tajikistan No. 190 dated April 15, 2005. “On approval of the Rules and procedure for registering those in need of improved housing conditions in the social mortgage system in the Republic of Tatarstan.”

A citizen who is registered as needing to improve their housing conditions must enter into a Social Mortgage Agreement with the State Housing Fund under the President of the Republic of Tajikistan. The attorney on behalf of the State Housing Fund is the PC “Building the Future”, acting on the basis of the agency agreement No. 258 dated August 18, 2005. and power of attorney No. 49 dated August 25, 2005, issued by the executive director of the State Housing Fund under the President of the Republic of Tatarstan T.M. Abdullin. To the Chairman of PC “Building the Future” Tsibizov A.A.

The State Housing Fund under the President of the Republic of Tajikistan enters into a social mortgage agreement with a citizen member of the PC “Building the Future”. To become a member of the PC “Building the Future” you need to write an application for membership in the PC “Building the Future” (the application form is available from representatives of the PC “Building the Future” locally) and pay the entrance membership fee. Family members under 18 years of age should not become members of the Cooperative and, accordingly, should not pay an entrance membership fee.

The social mortgage agreement is signed by all family members registered as in need of improved housing conditions. After concluding (signing) a social mortgage agreement, citizens can pay funds under a social mortgage agreement, thereby accumulating them for the purchase of a future apartment. All savings of citizens when moving into a new apartment are counted towards the redemption of square meters under a social mortgage agreement. Before moving into a new apartment, you can pay any amount at any time at your discretion.

How do you choose the apartment you will receive under a social mortgage agreement?

To streamline the selection of apartments, the following procedure is used:

All funds received under a social mortgage agreement before moving in, in addition to the fact that they are reflected in rubles, are also reflected in the form of points. Points are calculated by multiplying the amount of receipts in thousands of rubles by the number of days until the points are calculated. For example: You transferred under a social mortgage agreement 5 000,00 rubles and 10 September they arrived at the Attorney's bank account, and you need to find out how many points you have on 17 September then

5 * 8 days, 40 points,

8 days – number of days from the date of receipt of funds to the date of calculation of points,

5 – received funds, in thousands of rubles,

If you transferred another 7,000 rubles, which arrived at the Attorney’s account on October 3, then as of November 25 you will have:

5 * 77 days + 7 * 54 days = 385+378 = 763 points,

77 days = 21 days (in September) + 31 days (in October) + 25 days (in November),

54 days = 29 days (in October) + 25 days (in November).

Thus, you can independently calculate the number of your points (approximately, since you cannot know exactly the day the funds are received in the Agent’s account). You can find out the exact number of points on the website of PC “Building the Future” (instructions for using the site from representatives of PC “Building the Future”) or in the monthly newsletter from representatives of PC “Building the Future”.

- employees of organizations (enterprises) involved in financing social mortgages;

- public sector workers,

- citizens in need of urgent support (out-of-turn).

You must know which accounting group you belong to!

There are accounting subgroups, for example, employees of a particular enterprise belong to the accounting group “enterprise employees” or large families belong to the accounting group “out-of-turn”.

- In addition to the fact that you receive information about exactly what place you occupy in the list in your city, district and in your accounting group, the State Housing Fund and PC “Building the Future” will provide you with data on objects under construction and finished objects (houses, apartments). The specified information is posted on the website

www.kooperativrt.ru/

and from a representative of PC “Building the Future”, and presents the following data:

- about objects under construction and finished (houses, apartments),

- on the degree of their readiness and the timing of commissioning (occupancy).

- about apartment numbers, their floor by floor distribution, areas, floor layouts,

- estimated cost of one square meter (at the construction stage),

- the initial cost of one square meter after the start of the competition.

At any time from a representative of PC “Building the Future” and on the website www.kooperativrt.ru/ you can obtain information about the beginning and date (time) of the end of the competition for objects under construction and finished objects (houses, apartments).

From the moment the competition begins, if you have a desire to purchase an apartment in this particular building, and if you have paid at least 1,000 rubles under the social mortgage agreement. - for public sector workers and citizens in need of urgent support, or at least 10% of the cost of a future apartment (determined by multiplying the declared cost per square meter per total area) - for employees of enterprises, you can come to the representative office of PC “Building the Future” at the place where the social mortgage agreement was executed or to the head office in Kazan and fill out the “Protocol for choosing a future apartment.”

The “Protocol of participation, selection and transfer of a citizen’s future own apartment to a social mortgage agreement” is signed by the applicants, indicating the apartment number and the cost per square meter at which you are willing to purchase it. The cost per square meter that you declare cannot be lower than the announced Civil Housing Fund under the President of the Republic of Tajikistan. The declared cost per square meter increases your points (accumulated points increase by a step-by-step factor), 1 step – 100 rubles.

Odds table

Step |

|||||||||

|

Coefficient |

Step |

|||||||||

|

Coefficient |

Step |

|||||||||

|

Coefficient |

Step |

|||||||||

|

Coefficient |

Step |

|||||

|

Coefficient |

For example, you have accumulated 763 points (section 3), the initial cost of one square meter is 11,000.00 rubles. You declare the price at which you are ready to purchase a future apartment: 11,200.00 rubles, the step is 200 rubles, the coefficient is K = 1.06; 763*K=763*1.06=808.78 points. Moreover, each apartment you requested may have a different price, i.e. apartments on the 3rd floor, for example, at a price of 11,200 rubles. per square meter, and apartments on the 9th floor cost 11,000 rubles. per one square meter. In addition, in the “Protocol of participation, selection and transfer of a citizen’s future own apartment to the social mortgage agreement,” you can declare a shorter installment period than is provided to you in accordance with current legislation. In this case, the final cost of your future apartment will be less. Apartments in the “Protocol” are indicated as interest in them decreases (by priority), i.e. 100-apartment single-entrance 10-storey building. You want to purchase a one-room apartment, there are 2 of them on each floor. Theoretically, you can indicate all 20 apartments in the “Protocol”. For example, first of all you would like to purchase apartment No. 22 on the third floor, secondly, apartment No. 24 on the third floor, then apartment No. 76 on the 8th floor, etc.

“Competition”, the selection of apartments will occur automatically (by computer) on a certain day and time of the Civil Housing Fund, taking into account all received “Protocols of participation, selection and transfer of a citizen’s future own apartment to a social mortgage agreement”, accumulated points and priorities. Every citizen participating in the “Competition” has the opportunity to verify the correctness and fairness of the choice.

Attention! Please report all cases of pressure on you by indicating the apartment numbers, their declared value when filling out the “Protocol of participation, selection and transfer of a citizen’s future own apartment to the social mortgage agreement” indicating the person who exerted the pressure.

Information about who will receive which apartment as a result of the “Competition” can be found on the website www.kooperativrt.ru/ and from representatives of the Consumer Cooperative “Building the Future”.

After the results of the “Competition” are published (on the website and from representatives of PC “Building the Future” the day after the “Competition”), citizens must come to the place where the contract was drawn up and receive a “Protocol for choosing an apartment” indicating the apartment number and its cost , purchased square meters, installment period and payment schedule.

The social mortgage agreement and the “Protocol of participation, selection and transfer of a citizen’s future own apartment” to the social mortgage agreement, signed by the parties, are the basis for moving into and living in the selected apartment, in other words, with the agreement and protocol, you must go to the housing department or to the “key holder” , demand the keys to the apartment and conclude an agreement for the provision of housing and communal services. Payment for housing and communal services arises from the date of the competition, so it is in your interests to immediately receive the keys after the “Competition” and notify the housing maintenance organizations. This is due to the fact that at the time of the competition the apartments were put into operation, and the costs of its maintenance (heating, security) must be borne by the future owners.

The social mortgage agreement and the “Protocol for choosing an apartment” give you all the rights associated with accommodation, such as “registration”, registration in medical institutions, connecting a telephone, receiving subsidies, subsidies and other rights.

Rights and responsibilities after moving in and how to become the owner of your home?

After moving into a new apartment, you bear all the responsibilities and enjoy all the rights of citizens living as a “tenant,” the future owner.

Your rights:

- obtaining ownership of the apartment after full payment,

- receiving the full scope of housing and communal services that are provided to the residents of your home,

- carrying out routine repairs,

- registration at the place of residence of your family members,

- participation in the management of houses by proxy.

Your responsibilities:

- You cannot sell, exchange, gift, etc., etc. apartment until you receive it as your property,

- You cannot carry out redevelopment in the apartment without the permission of the relevant authorities and the State Housing Fund under the President of the Republic of Tajikistan,

- You should not “register” non-family members into the apartment,

- You cannot assign the rights of claim under the Social Mortgage agreement to a third party, without the permission of the State Housing Fund under the President of the Republic of Tajikistan,

- You must keep it in a condition suitable for habitation and in compliance with sanitary and technical standards during all the time you use the apartment before receiving ownership,

- You are required to regularly (monthly) make payments under the Social Mortgage Agreement in accordance with the payment schedule that you will receive upon moving in (the payment schedule indicates the monthly cost per square meter and when to make payments).

Attention! You can pay earlier and more than indicated in the payment schedule. In this case, the final cost of your apartment will be less, and you will receive ownership of the apartment earlier.

After you pay in full the cost of the apartment, PC “Building the Future”, by order of the State Housing Fund, issues you a Payment Reconciliation Certificate and a certificate of full payment of the cost of the apartment. With these documents, as well as the Social Mortgage Agreement, the “Protocol for Selecting an Apartment,” you can register ownership with the State Registration of Rights and receive a Certificate of Ownership.

All. Congratulations! Not only have you lived all this time in a comfortable apartment with all the amenities, worked for the benefit of the Republic, raised children, but you also became the full owner of your home.

I would like to note that when you did not live in the apartment as an owner, you did not pay property tax. You will receive an income tax benefit by presenting to the tax authorities the Certificate of receipt of ownership of the apartment, the Social Mortgage Agreement and all receipts for payment of its cost (please do not lose and keep the receipts). In addition, in the event of the birth of a child in your family, you will be credited under the Social Mortgage agreement with the cost of 18 (Eighteen) square meters of housing, - two children– 36 (Thirty-six) square meters will be counted. To do this, you need to submit an application to the State Welfare Fund under the President of the Republic of Tajikistan for the birth of a child. In addition to all of the above, you can get advice from our representatives at any time.

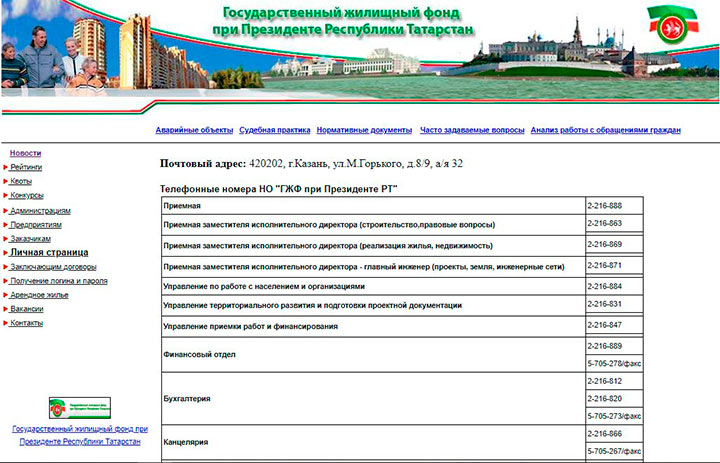

The State Housing Fund under the President of the Republic of Tatarstan is an online resource that contains information about residential properties in the republic that are under the jurisdiction of the state (private development is excluded).

The official website kooperativrt.ru (RT cooperative) through the personal section allows you to perform a number of important functions.

Navigation

When you enter the address kooperativrt.ru in the address bar, the main page of the portal of the State Life Fund under the President of the Republic of Tatarstan opens.

Under the site header there is a menu with the main categories:

- Emergency facilities. The section contains a list of emergency residential properties in the Republic of Tatarstan (Kazan, Nizhnekamsk, etc.) and current information for each (on the resettlement of apartments and approval of the status of emergency housing, etc.);

- Arbitrage practice. This category contains a list of all court decisions on claims in which the housing stock took part; all materials on the cases are available for downloading;

- Regulations. When you click on the link, a complete list of regulatory documents, forms to fill out and examples for drawing up appeals, applications, etc. opens. All materials are available for download and are divided into subcategories to simplify the search (for residents of rural areas, cities, etc.) . Also presented are the documents and resolutions on which the State Housing Fund operates;

- FAQ. When you go to this section, a list of 28 questions about the work of the state housing stock opens, which most often arise among resource users and citizens in general;

- Analysis of work from citizens' requests - the link provides reports on what work was performed in response to written requests and statements from citizens in 2015-2016.

Below, in the central part of the page, there are news and information about the current work of the fund.

To the left of it is a block of links for the second menu. By going through them you can get the following information:

- Ratings – you must enter the account number to see the rating of its processing;

- Quotas - a list of organizations is provided and what quotas for housing they have (in sq. m);

- Competitions – using the link you can select the type of competition from the list and see the available ones;

- Representative offices – contact details of all organizations and representative offices that are part of this government structure;

- Personal page of the Civil Society Foundation under the President of the Republic of Tajikistan – form for entering the personal section;

- Administration – login form for administrative employees;

- For enterprises – a form for entering the portal for representatives of contractors;

- For customers – login form for customers of work;

- For those concluding agreements - a page with a login form for those who want to enter into an agreement with the State Housing Fund under the President of the Republic of Tajikistan on a particular issue, for example, mortgage, social mortgage (social mortgage), etc.;

- Receiving a login and password - a form for entering personal information to obtain credentials to enter the portal (registration);

- Rental housing – a section with regulatory and standard documents with which you can carry out transactions with rental housing, there is also a link to a list of rental houses;

- Vacancies – work in the State Housing Fund under the President of the Republic of Tatarstan.

Navigating the portal is not very easy due to its design. There are quite a large number of small links-buttons that are difficult to find. Also, their name often does not reflect the content. However, the functionality of the resource is wide and it presents most of the information that users sometimes need when contacting the State Housing Fund under the President of the Republic of Tatarstan.

Personal page

A section of the website kooperativrt.ru - GJF RT “Personal Page” was created for applicants who have applied or want to contact the organization to resolve any issue.

To get into it, you must first register on the portal, providing the required minimum information on your documents.

To register in your personal account, follow the algorithm:

- In the left block on the main page, select the “Obtaining login and password” section and go to it;

- The registration form will open;

- In the first line you need to enter your last name, first name and patronymic;

- In the second line is the TIN number:

- In the field below, enter your date of birth in the format DD.MM.YYYY;

- In the line below, type the series of your identification document

- In the last line you need to enter your passport number (or other identification document);

- Click the "Continue" button located below the form.

The user password will be generated automatically. In order to use it, that is, enter the resource, find the “Personal Page” section in the left block on the main page and go to it. Here you need to enter the account number in numbers in the format ****-******-******. Below you need to enter your password in capital Latin letters.

If necessary, place a marker in the checkbox next to the inscription “Specialized entrance for enterprises.” After that, click the “Confirm” button.

Thus, the user has the opportunity to track the process of processing his requests, as well as monitor the progress of consideration of the applications submitted by him for social mortgages.