The net present value method of an investment project. Net Present Value - Investment Calculation

NPV (abbreviation in English - Net Present Value), in Russian this indicator has several variations of the name, among them:

- net present value (abbreviated NPV) is the most common name and abbreviation, even the formula in Excel is called exactly that;

- net present value (abbreviated NPV) - the name is due to the fact that cash flows are discounted and only then summed up;

- net present value (abbreviated NPV) - the name is due to the fact that all income and losses from activities due to discounting are, as it were, reduced to the current value of money (after all, from the point of view of economics, if we earn 1,000 rubles and then actually receive less than if we received the same amount, but now).

NPV is an indicator of the profit that participants in an investment project will receive. Mathematically, this indicator is found by discounting the values of net cash flow (regardless of whether it is negative or positive).

Net present value can be found for any period of time of the project since its beginning (for 5 years, for 7 years, for 10 years, and so on) depending on the need for calculation.

What is it needed for

NPV is one of the indicators of project efficiency, along with IRR, simple and discounted payback period. It is needed to:

- understand what kind of income the project will bring, whether it will pay off in principle or is it unprofitable, when it will be able to pay off and how much money it will bring at a particular point in time;

- to compare investment projects (if there are a number of projects, but there is not enough money for everyone, then projects with the greatest opportunity to earn money, i.e. the highest NPV, are taken).

Calculation formula

To calculate the indicator, the following formula is used:

- CF - the amount of net cash flow over a period of time (month, quarter, year, etc.);

- t is the time period for which the net cash flow is taken;

- N is the number of periods for which the investment project is calculated;

- i is the discount rate taken into account in this project.

Calculation example

To consider an example of calculating the NPV indicator, let's take a simplified project for the construction of a small office building. According to the investment project, the following cash flows are planned (thousand rubles):

| Article | 1 year | 2 year | 3 year | 4 year | 5 year |

| Investments in the project | 100 000 | ||||

| Operating income | 35 000 | 37 000 | 38 000 | 40 000 | |

| Operating expenses | 4 000 | 4 500 | 5 000 | 5 500 | |

| Net cash flow | - 100 000 | 31 000 | 32 500 | 33 000 | 34 500 |

The project discount rate is 10%.

Substituting into the formula the values of net cash flow for each period (where negative cash flow is obtained, we put it with a minus sign) and adjusting them taking into account the discount rate, we get the following result:

NPV = - 100,000 / 1.1 + 31,000 / 1.1 2 + 32,500 / 1.1 3 + 33,000 / 1.1 4 + 34,500 / 1.1 5 = 3,089.70

To illustrate how NPV is calculated in Excel, let's look at the previous example by entering it into tables. The calculation can be done in two ways

- Excel has an NPV formula that calculates the net present value, to do this you need to specify the discount rate (without the percent sign) and highlight the range of the net cash flow. The formula looks like this: = NPV (percent; range of net cash flow).

- You can create an additional table yourself where you can discount the cash flow and sum it up.

Below in the figure we have shown both calculations (the first shows the formulas, the second the calculation results):

As you can see, both calculation methods lead to the same result, which means that depending on what you are more comfortable using, you can use any of the presented calculation options.

Present value

Discounted value expresses the value of future payment streams in terms of the value of current payment streams. The definition of present value is widely used in economics and finance as a tool for comparing streams of payments received at different times. The discounted value model allows you to determine how much financial investment an investor intends to make to receive a certain cash flow over a given period. The discounted value of a future stream of payments is a function of:

- the period through which the future flow of payments is expected,

- risk associated with a given future flow of payments,

- other factors.

The present value indicator is used as the basis for calculating the amortization of financial borrowings.

Explanation

The value of money changes over time. 100 rubles received after five years have a different (in most cases, less) value than 100 rubles that are available. Available funds can be invested in a bank deposit or any other investment instrument, which will provide interest income. That is, 100 rubles. today, they give 100 rubles. plus interest income after five years. In addition, for the available 100 rubles. You can purchase a product that in five years will have a higher price due to inflation. Therefore 100 rub. in five years they will not be allowed to purchase the same product. In this example, the discounted value indicator allows you to calculate how much 100 rubles are worth today. which will be received in five years.

Calculation

where is the flow of payments received in years, is the discount rate determined based on the above factors, is the discounted value of the future flow of payments.

In order to receive an amount equal in years, given that inflation, risk, etc. determine the discount rate equal to , the investor agrees to invest an amount equal to today.

Discounted value of a series of payment streams and annuity payments

The discounted value of a series of payment streams is equal to the sum of the discounted values of each of the component payment streams. Thus, the discounted value of a series of payment streams received each year over a period of years is calculated using the following formula:

Discounted value of perpetuities (perpetual annuities)

Based on the formula for calculating the discounted value of annuity payments, you can obtain a formula for the discounted value of perpetuities (perpetual annuities). As the value approaches infinity, the , part of the formula approaches zero. Under such conditions, the formula for perpetuity will have the following form:

.The discounted value of perpetual securities with increasing payments, such as stocks with increasing dividend yields, is calculated using the Gordon model

References

Wikimedia Foundation. 2010.

See what “present value” is in other dictionaries:

Present value

Present value- (present value) amount (costs, income, etc.) at a base point in time, equivalent to amounts assessed at other points in time (produced or expected costs, income, etc.). Reduction in time is carried out using... ... Economic-mathematical dictionary

present value- An amount (costs, income, etc.) at a base point in time that is equivalent to amounts estimated at other points in time (produced or expected costs, income, etc.). Reduction in time is carried out using discounting.… … Technical Translator's Guide

present value- The present value of future payments or cash flows, discounted at some compound interest rate(s). For example, the present value of $1,000 to be received in 10 years is... ... Financial and investment explanatory dictionary

Present value- (PRESENT VALUE) the value of future quantitative quantities reduced to the current moment... Modern money and banking: glossary

Present value- the amount calculated by discounting the future cash flows of the analyzed project at a discount rate equal to the required return. Its value differs from net present value in that the calculations do not include... Glossary of terms on expertise and real estate management

Present value of accounts receivable- (present value of accounts payable) The value of accounts receivable without taking into account the created reserve for doubtful debts, discounted by maturity. Used in preparing separation balance sheets (during separation of companies) ... Economic-mathematical dictionary

The concept of "net present value" usually pops up in consciousness when it is necessary to evaluate the feasibility of certain things.

There are mathematically based theses that involve the concept (pure) and which are worth sticking to whenever you have the idea of \u200b\u200bforking out for this or that.

To understand what is net present value, we will analyze in detail a specific (hypothetical) example.

To do this, we will have to recall some basic information related to the topic of present value, which we already discussed on the pages.

So, an example.

Net Present Value: Introduction

Suppose you inherited a plot of land worth 23 thousand dollars. Plus, there are about 280 thousand “green” lying around in your accounts.

Total - 303 thousand dollars, which would be nice to put somewhere.

An investment option looms on the horizon, the price of which, as experts suggest, should skyrocket in a year.

Let’s assume that the cost of constructing a certain building is $280 thousand, acceptable to us, and the expected selling price of an already completed building is about $330 thousand.

If it turns out that the present value of $330,000 is greater than the amount of money you spent ($280,000 + $23,000 = $303,000), then you should agree to the proposal to build the facility.

In this case, the difference between both quantities will be the very net present value that we are so striving to find.

To begin with, however, we will have to deal with intermediate calculations aimed at establishing the present value.

How to calculate present value

Obviously, the $330 thousand that we will receive in the future is worth less than the $330 thousand that we have today. And it's not just about .

The main reason for this state of affairs is that we can invest the available 330 thousand dollars in risk-free instruments like banking or government ones.

In this case, to determine the “true” value of our 330 thousand dollars, it is necessary to add to them the income on the corresponding deposit ().

You can look at this situation like this: today's 330 thousand dollars will cost the same amount in the future plus interest income on risk-free financial instruments.

We are very close to understanding one of the most important theories: TODAY are worth EXPENSIVE than the money we get TOMORROW.

This is why the present value of any future income will be LESS its nominal value, and to find it, you need to multiply the expected income by some, obviously LESS units.

This coefficient is usually called discount factor.

To do this, let us introduce into the problem conditions the interest rate on risk-free financial instruments, equal to, for example, 8 percent per annum.

In this case, the discount rate will be equal to the value of the fraction 1 / (1 + 0.08):

DF = 1 / (1 + 0.08) = 1 / 1.08 = 0.926.

We calculate the present value of 330 thousand dollars as follows:

PV =DF*C 1 = 0.926 * $330,000 = $305,580.

Opportunity Cost

Now let's remember what we were talking about at the beginning of our conversation.

If the size of our investment turns out to be less than the present value of the income we expect, then the corresponding offer is PROFITABLE, and it should be accepted.

As you can see, $303,000.< 305 580 долл., а значит, строительство офиса на нашем участке (скорее всего) окажется вложением…

What we have just done sounds like this in the language of finance: discounting future income at a rate that other (alternative) financial instruments can “offer.”

The indicated rate of return can be called differently: profitability ratio, discount rate, marginal return, opportunity cost, opportunity cost.

All marked options are equally used, and their choice depends on the context.

It is worth paying attention to the term "opportunity cost", since it emphasizes the very essence of the current value of money, income, etc.

You'll just carry LOSSES, equal to opportunity costs.

About all this (and more) another time.

Additional information on the topic is presented in the articles:

1. ,

2. .

Happy investment!

The Net present value, or NPV, indicator of an investment project allows you to determine what income an investor will receive in monetary terms as a result of his investments. In other words, the NPV of a project shows the amount of financial income as a result of investments in an investment project, taking into account associated costs, that is, net present value. What NPV is in practice and how to calculate net present value will become clear from the NPV formula below and its explanations.

Concept and content of NPV value

Before moving on to the topic of NPV, talking about what it is and how to calculate it, you need to understand the meaning of the phrase that makes up the abbreviation. For the phrase “Net present value” in the domestic economic and mathematical literature you can find several traditional translation options:

- In the first version, typical for mathematical textbooks, NPV is defined as net present value (NPV).

- The second option - net present value (NPV) - along with the first, is considered the most used.

- The third option – net present value – combines elements of the first and second transfers.

- The fourth version of the translation of the term NPV, where PV is “current value,” is the least common and is not widely used.

Regardless of the translation, the NPV value remains unchanged, and this term means that

NPV is the net present value of value. That is, cash flow discounting is precisely considered as the process of establishing its (flow) value by bringing the cost of total payments to a certain (current) point in time. Therefore, determining the value of net present value (NPV) becomes, along with IRR, another way to assess the effectiveness of investment projects in advance.

At the level of the general algorithm, in order to determine the prospects of a business project according to this indicator, the following steps need to be taken:

- assess cash flows – initial investments and expected receipts,

- set the cost of capital - calculate the rate,

- discount incoming and outgoing cash flows at an established rate,

- sum up all discounted flows, which will give the NPV value.

If the NPV calculation shows values greater than zero, then the investment is profitable. Moreover, the larger the NPV number, the greater, other things being equal, the expected profit value. Given that the lenders' return is usually fixed, anything the project brings in above it belongs to the shareholders - with a positive NPV, the shareholders will earn. The opposite situation with NPV less than zero promises losses for investors.

It is possible that the net present value will be zero. This means that the cash flow is sufficient to replace the invested capital without profit. If a project with an NPV of zero is approved, the size of the company will increase, but the share price will remain unchanged. But investing in such projects may be related to the social or environmental objectives of the initiators of the process, which makes investing in such projects possible.

NPV formula

Net present value is calculated using a calculation formula, which in a simplified form looks like PV - ICo, where PV represents the current cash flow indicators, and ICo is the size of the initial investment. In a more complex form, which shows the discounting mechanism, the formula looks like this:

NPV= - ICo + ∑ n t=1 CF t / (1 + R) t

Here:

Here:

- NPV– net present value.

- CF – Cash Flow is the cash flow (investment payments), and t next to the indicator is the time during which the cash flow occurs (for example, an annual interval).

- R – Rate– discount (rate: coefficient that discounts flows).

- n– the number of stages of project implementation, which determines the duration of its life cycle (for example, the number of years).

- ICo – Invested Capital– initial invested capital.

Thus, NPV is calculated as the difference between the total cash flows updated at a certain point in time by risk factors and the initial investment, that is, investor profit is considered as the added value of the project.

Since it is important for an investor not only to make a profitable investment, but also to competently manage capital over a long period of time, this formula can be further expanded to include not one-time, but additional periodic investments and an inflation rate (i)

NPV= ∑ n t=1 CF t / (1 + R) t - ∑ m j =1 IC j / (1 + i) j

Example of NPV calculation

An example calculation for three conditional projects allows you to both calculate NPV and determine which of the projects will be more attractive for investment.

According to the example conditions:

- initial investments - ICo - in each of the three projects are equal to 400 USD,

- the rate of return - the discount rate - is 13%,

- the profits that projects can bring (by year) are listed in the table for a 5-year period.

Let's calculate net present value to choose the most profitable project for investment. The discount factor 1/(1 + R) t for an interval of one year will be t = 1: 1/(1+0.13)1 = 0.885. If we recalculate the NPV of each scenario by year with the substitution of the defining values into the formula, it turns out that for the first project NPV = 0.39, for the second – 10.41, for the third – 7.18.

According to this formula, the second project has the highest net present value, therefore, if we are based only on the NPV parameter, then it will be the most attractive for investment in terms of profit.

However, the projects being compared may have different durations (life cycles). Therefore, there are often situations when, for example, when comparing three-year and five-year projects, the NPV will be higher for the five-year one, and the average value over the years will be higher for the three-year one. To avoid any contradictions, the average annual rate of return (IRR) must also be calculated in such situations.

In addition, the volume of initial investment and the expected profit are not always known, which creates difficulties in applying the calculations.

Difficulties in applying calculations

As a rule, in reality, the variables read (substituted into the formula) are rarely accurate. The main difficulty is determining two parameters: the assessment of all cash flows associated with the project and the discount rate.

Cash flows are:

- initial investment – initial outflow of funds,

- annual inflows and outflows of funds expected in subsequent periods.

Taken together, the amount of flow indicates the amount of cash that an enterprise or company has at its disposal at the current moment in time. It is also an indicator of the financial stability of the company. To calculate its values, you need to subtract Cash Outflows (CO), the outflow, from the value of Cash Inflows (CI) - cash inflow:

When forecasting potential revenues, it is necessary to determine the nature and degree of dependence between the influence of factors that form cash flows and the cash flow itself. The procedural complexity of a large complex project also lies in the amount of information that needs to be taken into account. So, in a project related to the release of a new product, it will be necessary to predict the volume of expected sales in units, while simultaneously determining the price of each unit sold. And in the long term, in order to take this into account, it may be necessary to base forecasts on the general state of the economy, the mobility of demand depending on the development potential of competitors, the effectiveness of advertising campaigns and a host of other factors.

When forecasting potential revenues, it is necessary to determine the nature and degree of dependence between the influence of factors that form cash flows and the cash flow itself. The procedural complexity of a large complex project also lies in the amount of information that needs to be taken into account. So, in a project related to the release of a new product, it will be necessary to predict the volume of expected sales in units, while simultaneously determining the price of each unit sold. And in the long term, in order to take this into account, it may be necessary to base forecasts on the general state of the economy, the mobility of demand depending on the development potential of competitors, the effectiveness of advertising campaigns and a host of other factors.

In terms of operational processes, it is necessary to predict expenses (payments), which, in turn, will require an assessment of prices for raw materials, rental rates, utilities, salaries, exchange rate changes in the foreign exchange market and other factors. Moreover, if a multi-year project is planned, then estimates should be made for the corresponding number of years in advance.

If we are talking about a venture project that does not yet have statistical data on production, sales and costs, then forecasting cash income is carried out on the basis of an expert approach. It is expected that experts should correlate a growing project with its industry counterparts and, together with the development potential, assess the possibilities of cash flows.

R – discount rate

The discount rate is a kind of alternative return that an investor could potentially earn. By determining the discount rate, the value of the company is assessed, which is one of the most common purposes for establishing this parameter.

The assessment is made based on a number of methods, each of which has its own advantages and initial data used in the calculation:

- CAPM model. The technique allows you to take into account the impact of market risks on the discount rate. The assessment is made on the basis of trading on the MICEX exchange, which determines the quotations of ordinary shares. In its advantages and choice of initial data, the method is similar to the Fama and French model.

- WACC model. The advantage of the model is the ability to take into account the degree of efficiency of both equity and borrowed capital. In addition to the quotations of ordinary shares, interest rates on borrowed capital are taken into account.

- Ross model. Makes it possible to take into account macro- and microfactors of the market, industry characteristics that determine the discount rate. Rosstat statistics on macroindicators are used as initial data.

- Methods based on return on equity, which are based on balance sheet data.

- Gordon model. Using it, an investor can calculate dividend yield, also based on quotes of ordinary shares, and also other models.

The change in the discount rate and the amount of net present value are related to each other by a nonlinear relationship, which can simply be reflected on a graph. Hence the rule for the investor follows: when choosing a project - an investment object - you need to compare not only the NPV values, but also the nature of their change depending on the rate values. The variability of scenarios allows an investor to choose a less risky project for investment.

Since 2012, at the instigation of UNIDO, the calculation of NPV has been included as an element in the calculation of the index of the rate of specific increase in value, which is considered the optimal approach when choosing the best investment decision. The assessment method was proposed by a group of economists headed by A.B. Kogan, in 2009. It allows you to effectively compare alternatives in situations where it is not possible to compare using a single criterion, and therefore the comparison is based on different parameters. Such situations arise when the analysis of investment attractiveness using traditional NPV and IRR methods does not lead to clear results or when the results of the methods contradict each other.

Let's calculate the Net Present Value and Internal Rate of Return using the formulasMSEXCEL.

Let's start with a definition, or rather with definitions.

Net present value (NPV) is called the sum of discounted values of the payment stream reduced to today(taken from Wikipedia).

Or like this: Net present value is the current value of future cash flows of an investment project, calculated taking into account discounting, minus investments (websitecfin.ru)

Or like this: Currentthe cost of a security or investment project, determined by taking into account all current and future income and expenses at the appropriate interest rate. (Economy .

Dictionary . -

M .

: "

INFRA -

M ",

Publishing house "

The whole world ".

J .

Black .)

Note1. Net present value is also often called Net Present Value, Net Present Value (NPV). But, because the corresponding MS EXCEL function is called NPV(), then we will adhere to this terminology. In addition, the term Net Present Value (NPV) clearly indicates a connection with.

For our purposes (calculation in MS EXCEL), we define NPV as follows:

Net present value is the sum of cash flows presented in the form of payments of arbitrary amounts made at regular intervals.

Advice: when first becoming acquainted with the concept of Net Present Value, it makes sense to get acquainted with the materials of the article.

This is a more formalized definition without reference to projects, investments and securities, because this method can be used to evaluate cash flows of any nature (although, in fact, the NPV method is often used to evaluate the effectiveness of projects, including for comparing projects with different cash flows).

Also, the definition does not contain the concept of discounting, because The discounting procedure is, in essence, the calculation of present value using the method.

As mentioned, in MS EXCEL, the NPV() function is used to calculate the Net Present Value (NPV()). It is based on the formula:

CFn is the cash flow (money amount) in period n. The total number of periods is N. To show whether a cash flow is an income or an expense (investment), it is written with a certain sign (+ for income, minus for expenses). The value of cash flow in certain periods can be =0, which is equivalent to the absence of cash flow in a certain period (see note 2 below). i is the discount rate for the period (if the annual interest rate is given (let it be 10%), and the period is equal to a month, then i = 10%/12).

Note2. Because cash flow may not be present in every period, then the definition of NPV can be clarified: Net present value is the present value of cash flows presented in the form of payments of an arbitrary value, made at intervals that are multiples of a certain period (month, quarter or year). For example, initial investments were made in the 1st and 2nd quarters (indicated with a minus sign), there were no cash flows in the 3rd, 4th and 7th quarters, and in the 5th, 6th and 9th quarters revenue from the project has been received (indicated with a plus sign). For this case, NPV is calculated in exactly the same way as for regular payments (amounts in the 3rd, 4th and 7th quarters must be indicated =0).

If the sum of the given cash flows representing income (those with a + sign) is greater than the sum of the given cash flows representing investments (expenses, with a minus sign), then NPV > 0 (the project/investment pays off). Otherwise NPV<0 и проект убыточен.

Selecting the discount period for the NPV() function

When choosing a discount period, you need to ask yourself the question: “If we are forecasting 5 years in advance, can we predict cash flows with an accuracy of up to a month / up to a quarter / up to a year?”

In practice, as a rule, the first 1-2 years of receipts and payments can be predicted more accurately, say monthly, and in subsequent years the timing of cash flows can be determined, say, once a quarter.

Note3. Naturally, all projects are individual and there can be no single rule for determining the period. The project manager must determine the most likely dates for the receipt of amounts based on current realities.

Having decided on the timing of cash flows, for the NPV() function you need to find the shortest period between cash flows. For example, if in the 1st year receipts are planned monthly, and in the 2nd year quarterly, then the period should be chosen equal to 1 month. In the second year, the amounts of cash flows in the first and second months of the quarters will be equal to 0 (see. example file, NPV sheet).

In the table, NPV is calculated in two ways: through the NPV() function and by formulas (calculating the present value of each amount). The table shows that already the first amount (investment) is discounted (-1,000,000 turned into -991,735.54). Let's assume that the first amount (-1,000,000) was transferred on January 31, 2010, which means its present value (-991,735.54=-1,000,000/(1+10%/12)) is calculated as of December 31, 2009. (without much loss of accuracy we can assume that as of 01/01/2010)

This means that all amounts are given not as of the date of transfer of the first amount, but at an earlier date - at the beginning of the first month (period). Thus, the formula assumes that the first and all subsequent amounts are paid at the end of the period.

If it is required that all amounts be given as of the date of the first investment, then it does not need to be included in the arguments of the NPV() function, but simply added to the resulting result (see example file).

A comparison of 2 discounting options is given in the example file, NPV sheet:

About the accuracy of calculating the discount rate

There are dozens of approaches for determining the discount rate. Many indicators are used for calculations: the weighted average cost of capital of the company; refinancing rate; average bank deposit rate; annual inflation rate; income tax rate; country risk-free rate; premium for project risks and many others, as well as their combinations. It is not surprising that in some cases the calculations can be quite labor-intensive. The choice of the right approach depends on the specific task; we will not consider them. Let us note only one thing: the accuracy of calculating the discount rate must correspond to the accuracy of determining the dates and amounts of cash flows. Let's show the existing dependency (see. example file, sheet Accuracy).

Let there be a project: implementation period is 10 years, discount rate is 12%, cash flow period is 1 year.

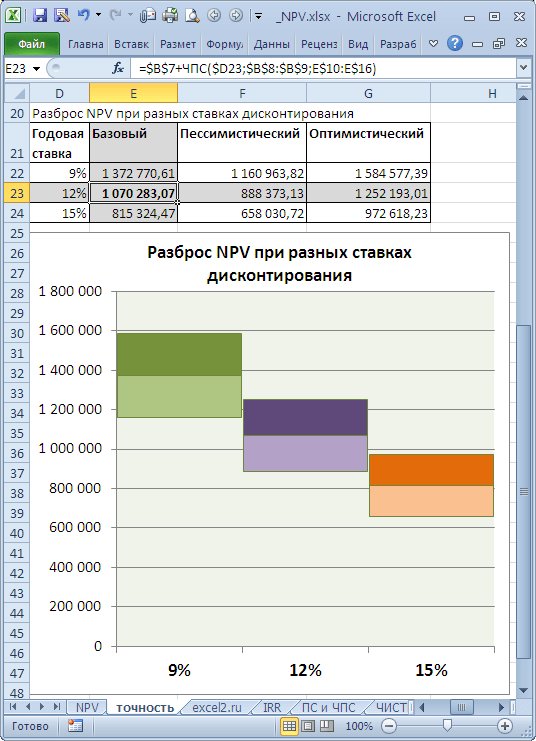

NPV amounted to 1,070,283.07 (Discounted to the date of the first payment).

Because If the project period is long, then everyone understands that the amounts in years 4-10 are not determined precisely, but with some acceptable accuracy, say +/- 100,000.0. Thus, we have 3 scenarios: Basic (the average (most “probable”) value is indicated), Pessimistic (minus 100,000.0 from the base) and Optimistic (plus 100,000.0 to the base). You must understand that if the base amount is 700,000.0, then the amounts of 800,000.0 and 600,000.0 are no less accurate.

Let's see how NPV reacts when the discount rate changes by +/- 2% (from 10% to 14%):

Consider a 2% rate increase. It is clear that as the discount rate increases, NPV decreases. If we compare the ranges of NPV spread at 12% and 14%, we see that they intersect at 71%.

Is it a lot or a little? Cash flow in years 4-6 is predicted with an accuracy of 14% (100,000/700,000), which is quite accurate. A change in the discount rate by 2% led to a decrease in NPV by 16% (when compared with the base case). Taking into account the fact that the NPV ranges overlap significantly due to the accuracy of determining the amounts of cash income, an increase of 2% in the rate did not have a significant impact on the NPV of the project (taking into account the accuracy of determining the amounts of cash flows). Of course, this cannot be a recommendation for all projects. These calculations are provided as an example.

Thus, using the above approach, the project manager must estimate the costs of additional calculations of a more accurate discount rate, and decide how much they will improve the NPV estimate.

We have a completely different situation for the same project, if the discount rate is known to us with less accuracy, say +/- 3%, and future flows are known with greater accuracy +/- 50,000.0

An increase in the discount rate by 3% led to a decrease in NPV by 24% (when compared with the base case). If we compare the ranges of NPV spread at 12% and 15%, we see that they intersect only by 23%.

Thus, the project manager, having analyzed the sensitivity of NPV to the discount rate, must understand whether the NPV calculation will be significantly refined after calculating the discount rate using a more accurate method.

After determining the amounts and timing of cash flows, the project manager can estimate what maximum discount rate the project can withstand (NPV criterion = 0). The next section talks about the Internal Rate of Return - IRR.

Internal rate of returnIRR(VSD)

Internal rate of return internal rate of return, IRR (IRR)) is the discount rate at which the Net Present Value (NPV) is equal to 0. The term Internal Rate of Return (IRR) is also used (see. example file, IRR sheet).

The advantage of IRR is that in addition to determining the level of return on investment, it is possible to compare projects of different scales and different durations.

To calculate IRR, the IRR() function is used (English version - IRR()). This function is closely related to the NPV() function. For the same cash flows (B5:B14), the rate of return calculated by the IRR() function always results in a zero NPV. The relationship of functions is reflected in the following formula:

=NPV(VSD(B5:B14),B5:B14)

Note4. IRR can be calculated without the IRR() function: it is enough to have the NPV() function. To do this, you need to use a tool (the “Set in cell” field should refer to the formula with NPV(), set the “Value” field to 0, the “Changing cell value” field should contain a link to the cell with the rate).

Calculation of NPV with constant cash flows using the PS() function

Internal rate of return NET INDOH()

Similar to NPV(), which has a related function, IRR(), NETNZ() has a function, NETINDOH(), which calculates the annual discount rate at which NETNZ() returns 0.

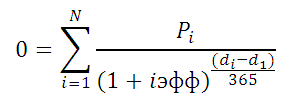

Calculations in the NET INDOW() function are made using the formula:

Where, Pi = i-th amount of cash flow; di = date of the i-th amount; d1 = date of 1st amount (starting date to which all amounts are discounted).

Note5. The function NETINDOH() is used for .