Revealing details about trading in the forex market. Real Forex or "Kitchen"? How to make real money in forex

Greetings readers "site"! Today we will talk about how to make money on Forex and what ways to make money on Forex exist.

After reading the article from beginning to end, you will learn:

- what is Forex and how to make money on it;

- is it possible to start earning on forex from scratch without experience and knowledge;

- how much to really earn on Forex for a beginner;

- and much more.

Also in this article you will find personal example Forex earnings, step by step instructions And trade rules for beginner traders, and Answers to frequently asked questions .

So let's go!

About how you can make money on Forex and whether it is realistic to start earning from scratch - read in our issue

About how you can make money on Forex and whether it is realistic to start earning from scratch - read in our issue Before proceeding to consider the process of earning income in Forex, you should find out, what it is, And how is it different from the stock market. Let's look at the definition first.

5. Personal example of earning on Forex - a real story + 4 golden rules for beginners ✍

Many are interested in examples of personal earnings in Forex, and are also looking for reviews about whether it is possible to make money on it at all. Below we present one such example. It was shared with us by a real trader who has been successfully trading in the Forex market for quite a long time.

A real example of personal earnings on Forex

📝 Read his story (in 1st person):

My name is Smirnov Vitaly, and I will tell you how I came to profit.

When I heard about Forex , I was wondering is it really possible to make money here?. By nature, I am very curious, so I zealously began to study.

When I found out what trading strategies exist, I opened a virtual account and started trading. In other words, I consistently went through all the steps that I described above in instructions for beginners .

Along with reading books and studying various forums, I opened real trading account in cents and contributed everything 10 $ . As a result, on the deposit I had 1 000 cents. These are the ones I started trading with. On the first day, I managed to achieve a profit of 100 cents. However due to overconfidence the very next day my deposit was halved↓.

At this stage, I did not use any strategy, but opened trades purely intuitively. Analyzing your behavior I decided to abandon the emotional component in trading.

I studied various strategies presented in the literature available to me and chose one of them. A month later I returned my deposit to the previous size. A month later, I realized that my trading plan is able to bring profit . At that moment I opened dollar deposit for the same amount and started trading on it. Gradually, I managed to significantly increase the balance of the account and achieve quite serious profits.

When I managed to achieve success, I analyzed my experience. Finally, I was able to isolate basic rules that help to achieve profit in Forex. Later I found confirmation of them in the specialized literature. Today I will share these rules with you.

⚠ The most important rules of Forex trading

The rules presented here must be followed. to every trader. They will help you achieve success much faster.

Rule 1. Control your emotions

In the process of trading, in no case should you be guided by emotions. It is important to open every trade exclusively under the influence of information about the further development of the situation obtained during the analysis, and not on the basis of intuition.

If a trader trades in the market based only on emotions, such activity can be compared to playing in a casino. It is very unlikely that such trading will bring at least a minimal income. Most likely, it will only lead to the drain of the deposit.

Beginners should remember: their main enemies, which inevitably entail failures, are fear And greed .

Rule 2 Learn to manage risk

A trader must learn to control risks. To do this, you should close the deal on time if a loss occurs on it.

An important trading rule is: you can not risk a large share of capital in one operation.

Rule 3 Trade exclusively according to the trading plan used

Special literature, as well as Internet forums, contain a huge amount of information about various trading strategies.

Any trading plan is formed depending on the emotional state of the beginner. He must take into account over what time period the transaction will be carried out, and, what currency pair the user works with.

Rule 4 Continuously learn and practice

Any independent activity requires quality development. Therefore, novice traders should definitely visit various courses And trainings , which help to better understand the specifics of trading on the currency exchange.

It would also be useful to study specialized literature . Another way to extract useful knowledge is YouTube video , which contain useful information about making a profit while trading.

Experts recommend beginners find an experienced mentor. A professional will be able to tell about how he achieved success. He will immediately indicate what mistakes he himself made during the trading process, as well as the well-known mistakes of other traders. In this case, the beginner will be warned, and therefore armed. As a result, success will be achieved much faster.

Every novice trader should learn the rules described above well. This will certainly help to achieve success and become a professional.

6. What determines earnings on Forex - 5 important factors affecting a trader's income 📊

You should not think that by learning how to trade correctly in accordance with the chosen strategy, you can achieve success. There are a huge number of factors that affect the income of a Forex trader. Below are Most Popular of them.

Factor 1. Competent choice of trading strategy

A trader should choose a strategy for trading that will be convenient for him. It is important that the trading plan does not cause psychological discomfort.

Short term trading plans very tempting, because it seems that they allow you to quickly earn a lot of money. Meanwhile, short trades require tremendous emotional stability. Not all beginners have the knowledge and experience sufficient to conduct such trading.

Besides, It will not be possible to choose the right strategy if you do not undergo training in the basics of Forex trading. Only high-quality fundamental knowledge will sooner or later allow a trader to achieve success.

Factor 2. The effectiveness of the strategy

Determining the effectiveness of a trading strategy is not difficult. However, it is important to do this on a virtual account.

Eg, it is enough to open on a demo account 10 transactions according to the trading plan. After their closure, it remains to analyze how many of them brought income , and how much lesion . It is important to follow all the rules of the trading system. Closing and opening transactions must be carried out in strict accordance with its terms.

The ratio of profitable and losing trades can be different. If from 3 -x currency transactions 2 closed with a profit such a strategy is considered quite acceptable. However, much also depends on the amount of risk and profit.

You should not immediately use an untested strategy on a real deposit. It is much better to open a virtual account and trade on it in accordance with the chosen trading plan for a month. If at the end of it a stable positive result is visible, you can apply the strategy on a real account.

Factor 3. Level of volatility

In all financial markets, including Forex, the concept of volatility is of great importance. The higher its level, the sharper the exchange rate fluctuations can be. .

Volatility in the foreign exchange market is not constant, it depends on:

- trading session;

- news.

It is important to know! Traditionally, before the release of particularly important news, the market rate change fading. For a sufficiently long period of time, there may be practically no movement.

However, in just a couple of minutes, sharp movements begin. On them you can how much to earn and how much to lose due to slips.

Volatility also has a huge impact on what trading session time is it now. The trading session, in its essence, is the time of work of one of the largest world exchanges. Trading sessions and their features are presented in the table below.

Table: "Trading sessions of the world's largest stock exchanges and their level of volatility"

Session name Exchange GMT opening hours Volatility level European Frankfurt, Zurich, Paris ( London) 6:00 (7:00) – 15:00 (16:00) High American NY ( Chicago) 13:00 (14:00) – 22:00 (23:00) High Pacific Wellington ( Sydney) 20:00 (22:00) – 5:00 (7:00) Low↓ Asian Tokyo ( Hong Kong, Singapore) 23:00 (0:00) – 8:00 (9:00) Low↓ Since the exchanges included in the same session are located in different cities with different times, the opening and closing times of the sessions can be determined in different ways. That is why the table in brackets presents another option for closing and opening a session.

Most traders prefer to be active during European And American sessions . At the same time, the Pacific and Asian sessions do not attract such a large number of users. This is due to the different levels of volatility on them.

⚠ Experts warn: it is important to always consider the level of volatility in the trading process. If this is not done, success in trading currencies will not be achieved.

Factor 4. The amount of capital invested in the account

In order to be successful in the trading process, it is important to follow money management principles .

📌 Eg, when opening a deal, it is important to ensure that in case of receiving loss he did not exceed 2% of the amount on the account .

Warren Buffett(one of the most famous investors in the world) and advises to risk no more than 0,1 % of funds on deposit. This approach allows, even in the event of an unsuccessful transaction, to leave the opportunity to open quite a few more transactions.

The ideal ratio of possible loss to expected profit is 1 to 3. In other words, in the case of a positive outcome, the income from the transaction will be three times greater than the loss in the case of a negative one.

It is important to bear in mind, however, that the amount of income is significantly affected by amount of capital on a trading account.

For example, placed on deposit 1 000 dollars, but managed to earn in a month 200 dollars. At the same time, if the account size were 100 000 dollars, the profit would be 20 000 dollars.

Of course, not all users can immediately deposit a large amount. However, you can increase your income if you attract funds from other users.

Factor 5. Resilience

Most beginner traders are sure that they are stress-resistant. They believe that the foreign exchange market in no way can turn their heads and force them to conclude transactions based on emotions.

In fact, high levels of volatility can make even experienced traders nervous. Wherein only transactions opened under the condition of a cold mind can be effective.

There are a huge number of factors that affect the amount of income received on Forex. Important to remember which carries significant risks. If the user is not ready for it, you should not even start, because the risk will not disappear anywhere. It is inextricably linked with foreign exchange transactions.

Practical tips for making money on Forex for beginners from scratch

7. What you need to start earning on Forex from scratch - 7 useful tips + review of the best brokers 🔎

It can be difficult for beginners to succeed in Forex. At the same time, tips that have been repeatedly tested by a large number of professionals help to facilitate the process. Absolutely all novice traders should familiarize themselves with them.

Council number 1. Do not neglect training on a virtual account

The stock market is not going anywhere. Do not rush and start trading immediately after gaining basic knowledge. Profitable opportunities will not disappear even if you start trading in a few months.

That is why it is worth opening in the first place demo account . This will avoid a huge number of common mistakes that are typical for beginners.

Council number 2. Keep a regular trading journal

As a trading journal, you can use electronic file or regular notebook.

The following must be entered in the trade journal:

- charts (copy or print), on which various actions are marked - the moments of opening and closing transactions.

- information about the profitability and unprofitability of the operation.

Council number 3. Conduct market analysis regularly

Even if the strategy has proven its effectiveness many times, the trader must be aware of the market situation. Therefore, any working day in Forex should begin with the study economic calendar . It reflects the most important events for the market.

Experts do not recommend for beginners to trade on the days when serious news is planned for the selected currency. This is due to the fact that during such a period it is difficult to predict the movement of the market even for an experienced trader.

Council number 4. Control your emotional state

Emotions are one of the worst enemies in the Forex market. However, each trader is able to take them under control. This can help trading strategy .

Constant analysis is of great importance. If the course goes in the opposite direction to the desired one, it should be understood is the trade opened in accordance with the trading plan:

- If yes, then you don't need to do anything. It remains only to wait for the right moment.

- If the trading plan is violated, it is better to close such a deal.

Council number 5. Choose the right trading strategy

When choosing a strategy, it is important to consider a huge number of factors:

- how much is in the account;

- time used for trading;

- the level of risk acceptable to the trader;

- what type of analysis you prefer to use.

In fact, the list presented is far from complete. Experts advise testing the chosen trading strategy on virtual And cent account.

Council number 6. Do not deposit a lot of funds at once

- Firstly, Forex is associated with serious risks. Beginners often lose their money. It will be very unpleasant if trading becomes a blow to the family budget.

- Secondly, when a certain experience appears and it turns out to achieve serious profits, you can count on attracting funds from investors.

Council number 7. Be serious about choosing a broker

Today, there are a huge number of brokers on the Internet. At the same time, the success of trading largely depends on the correct choice of the company. If you don’t have time to independently analyze the conditions of various brokers, use the list below.

1) Forex Club

Forex Club - a broker who has been operating in the foreign exchange market for a long time.

Among benefits companies include the following:

- quality customer support;

- high-level analytics;

- professional education.

Forex club offers various trading conditions for its clients. That is why both beginners and experienced traders will be able to choose the best service options for themselves.

2) Alpha Forex

IN Alpha Forex not only traders can earn. You can also earn income here by working in the analytical department, as well as participating in the affiliate program.

Experts believe that Alfa Forex best for long term trading. The fact is that this broker makes analytical forecasts for weekly timeframes.

3) Alpari

Alpari is one of the largest brokers. Here clients are offered Training courses High Quality. Moreover, every day webinars market analysis and master classes from experienced traders.

Few brokers can boast as many different licenses as Alpari. That is why it can be considered one of the most reliable.

4) BCS Forex

Broker BCS Forex offers its clients a good training program, as well as high quality analytics. At the same time, it is possible to work with more than 420 tools under various service conditions.

BCS Forex boasts very low ↓ spread. Therefore, the broker in question is perfect for working not only on medium-term time periods, but also for scalping .

Clients from service in BCS Forex can receive additional bonuses. Newcomers are offered various promotions. Professionals can take part in competitions with serious prizes.

5) Instaforex

Instaforex perfect for beginner traders. This broker gives out serious bonuses. By topping up your account, you can additionally receive up to 250% . The company offers high-quality analytics, which contains the results of analysis using all known methods.

Moreover, for different options for the development of the market situation, experts offer specific actions. This makes InstaForex convenient for beginners.

If you carefully study the above tips and strictly adhere to them, you can significantly increase the likelihood of success in Forex.

8. Answers to frequently asked questions 📢

The subject of Forex is interesting to many. However, not everyone has a financial education. Therefore, in the process of studying the foreign exchange market, many questions arise. We decided to answer the most popular of them in the presented publication.

Question 1. How can you make money on Forex without experience and knowledge?

Making money in Forex is not easy. However, there are ways that allow a trader to earn income without having any knowledge. The most popular among them are:

- Signals. In this case, the trader uses special services that send him signals to conclude transactions. You only need to know how to work with the trading terminal. Of course, it is quite possible to earn income in this way. However, he has his flaws – there is a risk that the signals will be of low↓ quality. Moreover, it is unlikely that it will be possible to gain experience in trading with the help of signals.

- Advisors. This option involves installing a special algorithm in the terminal that performs automated trading. Flaw advisors lies in the lack of flexibility. Such algorithms cannot independently adapt to market changes. Therefore, experts recommend using them only as a complement to independent trading.

In fact, success in the market can only be achieved through training. Therefore, before you start trading, you have to go through several steps:

- To study the theoretical foundations of the Forex market. At this stage, it is important to understand the most important terms and definitions.

- Learn to work in the trading terminal. It is necessary to master the principles of concluding transactions, working with advisors and indicators, and the rules for conducting analysis.

- Choose a trading style. First of all, this concerns the preferred time period.

- Start trading first on a demo account. This will allow you to hone your trading skills without risking real money. However, on a virtual account, you should not indulge for too long. Enough to spend on it from 2 -x weeks before 2 -x months. If self-confidence appears, and the chosen strategy starts to bring a stable profit, you can proceed to the next stage.

- Start trading with real money. At the same time, it is important not to be afraid to open trades, but at the same time, it is necessary to ensure that they exactly correspond to the trading plan.

To complete the algorithm presented above, it will be required from 2 -x to 4 -x months. Of course, it will not be possible to become a professional after this, but it is no longer possible to call a trader a novice who has consistently overcome the described stages.

Question 2. How much can a beginner earn on Forex?

As we have already said, it is quite possible to make money on Forex. There are many traders around the world who have managed to achieve consistently high profits in about 5 years. However, you don't have to wait that long.

Practice shows that even beginners who have little to no experience manage to make a small profit within a few days. However, you should not expect a huge income right away.. Moreover, in order to make a profit in the absence of experience, serious knowledge of theory will be required.

If we consider the specific amount of possible income, you should pay attention to reports on PAMM accounts . On average, their returns are about 200% per annum . This is a good indicator and it is quite possible to achieve it. If at the same time you use not only your own, but also borrowed funds, there is a chance increase annual return before 300 % .

If choose aggressive trading , it is possible to achieve an increase in the deposit by 20 -100 % in just a week. However high risk level can lead to a rapid drain on capital.

Beginners should be prepared that at the initial stage, the profit usually does not exceed 100 % per annum. At the same time, it is difficult for many novice traders to achieve even income in the amount of interest on bank deposits - 10 -15 % per annum.

Question 3. Why do many people think that it is impossible to make money on Forex?

Many people think that it is unrealistic to make money by trading on Forex. In fact, such an opinion is erroneous.

The spread of information about Forex as a scam is due to the fact that about 90 % traders almost immediately drain their deposit. Of the remaining only 3% go to a decent profit. The rest 7 % at best, they trade at zero.

By the way, those who manage to get serious amounts from trading try not to advertise this fact. At the same time, those who failed to make money spread information that Forex is a scam.

To make a profit in the foreign exchange market, you have to study a lot and for a long time. But due to the spread of advertising about the opportunity to make money quickly and easily, even those who know absolutely nothing about Forex tend to enter Forex.

9. Conclusion + video 🎬

Learn to earn on Forex under the power of everyone. However, do not think that you will be able to immediately receive huge profits. Trading will take a long time to learn.

You can start trading almost immediately, but it is better to use cents And virtual accounts. This will help you hone your skills and test your chosen trading strategy.

We wish the readers of the online magazine "site" financial success. Let Forex bring you serious profit!

Author of the financial magazine "Businessmen.com", former head of a well-known SMM agency. Currently a coach, Internet entrepreneur and marketer, investor. I tell you how to effectively manage personal finances, how to increase them profitably and earn more.

On the pages of the site you will find a lot of useful information.

The main question that almost all novice traders ask is: how to trade on Forex profitably? The secrets of success are different for everyone, but there are several important points that every self-respecting stock speculator should be familiar with. Some even believe that there is a law of break-even trading, and a certain circle of people knows it. In fact, things are somewhat different. Let's talk about how to trade Forex profitably. Tips and secrets of exchange players will be presented in this article.

Trading Basics

First of all, before registering your trading account to work on the world currency exchange, you need to study the basic rules and trading techniques. Today there are a great many different strategies, but they are all based on fundamental rules. There are two types of analysis. You can learn more about them in the specialized literature or get trained by professionals. After all, without knowledge it will be impossible to conduct break-even trading. Relying only on his intuition, a novice trader will quickly “merge” the deposit and become disappointed in trading.

Choosing a strategy

Today on the Internet you can find many different strategies. Some of them really help to earn a good deposit, but most are designed specifically to receive money from inexperienced players. That is, a person who does not understand anything about currency trading hopes that by purchasing a certain strategy for working on Forex, he will be able to immediately earn capital. Very rarely is this true. Most often this is a coincidence or a happy accident. To develop a strategy, you need to spend a huge amount of time and knowledge before you start to receive a stable income. That is why experienced players are reluctant to share their intricacies of the game, helping to trade on Forex profitably. The main secrets of professionals, of course, were drawn from the fundamental foundations of the theory, but some of the nuances are known only to successful players who are unlikely to disclose them to anyone.

Thus, in order to choose, you must first test the various principles of working with currencies, choose the most suitable trading technique for yourself, and then draw up a plan for consistent actions.

How to choose a broker

One of the important factors influencing the success of novice traders is the choice of a reliable broker who can help find a method for how to trade Forex profitably. The secrets of the success of professional traders also lie in this nuance. Before opening a trading account with an intermediary between you and the trading platform, you should ask about its reputation. It's good that you can now find out about any company on the Internet. So, after reading the reviews and familiarizing yourself with the history of the company, you can make a choice in favor of one of them. Here are some points that you should pay special attention to: how many years the brokerage company has existed, the number of positive and negative reviews, where the organization is registered.

Professional opinions

Experienced stock speculators are advised to always assess the risks. You should not open a deal with a high ratio. So, if you want to get a big profit in a short period of time, you can lose your entire deposit. With a large price fluctuation, the amount of money in the working account may simply not be enough.

Another secret to successful trading is the use of stop orders. With their help, you can safely go about your business and not worry about closing the deal at the right time. For example, by placing an order at the price level that the trader considers necessary, you will be able to leave your workplace for a while. If you do not use stop orders, then you should always be aware of what is happening in the market and wait for the price to get to the required level.

So, it becomes clear that by following simple rules, you can learn how to trade Forex profitably. Secrets for beginners are often the basic rules of trading strategies even for experienced traders.

News impact

As you know, the market is influenced by many factors, and one of the main ones is the release of news. Professionals and experienced traders always keep a close eye on what is happening in the world. There are also specially designed currency indicators, the analysis of which helps to make profitable transactions. However, most often traders do not resort to using them, because the market can behave unpredictably during the release of some important economic news. Here it is better to wait for time and, perhaps, close all transactions for a while. Such a strategy helps to get the right answer to the question of how to trade Forex profitably. Secrets without indicators are quite obvious, the main thing is to make a correct analysis of incoming signals.

Do everything on time

The main criterion for successful work is the possession of high discipline. Only if a trader is psychologically resistant to high fluctuations in currency pairs and does not panic when the market goes in the wrong direction in which he predicted, only then can he count on profit. First of all, they advise you to learn to control your emotions. One should not be tempted to open trades when the market is too volatile, and one should also be able to close their trades in time. Most often, novice traders lose their deposits precisely because they did not leave the game on time. Thus, in order to earn money, you need to open and close your positions on time.

How to trade Forex profitably: basic secrets

Someone chooses long-term trading for themselves, while someone prefers to work daily. In both cases, there is an opportunity to earn. Only the main condition for a profitable transaction is a sober head. As practice shows, only psychologically stable traders achieve success in the market. That is why this fact can be attributed to one of the main indicators of how to trade on Forex profitably. The secrets of big earnings also lie in the ability to quickly analyze the situation. That is, there is no need to complicate your strategy to such an extent that there is not enough time to assess the situation instantly, as required by market conditions. It is enough to have just a few indicators that accurately show the state of the world stock exchange.

In order for a novice trader to become a successful speculator, you need to study a lot and finally get an answer to the question of how to trade on Forex profitably. The secrets of the skill of professionals also lie in the fact that they work on the stock exchange not when they want it, but when it is profitable. That is, you can not subordinate the movement of the trend only to your desire to get an instant profit. It is necessary to first analyze the situation, make forecasts, once again carefully consider and weigh everything, and only then, with a “cold” head, make a decision to open or close a transaction.

Before opening a working account with a broker, you should decide on the size of the deposit. A novice player must risk the amount of money that he is willing to lose. Otherwise, it is better to abandon the idea of currency trading, otherwise the lack of discipline will be guaranteed.

If you are interested in speculation in the foreign exchange market, then we will teach you all the tricks. Forex trading for beginners. Big earning success. Basic concepts of the financial market, terminology, the essence of the work. How can a beginner with minimal capital start making money within 2 weeks after starting to learn how to trade on the market? What are quotes, stop losses and patterns? The article “Forex Trading for Beginners” will tell you how to become a trader.

How to make your first money on Forex in a week

If you have never dealt with the financial exchange and do not know what a “bullish downtrend pattern” is, this article is designed to help you figure it out as quickly as possible.

The main question is: can a person whose knowledge is limited to the concept of “financial exchange” make money on Forex? This is of interest to tens of millions of people and we will try to answer this question in detail. We will try in simple words to answer questions regarding terms, elementary methods of analysis and other nuances that concern you.

A financial exchange is a specific type of market in the economy where money or financial assets are traded, without the use of direct-purpose goods and services. It should also be noted that the speculation on the Internet is significantly different from the real one. It is much easier to do business here, there are many tools to increase the profitability of your activities, so you will earn many times more online.

What is Forex

It is an online currency exchange where traders can enter the market. Forex is part of the global financial system. This is where money trading takes place - the exchange of one currency for another. The task is to earn on the difference in rates and receive income on the rise in price or reduction in price of quotes of world and digital currencies. Forex has its own laws and rules, according to which both beginners and professionals work.

By deciding to receive income by betting on the increase or decrease of currencies, you take on a certain responsibility. For their actions, for decisions made, for income and losses. But sometimes, a mistake costs a lot of money. Trades are unpredictable. Suffice it to recall the story of the legendary financier George Soros. How he made a fortune by crashing the pound, and subsequently drained the money he earned. Avoid such mistakes.

Do not neglect the psychological factors. Often the thirst for profit destroys many young "fighters". Remember. Only tactics, forecast and cold calculation.

“The key to trading success is emotional discipline. If intelligence were the key, then many people would make money trading… It will sound like a cliché, but the only reason people make money in the financial markets is because they don’t cut their losses.” (Victor Sperandeo)

There is a myth among beginners that in order to make money, you need to monitor charts around the clock. This is wrong. It is enough to develop an action plan and set up a program. You are even able to set the settings so that the program will make transactions for you.

Basic concepts

Before proceeding with the operation, it is necessary to understand the terminology. This is the base, like the alphabet, which must be mastered before you start “reading”.

Forex - from the English FOReign EXchange Market. Translated, this phrase means foreign exchange. They exchange money on Forex. The main principle is the free conversion of money, without any interference from the state.

The main participants in the process are traders. These are those who are engaged in speculative transactions and earn on exchange rate differences. Trading processes between the financial exchange and the trader are carried out by an intermediary - a broker. Choosing a good and reliable broker is the most important stage in the work of any bidder. Despite the fact that modern brokers offer almost identical conditions, some of them are not good partners who do not delay payments and ensure the safety of funds for their investors. Before deciding on an intermediary organization, check out the ratings that are easy to find on the net.

To make transactions, you need a special program - a terminal. This is software that is installed on the user's PC, thanks to which you will explore charts, analyze information and make deals. The most popular trading terminal model is MetaTrader4. Previously, before there was no TT, traders had to call their broker and ask for prices. With the advent of MetaTrader4 or other similar software, this has become much easier. You trade directly in the program.

Forex is a system, discipline and hard work. If you are ready to invest in education and comprehend this interesting science, then pleasant bonuses await you.

Terminology

Timeframe is a graphical scale that determines the minimum steps of quotes displayed in the terminal. For example, an hourly timeframe implies the presence of hourly candles on it, and a daily timeframe implies daily ones. It turns out that the larger the timeframe, the more time it can cover, but then the accuracy of the analysis decreases. Those who have been trading for a long time and make good money are accustomed to using several timeframes simultaneously to adequately assess the situation.

Leverage- this is a proportional ratio of the amount deposited as a deposit to the funds for which a transaction can be opened. It allows you to make money. Choose the leverage based on your preferences, while you do not need to pay anything for it. For example, the deposit is $100, but you want to make a deal for $10,000. In this situation, the leverage is 1:100.

Order is a position in Forex. It is the order that allows you to buy or sell currency quotes.

Lot - this is the usual order volume, that is, positions on the currency exchange. As a rule, one lot is equal to one hundred thousand dollars, but experienced traders trade only certain fractions of this lot. By the way, if it were not for the leverage, it would be simply impossible to open accounts with small deposits.

Indicators are computer programs that are built into the platform and analyze the situation on the market. It is on these trading indicators that the lion's share of strategies is built.

Candles- These are the main components of the candlestick chart. Candlesticks show the movement of quotes over a certain period of time. Thus, a minute candle gives data on the price level at the time of opening, at the time of closing, the maximum and minimum price values at that time.

“Markets are constantly in a state of uncertainty and fluctuation, and money is made by calculating the obvious and betting on the unexpected.” (George Soros)

In order to master the intricacies of working on FOREX, it is necessary to become more familiar with the general principles of speculative trading. They are not so complicated and do not require deep knowledge, but they consist in simple rules and calculations, which for the most part are carried out by automated systems and the terminal itself.

Before you proudly call a trader, master the terminology and study such concepts as: trend, consolidation area, swap, margin, pattern, support and resistance level, StopLoss and TakeProfit.

Quotes

Or currency pairs, this is a proportional ratio of the price of 2 currencies. They display the ratio of the price of one to the other. The first standing in a pair is considered the main one. Its value is always equal to one.

- EUR - euro,

- GBP - British pound sterling,

- JPY - Japanese yen,

- CHF - Swiss franc,

- CAD - Canadian dollar,

- AUD - Australian dollar,

- NZD - New Zealand dollar.

These currencies form pairs for which the largest number of transactions take place, since they are more liquid on the world market.

The most common and important pairs: USD/EUR, USD/JPY, USD/GBP, USD/CHF

Step by step instructions to start trading

1. Carefully study the basic information related to the category "for a teapot". A beginner is a person who has nothing to do with finance, so for a start it’s a good idea to master the entire trading base, which is what you are actually doing at the moment.

2. Learn the rules of the chosen trading strategy like “our father”, because this is the future income, because. it depends on it whether you will earn and how well. It is necessary to follow certain laws of currency trading, and not to deviate from them under any circumstances. The chosen approach must be reliable and verified before you by other market participants.

3. Master the basic terms.

4. Choose a quality and proven intermediary. The safety of investments and the quick withdrawal of earned money are determined precisely by the choice of a broker. Unreliable trading partners may provide “hanging” sites, not provide up-to-date currency quotes, and so on.

By following these four simple conditions, you will quickly learn how to profit from your trades without fear of the blunders that most beginners make. Of course, mistakes will still occur, but they will not bring you those colossal losses that are quite real if you trade without tactics or work with a fraudulent broker.

How does speculation happen?

If you have ever been to an ordinary grocery market, then be sure that you have an understanding of how the whole process takes place. Let's say you need to buy a product. Before you buy, you need to look around and find a seller. Next, you ask for the cost, for what amount he is ready to give his product - it will be ASK, The bid price at which the seller is willing to sell his product. Considering that it is expensive, you start bargaining. And name the amount acceptable to you - this is BID, or the asking price.

Let's translate the described process into forex terminology. You buy a currency and open a position byu by price ASK. Or sell the asset at cost BID and open a deal sell. The difference between these two values is called SPREAD.

Let's translate the described process into forex terminology. You buy a currency and open a position byu by price ASK. Or sell the asset at cost BID and open a deal sell. The difference between these two values is called SPREAD.

Market analysis

What determines the value of a particular currency? Similarly with the classical market, the price is determined by supply and demand. The more people want to buy the currency, the more it becomes more expensive. And vice versa. The least attractive assets are not in demand and fall in value. The main task is to determine the trend and the possible direction of the price.

Looking at the graphs, you can see a certain pattern. The value does not move spontaneously. She has her own rules. Technical and fundamental analysis will help you understand these nuances.

In contrast to the fundamental, technical analysis is based on statistical and mathematical calculations. It includes charts, figures, indicators and more. Forecasting is based on the history of trends and the price path of a particular currency.

Fundamental analysis is a kind of market analysis when you analyze not the chart, but the factors that influence it: news, politics, speeches of country presidents and other global and local events. It can also be various economic news, which include data on the gross domestic product, interest rates, unemployment, and so on. Economic news can determine the trend of quotes with a high degree of probability. And it helps professional financiers to use this information for successful trading.

Most popular newbie questions

Can I make good money with absolutely no understanding of economic matters?

This question is the most relevant among those that we have heard. How to succeed in Forex for those who have never had anything to do with finance in their lives? Yes, you need to know a lot, but why don't you acquire this knowledge? You can complete the course as soon as possible. Learn the basics, and in the process of trading at minimal risk, learn what real professionals know.

How to start?

For profitable trading, you need to be well prepared, choose a strategy, find a suitable intermediary in the form of a broker, and master some of the nuances of trading. The lion's share of beginners perform operations without any preparation at all, which is their main mistake. Despite this, getting a stable profit is very real, the main thing is not to be lazy and invest time in gaining knowledge.

How to choose the right trading strategy?

A trading strategy is a list of certain laws for beginners and professionals. Speculation without any tactics is just irresponsible stupidity that will not lead to favorable consequences. Remember this! It remains only to choose the right system. How to do it? Before choosing, answer the following questions for yourself:

1. How often do you want to trade? There are approaches that require daily sitting at the computer for 3-4 hours to open a large number of positions within the day. There are, on the contrary, those that do not require a daily visit to the trading platform. They are called scalping and long-term trading. There are also medium-term trades that allow you to open positions up to 1 week.

2. What kind of analysis do you plan to use? You already know that there are technical and fundamental analyzes. Each trader must determine the method of analysis according to their skills, talents and preferences.

To get acquainted with the tools of technical analysis and study the fundamental one in more detail is the key to success. Start doing it right now. You will find all comprehensive information on our portal.

“Neither the book, nor the guru, nor the strategy will answer the question of how to trade profitably. Success comes with time, if you put enough effort into it.” (Bret Steenbarger)

How much money to replenish the account?

In general, you can start trading even if you only have one dollar in your trading account. Of course, this is in theory. Please note that a small deposit will bring a small income. In order to consistently earn on Forex, you need to have a deposit of at least $250 if you plan to become a professional in the future. This is not such a large amount and any citizen can afford it.

How to choose the parameters of your account?

During registration, you will set up your trading account: leverage, variety, swaps - the profitability of the whole undertaking as a whole will depend on the choice. Carefully study all parameters for accurate and efficient tuning.

When is the best time to trade?

A big mistake for beginners is to work at the wrong time. There are times of the day when the schedule is very easy to predict. For each pair - this is its own interval. If you trade only at this time, you can minimize risks and increase profitability.

What quote to choose?

Most beginners ask which pair to choose. Start with the standard ones, but over time, learn the features of 4-5 currency pairs in order to be able to open the most profitable and convenient deals for you and increase your income.

Deal example

The deposit is $500. You have decided to open a trade on the EUR/USD pair. After analyzing the trend, bet on an increase in the rate. You open a position of 0.1 lot at the quote 1.5455 offered by the broker. To increase profitability, you decide to work with a larger amount and take leverage.

Now you have + 10 000 EUR for which you paid 15 455 USD.

After some time, you decide to close the deal. You are offered a sell price of 1.5655.

Previously purchased 10 000 EUR sell for 16 155 .

And count your profit: 15 655 - 15 455 = 200$

The more you trade, the more you will earn. But be careful. The risk of significant losses in case of an incorrect forecast is similarly high.

parting word

This article was supposed to dispel the fog around such a complex and incomprehensible Forex market for beginners. If you work hard and absorb knowledge like a sponge, you can really start getting money after 2-3 weeks of training. Having thoroughly dealt with this issue, you open excellent prospects for the future.

This month I earned +120% on Forex to my deposit. Do you think becoming a millionaire at 25 is real? How to make millions without getting up from the couch? Do you want to know how to earn huge money lying on the beach, on the seashore?

Agree, the first thoughts that come to mind after listening to the above listed advertising of absolutely all dealing centers (hereinafter DC), isn't that a scammer. We are all adults and we understand that free cheese can only be in a mousetrap, but here they promise mountains of easy money. And yet, after thinking a little, we take our money and try to find out in practice: " What if I was wrong and this is a real way to earn a lot of money on Forex?".

Hour X comes and the novice trader makes the most stupid decision. In hope earn money in the Forex market (Forex), a trader goes to study at a company that makes money from traders. Unclear? OK, I'll tell you more.

Dealing center- a company that provides a trader with a trading platform and access to the Forex market (Forex). In most cases, DCs earn not on commissions from trades of traders (as it should be), but on the ruin of a trader. With a complete loss, the money from the trader's account flows to the account of the dealing center.

A novice trader goes to study in such companies, and as you understand, he is taught not how to make money, but rather how to lose money. They tell in detail what a trend line is, how to work with a support and resistance line, they even show trading formations (patterns), give examples on the chart, and especially meticulous students, for greater persuasiveness, will be presented with detailed statistics of transactions, where the numbers +$1000 appear, +2500$ and so on, well, you understand, the larger the amount, the more convincing the teacher looks. The DC teacher will also not forget to mention the statistics, according to which 95% of newbie traders lose their money in the very first transactions and no longer return to the foreign exchange market.

At first glance, everything looks just great, no deception, they told, showed, and even warned, but all these stories only affect inexperienced and greedy people. The fact is that a trend line can be built in different ways, and it will be great to draw it only on history, and the patterns that the Teacher boasted about so much no longer work, because the currency market is alive, it tends to change, and what worked yesterday , very often will not work tomorrow.

Well, the statistics are against us, or rather, against the majority, who do like everyone else, but this is not the most important thing, the main problem is that we started doing a business that we initially gave an assessment of " Isn't this a scammer?". This thought will sit until the very end, and what is very sad, this end comes very quickly.

Having tried to trade, the new trader rather thinks not about the quality of the transaction, because he was not told that it could be somehow different, but about how to make money fast in the Forex market (Forex) and what can be bought with the money earned from the exchange. Are you familiar with the proverb " Sharing the skin of an unkilled bear"When you start doing this, it usually doesn't work out, and a novice trader can't be multiplied by 100 Because he does EVERYTHING wrong. Having received the first knowledge, he did not deign to check them, his head is full of transaction statistics provided by the teacher from the DC and illusions about speedy wealth.

But, this does not happen, and instead of wealth, expectations to earn, the trader loses his hard-earned money. What do you think he will say to others? Of course, Forex trading (Forex) is a scam (deception), everyone is to blame: the DC, who lured with advertising, the Teacher from the DC, who taught poorly, but in no case is the new trader himself to blame, because no one told him that before making money, it would not be bad to learn this. His head was filled exclusively with wealth, new cars, apartments, yachts, he saw himself already in a new image, but to think about the mundane, that people only study at institutes for 5 years, of course, I don’t want to think about it, because money need fast.

How to make money in the Forex market (Forex). The essence and principle of action

Forex (Forex, sometimes FX, from the English FOReign EXchange - “foreign exchange”) is an interbank currency exchange market at free prices.

I hope that now you are mentally prepared that you will not see easy money, and in return you will have to study, study and study. If you do not understand, go back and re-read the introduction again, the rest "Follow me!".

To get started, check out the Trader's Library. I have prepared a good range of books on the topic "how to make money on the exchange", which is suitable for both beginners and more experienced traders.

Let's understand the theory of how to make money on Forex.

How to make money in the Forex market?

Many of my friends know what I do. For them, the word "trader" is associated with something grandiose, but somehow, the conversation turned to the practical part, and they asked me: " How exactly do you make money in the Forex market?". Frankly, for me it was a strange question, because I thought that the explanation lies on the surface: bought cheaply, sold dearly, profit in my pocket.

But, since people are interested, I will try to answer in a simple form, using a banal example:

According to reliable data, you learned that in a month soap will cost 15 rubles, although now it costs 10 rubles. How to earn on your information?

Now you need to buy soap for 10 rubles, and when it costs 15 rubles, sell it, and get 5 rubles from this transaction. The task is simple, but this simplicity is the essence of making money on the Forex market.

Trading on the foreign exchange market takes place through special terminals, of which there are a lot. For trading on the Forex market, the MetaTrader 4 terminal is usually used (in one of the articles, I will describe in detail the functionality of the platform). Trading operations are carried out using the terminal (Sell, Buy, etc.)

The principle of earning on the Buy position (purchase)

let's consider real life example of how to make money on currency speculation on Forex (Forex).

Buy order for the EUR/USD currency pair

1 lot in EUR/USD pair = $100,000

1 pip with an open trade of 1 lot = $10

Let's draw an analogy with our example about soap. Just like with soap, for some reason, the trader decides that the price 1.2928 is cheap. A trader makes a deal on Buy with the 1st lot, in other words, he tries to earn money on a short-term rise in the price of EUR (Euro) against USD (Dollar). Once the price reaches the level 1.2973 , the trader closes his position (sells).

Let's do the calculation. Between 1.2928 And 1.2973 price passed 45 points, 1 pp = 10$ , it turns out that on this transaction, the trader earned 450$ .

The principle of earning on a Sell position (sale)

Here the example with soap will not work, but without it the essence will be clear.

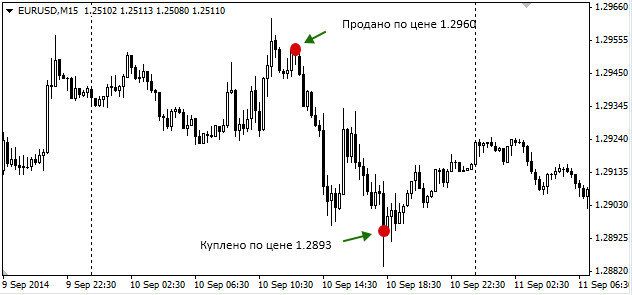

Sell order for the EUR/USD currency pair

Let's look at the following example of earning on Forex, in which the trader wanted to make a Sell deal (sale). The question immediately arises: What about the sale? After all, in order to sell something, you don’t need to buy something."Quite right, but slightly different rules apply on the foreign exchange market. The DC allows you to make a sale, as if on credit, so this transaction is quite real on the foreign exchange market.

And so, the trader decides that the price 1.2960 for the EUR/USD pair is overvalued, and is waiting for a short-term decline. To capitalize on their expectations, the trader follows the price 1.2960 make a Sell deal and wait for an acceptable price at the level 1.2893 . After the transaction is closed, funds will be transferred to the trader's account at the rate of:

Sold for the price 1.2960 , the transaction is closed (purchased) at the price 1.2893 , as a result, it turns out that the couple passed 66 pp, which in terms of money equals 660$ .

How to make money on Forex (Forex) online

Choosing a DC for registering a trading account

Now that we know how, in theory, traders earn by speculating in currency pairs on Forex, we can consider several options for Dealing Centers for opening a trading account and withdrawing our money to the exchange.

It must be admitted that in our time Dealing centers are a dime a dozen, for this reason, it is very easy for a new trader to get confused and choose an unscrupulous company.

What do I mean by "dishonest"? Will explain.

Unfortunately, in Russia (I don't know about other countries), the Forex market is not regulated by the government. This means that the Dealing Center can register its companies, for example, in Cyprus and, in case of disputes, sue under Cypriot laws.

How many will do it? I think no.

For this reason, DCs are often compared to a “kitchen”, which means that transactions that traders make are not brought to the market (exchange), but are rotated exclusively within their company. There are several reasons for this:

- Knowing the statistics of losing traders, the DC thinks as follows: "Why take a deal to the intermarket and pay for it if the trader loses the deposit anyway. I'd rather make the appearance of trading on my simulator, leaving all the profit to myself."

- There are traders who are able to make money, but you can also find the key to them. Which? Yes, just do not pay the money earned, and let him sue, I don’t understand with whom.

Fortunately, the government will soon take the side of Russian traders, if I am not mistaken, in October 2015, in the Duma, they will adopt a law on the regulation of the Forex market and present requirements for brokers (dealing centers). Now, to the question: How to make money in the Forex market?", there will be only one answer: " Analyze, learn and earn, now no one bothers you".

In one of the following articles, I plan to describe this law in more detail and put it on the shelves.

The law is the law, but we should not mess up, you can't make a mistake and choose a one-day company. I suggest you stop at 3 reliable brokers. Their reliability lies in the feedback of our fellow traders and the age of the company.

In addition, at a time when the Internet is moving by leaps and bounds, website design can say a lot. More than once I went to pages that are engaged in serious investments (as they say), and the site is made, as they say, "on the knees": nondescript, gloomy and not interesting.

You say: " Yes, this is not an indicator, the site can be made anything in beauty?"You can, no doubt, but as practice shows, one-day companies do not bother too much about design. Their goal is to attract a client, fool and abyss.

1. Alpari company.

The company has been on the Forex market since 1998 and has proven itself both in terms of customer service (timely payments, high-quality functionality, experienced analysts, etc.) and its reliability.

In addition to excellent conditions for trading traders, Alpari offers great opportunities for investors: PAMM accounts, PAMM portfolios, investment funds, structured products, etc. In my opinion, it is in Alpari that profitably trading traders and the yield curve of PAMM accounts are collected, which is a confirmation of this.

2. RoboForex Company.

In the Forex market since 2009. Despite the fact that the company is registered in Cyprus, there are no claims either for service or for the execution of orders. On the Internet you can find a lot of positive reviews that add significant bonuses.

Of the features: free access to the VPS server, the One-Click Trading service, designed for strategies aimed at making a large number of transactions, the Rebates program, which allows you to reduce the spread.

3. Forex4you company.

It began its activity in 2007, provides access to the interbank Forex market using the NDD model. At one time, I talked with the guys who had registered accounts of $ 100,000, every month withdrew profits of 5-10%, and there were no complaints, delays or negative factors.

The company cooperates with several banks. The main features are: the Share4you service, which allows you to automatically copy transactions on Forex, PAMM accounts, investment security of funds: funds from 100,000 USD are stored in one of the banks in Switzerland, services of depository banks for customers investing from 500,000 USD.

Additional Information!!!

Part 1. Background

I first heard about the forex market back in 2010. Then my older brother signed up for trading courses and told me a lot about the basics of currency exchanges, Japanese candlesticks and people who made fortunes on this. In those distant years, I was still not at all interested in the market, and somehow I did not have a thirst for easy money. And all these terms like Japanese candlesticks, margin, leverage, sounded like white noise to me. But my brother confidently attended classes, watched video tutorials and tried to trade on a demo, and then on a real account. At the end of the course, the academy opened a real account for each student with $100 on it. For overclocking, so to speak. According to the stories of his brother, half of his "colleagues" merged these deposits very quickly. And, as the teachers said, this is a typical beginner's mistake, everyone goes through it. Time will pass, and you will learn how to manage risks, and money will flow, if not a river, then at least a stream, so that there is enough for sandwiches with sausage. Sounds tempting, doesn't it?

Time passed and my brother's ardor somehow faded. He almost lost his 100 dollars, and, unfortunately (and as it turned out later, to great happiness), there was nothing to replenish the deposit. Thus ended his career as a trader. But he left the market without realizing whether it is possible to earn money there. One of his St. Petersburg friends, inspired by his brother’s stories, also began to trade, but it was difficult to say whether it was successful or not, because his words were: “I seem to earn something, but then I merge everything again” (oh, how often I heard this phrase later ).

A couple of years passed, and the idea of easy money on the races of exchange rates crawled somewhere in the subcortex of my brain. A year in 2012, my friend told me that his friend was sitting at home and making a living and a mortgage on the forex exchange. The pier opens a couple of three well-thought-out deals and lights up with 500 bucks each. Here we saw the first person who really makes money on Forex. And the fire in our hearts blazed. We started reading articles and watching video tutorials about what an exchange is, what trading terminals exist. Terms rained down on our heads like from a bucket - margin, leverage, indicators, orders, and so on. But it was even funny, because we felt that this was the beginning of our career as millionaires. We registered demo accounts and began to master trading.

Naturally, at first everything was incomprehensible, some arrows, graphs, numbers. But, after a couple of weeks, we settled in and felt like a fish in water. There was only one but - even on demo accounts we did not have a profit. But the excuse was quickly found - with the demo account wrappers there is no risk and no fear, it's time to switch to real money. We quickly looked through the tops of the best brokers and chose the right option for ourselves. And we brought to our first accounts, as expected, $ 100 - the minimum deposit. Well, trading began, and our expectations were justified, with real money came fear and a sense of responsibility. At the opening moments of the first real deals, my hands were shaking like on an exam in the traffic police. Yes, that's just with real deposits came another factor, the most dangerous and insidious. The factor that caused millions of people to lose everything in their lives. The factor that destroys families and even lives is PASSION! And no matter how much I thought of myself as an objective, sane and not subject to excitement, I succumbed to excitement. And its perniciousness lies in one simple thought: “Now I’ll invest more in this deal and not only beat off all the minuses, but also double the deposit.” This thought destroys all plans, strategies and methods of risk management. And no matter how many articles I read about the need to develop a system and strictly act on it, nothing worked out for me. Sooner or later the excitement took its toll. Of course, you can say that I am so small-hearted and spineless, but, unfortunately, I am not the only one. And so far in my life I have not seen a person earning on Forex, except for ... a broker!

As a result, like all newbies, we lost our first deposits. But, again, this was expected, because this is a “standard error”. And since the error is standard, then we are moving along the beaten path to enrichment and paradise life. We need to work on the bugs. And to work, you need funds. So we poured the second batch of money into our deposits. Well, what can you trade with 100 dollars, we filled in 500 each. Well, in order to immediately recapture those 100, and earn new ones. By the way, there were moments when 500 grew to 600 and it was really nice. But then they turned into 400, 300 and melted from deal to deal. We made promises to ourselves that it was time to reduce trading volumes in order to reduce risks. One simple factor prevented us from doing this - the painfully familiar AZART. After all, every time it seemed that this is the very deal of my whole life and now I will invest everything in it, and how the market will explode in the right direction. Yes, but he always tore in the opposite direction, taking with him the remnants of our deposit. The second deposits were approaching zero.

And then we thought, is it really possible to make money in the forex market?

Part 2. How we got rich on gold

As I said, our second deposits were coming to an end, and we decided to understand what was the reason for our adversity. We identified the reason quite quickly - the wrong trading strategy. Like all novice traders, we traded haphazardly. Yes, we had some tactics, but, succumbing to excitement, we forgot about everything and rushed after the rapidly disappearing charts. The fast movements of the market drove us into a frenzy, afraid of missing out on a lot of income, we rushed into transactions. This behavior is even described in many clever articles and is called "Jump into a departing train." And the fact that our behavior once again fits the classic definition of beginner's mistakes only confirmed that very soon we will become seasoned pros and start earning decent money.

Yes, but the merged amount of almost 600 dollars no longer seemed trifling to us, and we decided to slow down a bit. We switched to very small transaction sizes, tried to open strictly according to the system. And, in general, even something worked. Only here the profits were quite boring. From the balance of deposits of about 100 dollars, we earned 1-2 dollars per transaction, which could last more than one day. This situation upset us, because at such a pace it will not be possible to return the former deposits soon.

And we decided to ask for help from our friend, the one who, sitting at home, earns on the stock exchange both for a mortgage and for a living. His answer was simple and clear - you are trading in the wrong pairs. Throw this Eurodollar, switch to gold trading (XAU/USD). Yes, but there was one significant drawback in trading gold - the minimum transaction amount is $ 125, and even you need a little for a drawdown. In general, our deposits were not suitable for gold at all, and somehow I did not want to put new money on them from my own wallet. However, we added a gold chart in our terminals and began to look at it regularly. Painfully beautiful there were figures, and the intensity of the movement really inspired hope for a quick profit.

After a couple of weeks, we felt we were ready! It seems that deposits have ceased to melt and we have somehow begun to control ourselves. They developed their own systems, graphics there, arrows, almost like a pro. We gathered our strength and put another $500 on deposits. Well, just 125 was needed for one deal, and not the fact that it was she who would shoot, and that the stock was small. And we went to trade for gold. I remember that of course we had enough adrenaline. Opening a trade where each pip costs $1 was cool. With each movement of the market, the numbers in the terminal changed not like a child. The most interesting thing is that we had profitable trades, and the fact that the cost of one point is high made the profit very significant. We closed a couple of deals +200 dollars. The second interesting fact is that gold really lends itself well to analysis. Especially well it worked out strong lines. True, there was one but - the chart approached strong lines no more than once a month, but I always wanted to trade. But we controlled ourselves, placed pending orders and waited for juicy deals.

And life would be honey if everything depended on us. After some time, we saw that gold does not always work out strong lines, sometimes it just breaks through them and is carried away to stop losses, taking away our money. Having succumbed to the same EVIL, we rushed after the chart, changing transactions to the opposite ones. But this, as you know, is a bad practice and we merged the deposits. Moreover, we merged them very, very rapidly, rushing into one or another adventure. And what is most interesting, in all this fuss, you start to get tired of losing and stop feeling that you are losing real money. Their own, which they recently transferred from their own wallet to a broker.

At the moment when the margin call hit our accounts, we were so exhausted that, in general, we were even glad that it was finally over and there was no need to worry anymore. We firmly decided to leave the forex market and all these ventures with easy money. Even despite the fact that we saw profitable deals and even closed them. Despite the fact that we, our comrade, are sitting at home and making a living with a couple of deals, and we plow at our jobs and there are no prospects for a carefree future.

Is it possible to quit forex? Is it possible to just walk away from it one day and never come back?

Part 3. How the trading assistant helped us drain the deposit

After a couple of months without Forex, my hands began to itch a little. The resentment of the loss faded away, and those very profitable deals and big candles on gold did not give us rest. After all, there were successful transactions, and they were opened according to our system, when all the facts were clearly planned, and the entry into the transaction was carried out only in the presence of signals. So what then was the reason for our defeat? Why did we leave defeated? And all the forums and books said with one voice that the market does not forgive mistakes, that 90% leave with nothing precisely because I trade haphazardly. And only 10% of real pros actually made their millions in the market.

And then we came across one interesting phrase "The road will be mastered by the walking one." We used this phrase more than once in a joking version of "The road will be mastered by the one who goes, who goes to ...". One way or another, it has become our motto. But really, after all, all our troubles are just a thorny path to laurels. And only cold-blooded traders who are able to learn from mistakes are able to reach the end. And we went. But how can we learn to be cold-blooded? How to stop succumbing to temptation and trade strictly according to the plan?

The answer came as an insight - you need to write an assistant. After all, it is a cold-blooded machine that will be able to objectively assess the situation on the market without succumbing to panic and excitement. Almost all modern terminals have built-in programming languages, and we, by the way, are programmers by profession. The idea was innocent - to write an assistant that would evaluate the market on a number of factors and tell us whether to open a deal or not. During the week we tried to code. We read the specifications, looked at the examples - everything became clear. The helper was written pretty quickly. I will not go into the details of our system, but it evaluated the chart on different periods and highlighted interesting moments in which, in our opinion, trading began.

The helper test began, which was quite successful. Yes, there were many mistakes, but there were more than 70% correct decisions. So far, we have been working on demo accounts, because our real accounts were lying around at zero. In the process of writing the assistant, we saw in it another important advantage - it can work around the clock, it's a machine. Here we decided to entrust him with all trade. We supplemented it with the function of opening a deal and started testing it. Again, almost all terminals have access to price history and are able to evaluate the effectiveness of the history assistant. The evaluation results surprised us. Income from transactions was up to 1000% of the deposit per month. True, it was only a story, but we tested it for a long period and the results inspired confidence. Having debugged a number of system parameters on history, we decided to launch the assistant in real time. True, while on a test account.

A couple of weeks of tests showed nothing. The profit was at zero, but there were no losses either. We quickly found an excuse - now the market is sluggish. The market was indeed sluggish during this period. We decided not to torment ourselves, otherwise we would suddenly miss all the action with this demo account - we replenished deposits and launched an assistant on a real account. They set him the minimum size of the transaction and let him sail. He sailed for about a month. The behavior of the market was completely different from history. Although all forums and textbooks unanimously repeated the golden rule of trading: "history repeats itself." Yes, that's something she did not repeat. The robot traded, opened a bunch of deals, but we did not wait for a 1000% growth.

Probably, the phrase “Third deposits were merged” is now expected. We allowed the assistant to drain only half of the deposits, then cut off his wires. There were 250 bucks left on our accounts. Meanwhile, gold was approaching a very strong line. Well, AZART took its toll and we decided to recapture all the lost money with one deal. Placed orders and waited. By the way, the orders worked out as they should. And we went to the plus. Grow up to $500. But they did not stop there, they began, as they wrote in the textbooks, “Milk the market to the last drop.” But the market milked us faster.

The third deposits were merged. And the mistakes are still the same - succumbing to excitement, we deviated from the plan. Although sometimes history simply did not repeat itself, and the market ignored all the lines and went about its business. Is the market amenable to analysis or is it influenced by random fundamental factors that frustrate all the plans of traders?

But the main question that began to interest us: “Are there people who have earned on the forex market?”

Part 4. Are there people who have made money in the forex market?

We, in fact, studied this question at the earliest steps, and the answer was obvious - YES! But we began to look more carefully. There are a lot of stories on the Internet about that trader and this one, here they are, these lucky ones. And, reading their stories, we saw how they started, how they made all the same mistakes of beginners. There is a German grandmother who, in retirement, sat down at the terminal and made a fortune. Well, yes, there are such people on the Internet. And in life?

We turned to our old acquaintance with a mortgage. The truth struck us - so far he has not earned anything, but only lost 200 thousand !!! The wife pays for the mortgage, and he survives on part-time jobs, and all he earns is on deposit, in the hope of recapturing the minus. Before that, he was simply ashamed to admit his failures, they say, they will think that you need to be crazy in order to lose such money. So it is, in general, it is. Although, in his understanding, he did not lose them, he is still in the process of learning the market, and big profits are already on the horizon.

A St. Petersburg friend of my brother abandoned this business a couple of years ago, saying that he "earned something, but then he merged everything." It turns out that all the real people with whom you can talk have not earned anything. On the Internet, on forums, people boast that they have been trading for years and very successfully, but in neighboring branches, these same people say that they open at a minimum, because the deposit is close to zero. Odd for a millionaire.

After analyzing the entire forex market, I came to a number of contradictions:

1) If the market is easy to make money, as brokers say, why don't they just trade themselves? After all, why should they collect these crumbs, in the form of interest from transactions, when they themselves can turn millions there and earn millions. But brokerage companies employ hundreds of employees.

2) Why would someone who has developed their own unique trading system that brings in a steady income share it with others? Yes, not just sharing, but also trying to conduct paid seminars for 100 rubles per participant. And some even offer to send CDs by mail for 200 rubles. It's somehow petty for a millionaire, don't you think?

3) Why do people who have written a successful assistant that brings 1000% per month post it online? After all, you are already a millionaire, why create competition?

4) Why does a person who considers himself a pro and has been successfully trading for many years write questions on the forums: “Well, where will the market go? What are the predictions? After all, you have a system and you are based on your proven signals, and not on the opinions of little-known people.

Based on my experience and others, I came to the following conclusions:

1) Yes, there are people who have made money in the forex market, and these are the same brokers who collect interest from transactions and conduct paid seminars “how to drain the deposit as soon as possible”. Also, I'm sure most of them don't open your trade at all, but just hold money in their accounts, waiting for you to merge. And you will merge them, because all these trading systems are nonsense.

2) People who say they make money in the forex market are actually ordinary slot machine players. Just addicted to PASSION and thirsty that they are about to recoup all the losses and hit the jackpot. Not casually, I singled out this word in all articles. This is the same addiction as a casino and other long-proven addictions.

3) All these win-win systems are aimed only at making you lose the deposit as soon as possible and, in the hope of returning the lost, carry more and more money to the broker.

I described my experience only so that people who are going to or are already trading in the forex market analyze my words and try to understand that it is impossible to make money there. You will not be able to tame the market. The market is not subject to either analysis or systems. Most likely, you will simply lower your deposit, and then the next and the next. Leave these ideas before it's too late. You will not be able to return the money already spent.

Stop! Forex is a soulless machine that consumes your earned money.